Stock Analysis

- South Africa

- /

- Banks

- /

- JSE:CPI

Here's Why We Think Capitec Bank Holdings (JSE:CPI) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Capitec Bank Holdings (JSE:CPI), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Capitec Bank Holdings

How Fast Is Capitec Bank Holdings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Capitec Bank Holdings grew its EPS by 16% per year. That's a good rate of growth, if it can be sustained.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Capitec Bank Holdings' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Capitec Bank Holdings maintained stable EBIT margins over the last year, all while growing revenue 2.6% to R24b. That's encouraging news for the company!

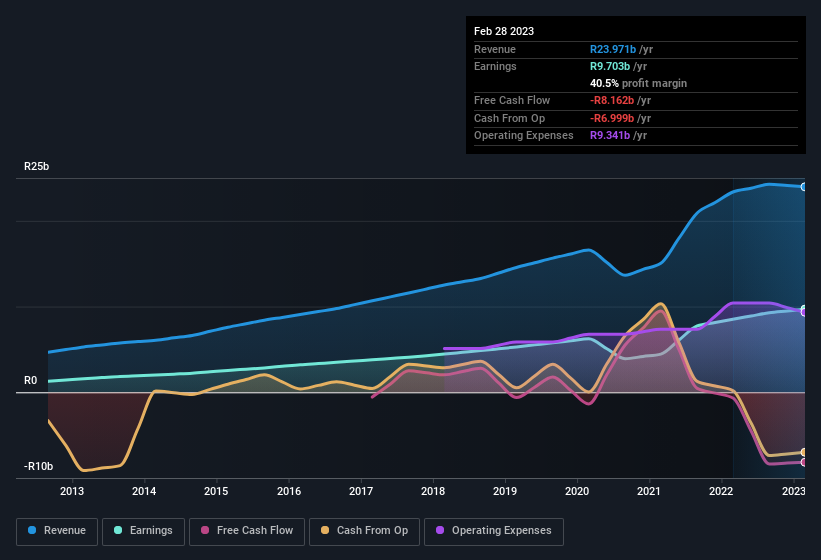

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Capitec Bank Holdings' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Capitec Bank Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth R530k) this was overshadowed by a mountain of buying, totalling R24m in just one year. This adds to the interest in Capitec Bank Holdings because it suggests that those who understand the company best, are optimistic. We also note that it was the CEO & Executive Director, Gerhardus Fourie, who made the biggest single acquisition, paying R15m for shares at about R1,687 each.

On top of the insider buying, it's good to see that Capitec Bank Holdings insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at R35b. This totals to 19% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Very encouraging.

Is Capitec Bank Holdings Worth Keeping An Eye On?

As previously touched on, Capitec Bank Holdings is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. However, before you get too excited we've discovered 1 warning sign for Capitec Bank Holdings that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Capitec Bank Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Capitec Bank Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:CPI

Capitec Bank Holdings

Capitec Bank Holdings Limited, through its subsidiaries, provides various banking products and services in South Africa.

Reasonable growth potential with proven track record.