- South Africa

- /

- Professional Services

- /

- JSE:NTU

Transaction Capital Limited's (JSE:TCP) Popularity With Investors Is Under Threat From Overpricing

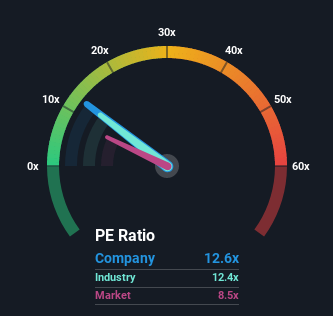

Transaction Capital Limited's (JSE:TCP) price-to-earnings (or "P/E") ratio of 12.6x might make it look like a sell right now compared to the market in South Africa, where around half of the companies have P/E ratios below 8x and even P/E's below 5x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's lofty.

Recent times have been advantageous for Transaction Capital as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Transaction Capital

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Transaction Capital's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 441%. The strong recent performance means it was also able to grow EPS by 198% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 0.2% per year as estimated by the dual analysts watching the company. Meanwhile, the broader market is forecast to expand by 8.3% per year, which paints a poor picture.

With this information, we find it concerning that Transaction Capital is trading at a P/E higher than the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

What We Can Learn From Transaction Capital's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Transaction Capital's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Transaction Capital (2 are a bit unpleasant!) that you need to be mindful of.

You might be able to find a better investment than Transaction Capital. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nutun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:NTU

Nutun

Through its subsidiary, Nutun Holdings Proprietary Limited, provides business process outsourcing solutions (BPO) in South Africa, Australia, the United Kingdom, and the United States.

Low risk and slightly overvalued.

Market Insights

Community Narratives