Why We're Not Concerned About Sappi Limited's (JSE:SAP) Share Price

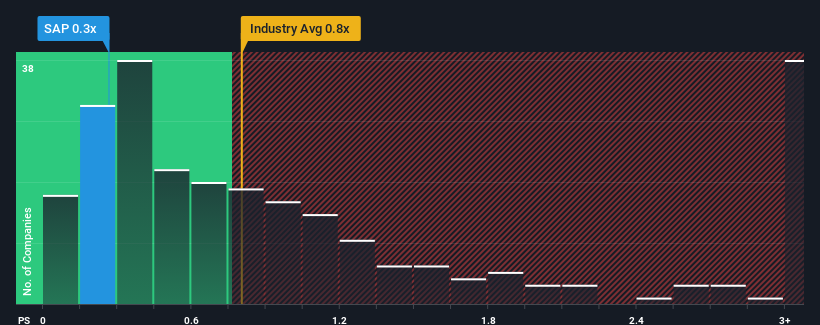

There wouldn't be many who think Sappi Limited's (JSE:SAP) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Forestry industry in South Africa is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Sappi

How Sappi Has Been Performing

The recently shrinking revenue for Sappi has been in line with the industry. Perhaps the market is expecting future revenue performance to continue matching the industry, which has kept the P/S in line with expectations. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues tracking the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sappi.How Is Sappi's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sappi's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 21% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 3.4% each year as estimated by the six analysts watching the company. With the industry predicted to deliver 4.7% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Sappi's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Sappi maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

You always need to take note of risks, for example - Sappi has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:SAP

Sappi

Engages in the provision of materials made from woodfiber-based renewable resources in Europe, North America, and South Africa.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives