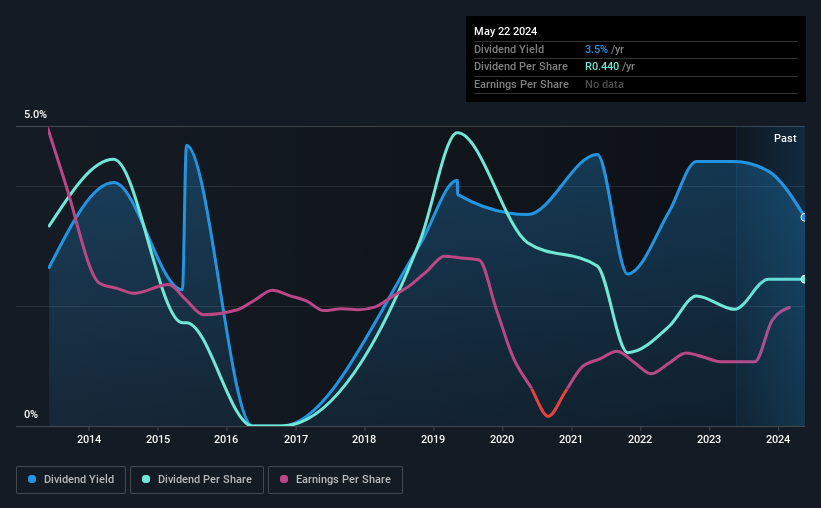

The board of Altron Limited (JSE:AEL) has announced that it will be increasing its dividend by 74% on the 10th of June to ZAR0.33, up from last year's comparable payment of ZAR0.19. Despite this raise, the dividend yield of 3.5% is only a modest boost to shareholder returns.

Check out our latest analysis for Altron

Altron's Dividend Is Well Covered By Earnings

Even a low dividend yield can be attractive if it is sustained for years on end. Before making this announcement, Altron was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

EPS is set to fall by 8.3% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could be 52%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was ZAR0.60 in 2014, and the most recent fiscal year payment was ZAR0.44. The dividend has shrunk at around 3.0% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth May Be Hard To Come By

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's not great to see that Altron's earnings per share has fallen at approximately 8.3% per year over the past five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Altron's payments are rock solid. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 2 warning signs for Altron (1 is significant!) that you should be aware of before investing. Is Altron not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:AEL

Altron

Engages in information communication and technology business in South Africa, rest of Africa, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success