- South Africa

- /

- Real Estate

- /

- JSE:CPP

Collins Property Group Limited (JSE:CPP) Looks Interesting, And It's About To Pay A Dividend

Collins Property Group Limited (JSE:CPP) stock is about to trade ex-dividend in three days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Meaning, you will need to purchase Collins Property Group's shares before the 20th of November to receive the dividend, which will be paid on the 25th of November.

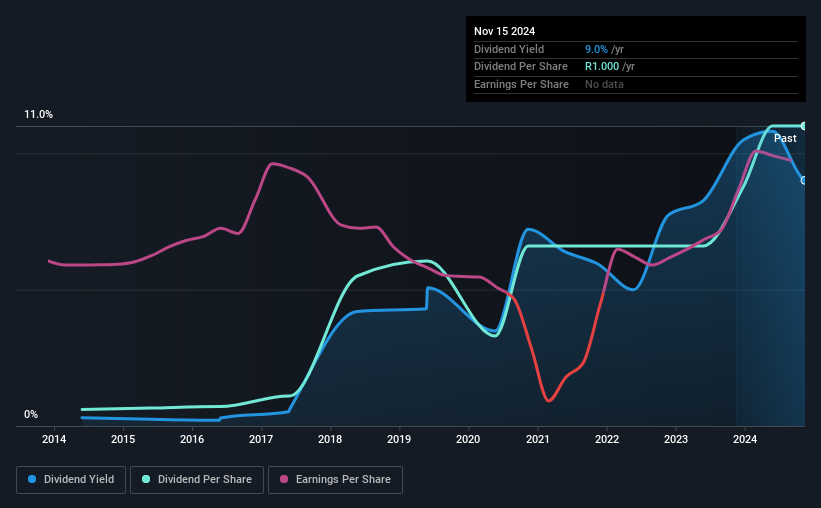

The company's next dividend payment will be R00.50 per share, and in the last 12 months, the company paid a total of R1.00 per share. Calculating the last year's worth of payments shows that Collins Property Group has a trailing yield of 9.0% on the current share price of R011.10. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Collins Property Group

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Collins Property Group paid out a comfortable 25% of its profit last year. A useful secondary check can be to evaluate whether Collins Property Group generated enough free cash flow to afford its dividend. Over the last year it paid out 62% of its free cash flow as dividends, within the usual range for most companies.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Collins Property Group paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. It's encouraging to see Collins Property Group has grown its earnings rapidly, up 30% a year for the past five years.

We'd also point out that Collins Property Group issued a meaningful number of new shares in the past year. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last 10 years, Collins Property Group has lifted its dividend by approximately 34% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

The Bottom Line

Is Collins Property Group an attractive dividend stock, or better left on the shelf? From a dividend perspective, we're encouraged to see that earnings per share have been growing, the company is paying out less than half of its earnings, and a bit over half its free cash flow. There's a lot to like about Collins Property Group, and we would prioritise taking a closer look at it.

So while Collins Property Group looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. For example, we've found 5 warning signs for Collins Property Group (2 can't be ignored!) that deserve your attention before investing in the shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:CPP

Collins Property Group

An investment holding company, owns, develops, manages, and leases real estate properties.

Established dividend payer moderate.