- South Africa

- /

- Building

- /

- JSE:TRL

Getting In Cheap On Trellidor Holdings Limited (JSE:TRL) Might Be Difficult

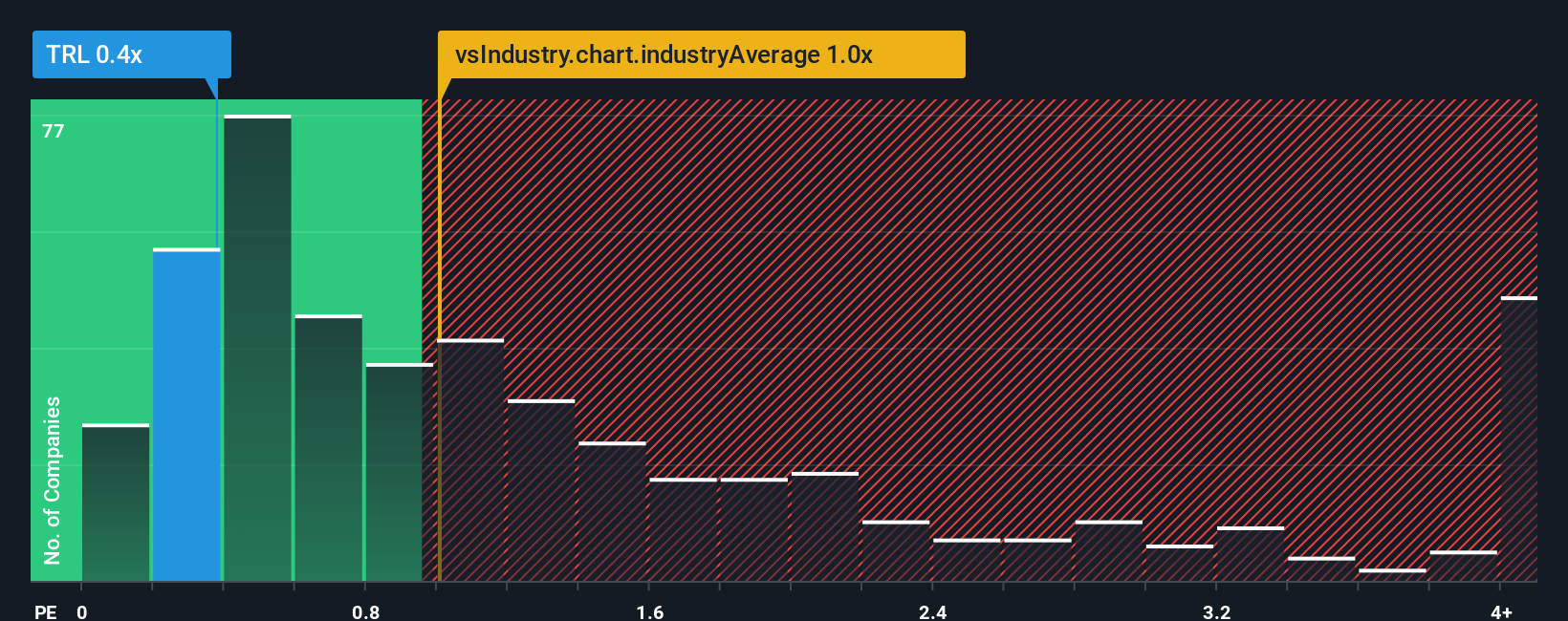

It's not a stretch to say that Trellidor Holdings Limited's (JSE:TRL) price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" for companies in the Building industry in South Africa, where the median P/S ratio is around 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Trellidor Holdings

How Trellidor Holdings Has Been Performing

The revenue growth achieved at Trellidor Holdings over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Trellidor Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Trellidor Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Trellidor Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Revenue has also lifted 11% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 4.9% shows it's about the same on an annualised basis.

With this in consideration, it's clear to see why Trellidor Holdings' P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What We Can Learn From Trellidor Holdings' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears to us that Trellidor Holdings maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 2 warning signs for Trellidor Holdings that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Trellidor Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:TRL

Trellidor Holdings

An investment holding company, engages in the manufacture, sale, and installation of custom-made security barrier products in South Africa, the United Kingdom, and Ghana.

Flawless balance sheet and good value.

Market Insights

Community Narratives