- South Africa

- /

- Metals and Mining

- /

- JSE:ACL

One ArcelorMittal South Africa Ltd (JSE:ACL) Analyst Just Slashed Their 2021 Revenue Estimates

Today is shaping up negative for ArcelorMittal South Africa Ltd (JSE:ACL) shareholders, with the covering analyst delivering a substantial negative revision to this year's forecasts. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative. Shares are up 5.0% to R7.12 in the past week. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

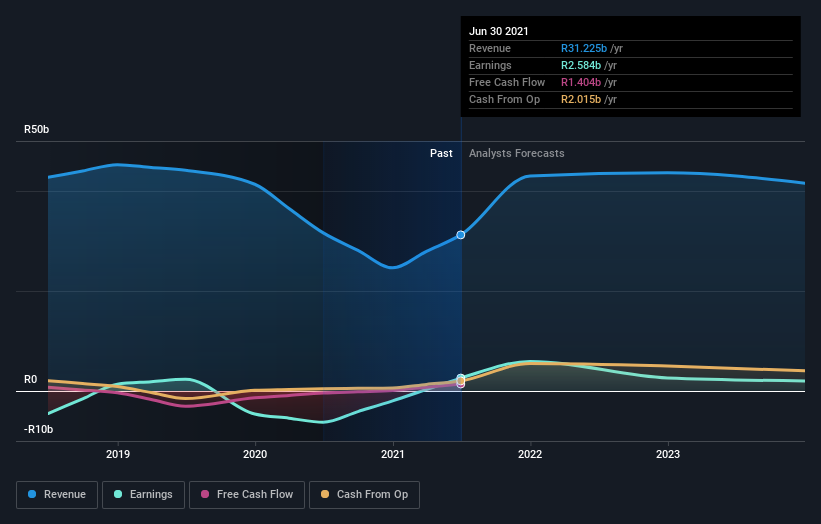

Following the downgrade, the most recent consensus for ArcelorMittal South Africa from its solitary analyst is for revenues of R43b in 2021 which, if met, would be a huge 38% increase on its sales over the past 12 months. Prior to the latest estimates, the analyst was forecasting revenues of R62b in 2021. It looks like forecasts have become a fair bit less optimistic on ArcelorMittal South Africa, given the pretty serious reduction to revenue estimates.

See our latest analysis for ArcelorMittal South Africa

There was no particular change to the consensus price target of R8.60, with ArcelorMittal South Africa's latest outlook seemingly not enough to result in a change of valuation.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. For example, we noticed that ArcelorMittal South Africa's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 38% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 2.5% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to decline 3.6% per year. So although ArcelorMittal South Africa is expected to return to growth, it's also expected to grow revenues during a time when the wider industry is estimated to see revenue decline.

The Bottom Line

The clear low-light was that the analyst slashing their revenue forecasts for ArcelorMittal South Africa this year. They're also forecasting for revenues to perform better than companies in the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on ArcelorMittal South Africa after today.

That said, this analyst might have good reason to be negative on ArcelorMittal South Africa, given a weak balance sheet. For more information, you can click here to discover this and the 2 other warning signs we've identified.

You can also see our analysis of ArcelorMittal South Africa's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:ACL

ArcelorMittal South Africa

Manufactures and sells steel products in South Africa and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives