- South Africa

- /

- REITS

- /

- JSE:HET

Heriot REIT Limited's (JSE:HET) Has Had A Decent Run On The Stock market: Are Fundamentals In The Driver's Seat?

Heriot REIT's (JSE:HET) stock up by 6.7% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Particularly, we will be paying attention to Heriot REIT's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Heriot REIT

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Heriot REIT is:

13% = R869m ÷ R6.8b (Based on the trailing twelve months to June 2024).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every ZAR1 worth of equity, the company was able to earn ZAR0.13 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Heriot REIT's Earnings Growth And 13% ROE

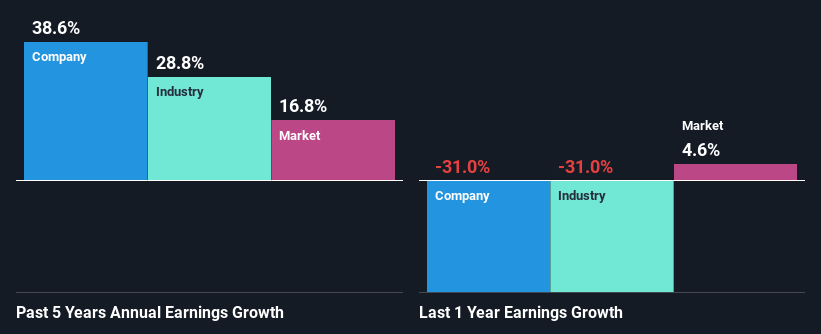

When you first look at it, Heriot REIT's ROE doesn't look that attractive. Although a closer study shows that the company's ROE is higher than the industry average of 7.8% which we definitely can't overlook. Even more so after seeing Heriot REIT's exceptional 39% net income growth over the past five years. Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. Therefore, the growth in earnings could also be the result of other factors. Such as- high earnings retention or the company belonging to a high growth industry.

Next, on comparing with the industry net income growth, we found that Heriot REIT's growth is quite high when compared to the industry average growth of 29% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for HET? You can find out in our latest intrinsic value infographic research report

Is Heriot REIT Making Efficient Use Of Its Profits?

Heriot REIT seems to be paying out most of its income as dividends judging by its three-year median payout ratio of 96%, meaning the company retains only 3.8% of its income. However, this is typical for REITs as they are often required by law to distribute most of their earnings. In spite of this, the company was able to grow its earnings significantly, as we saw above.

Moreover, Heriot REIT is determined to keep sharing its profits with shareholders which we infer from its long history of seven years of paying a dividend.

Summary

Overall, we feel that Heriot REIT certainly does have some positive factors to consider. Namely, its significant earnings growth, to which its moderate rate of return likely contributed. While the company is paying out most of its earnings as dividends, it has been able to grow its earnings in spite of it, so that's probably a good sign. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Heriot REIT and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

Valuation is complex, but we're here to simplify it.

Discover if Heriot REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:HET

Heriot REIT

Heriot REIT Limited (“Heriot” or “the Company”) is a property holding and investment company that is listed in the “Diversified REITs” sector on the Alternative Exchange of the JSE Limited (“JSE”).

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success