US$224 - That's What Analysts Think Installed Building Products, Inc. (NYSE:IBP) Is Worth After These Results

Shareholders of Installed Building Products, Inc. (NYSE:IBP) will be pleased this week, given that the stock price is up 13% to US$234 following its latest full-year results. Installed Building Products reported US$2.8b in revenue, roughly in line with analyst forecasts, although statutory earnings per share (EPS) of US$8.61 beat expectations, being 3.0% higher than what the analysts expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

See our latest analysis for Installed Building Products

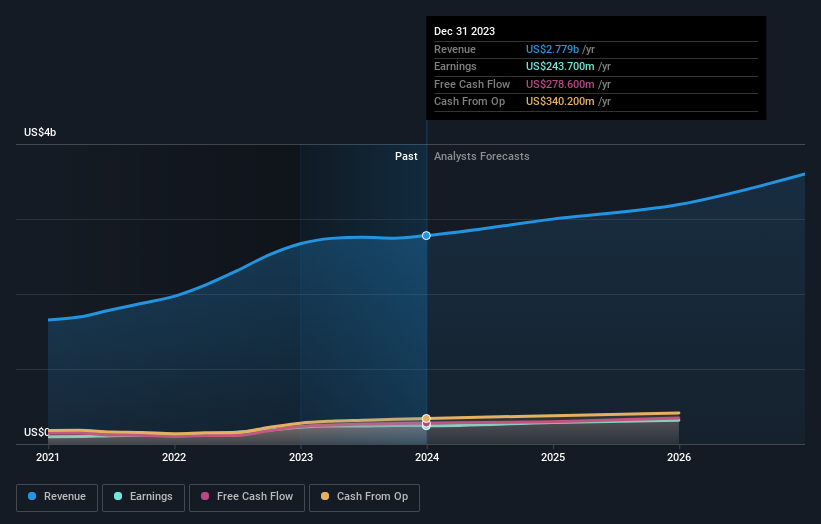

Taking into account the latest results, the most recent consensus for Installed Building Products from eleven analysts is for revenues of US$3.00b in 2024. If met, it would imply an okay 7.9% increase on its revenue over the past 12 months. Per-share earnings are expected to swell 17% to US$10.14. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$2.89b and earnings per share (EPS) of US$9.06 in 2024. There's been a pretty noticeable increase in sentiment, with the analysts upgrading revenues and making a solid gain to earnings per share in particular.

It will come as no surprise to learn that the analysts have increased their price target for Installed Building Products 20% to US$224on the back of these upgrades. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Installed Building Products at US$260 per share, while the most bearish prices it at US$170. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Installed Building Products shareholders.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that Installed Building Products' revenue growth is expected to slow, with the forecast 7.9% annualised growth rate until the end of 2024 being well below the historical 17% p.a. growth over the last five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 5.0% per year. Even after the forecast slowdown in growth, it seems obvious that Installed Building Products is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Installed Building Products following these results. Happily, they also upgraded their revenue estimates, and are forecasting them to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Installed Building Products going out to 2026, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Installed Building Products , and understanding these should be part of your investment process.

Valuation is complex, but we're here to simplify it.

Discover if Installed Building Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

This article has been translated from its original English version, which you can find here.