- United States

- /

- Other Utilities

- /

- NYSE:WEC

Does WEC’s $3 Billion Equity Plan Signal a Shift in Its Capital Allocation Approach (WEC)?

Reviewed by Sasha Jovanovic

- In early November 2025, WEC Energy Group completed a US$600 million notes issuance and announced a US$3 billion equity distribution agreement to support its future investment initiatives and optimize its capital structure.

- These back-to-back financings highlight WEC’s proactive approach to securing funding for ongoing grid modernization and regional energy demand growth, particularly with anticipated large-scale data center projects on the horizon.

- We’ll explore how these significant capital-raising moves may reshape WEC Energy Group’s investment narrative and support its ambitious infrastructure plans.

Find companies with promising cash flow potential yet trading below their fair value.

WEC Energy Group Investment Narrative Recap

At its core, WEC Energy Group offers investors a way to participate in the long-term expansion and modernization of the Midwest power grid, anchored by robust demand growth from large-scale data center projects and continued infrastructure upgrades. The recent US$600 million notes issuance and US$3 billion equity distribution are intended to reinforce WEC’s funding base, but do not themselves materially alter the most significant short-term catalyst, increased electricity demand from anticipated data center developments, or the most pressing risk, which remains exposure to higher financing costs and dilution should interest rates climb or equity markets weaken.

Among recent company announcements, the reaffirmation of 2025 earnings guidance in late October stands out, providing an anchor for near-term expectations as the influx of new capital supports WEC’s ability to pursue its aggressive capital investment plans. This consistency in financial targets, paired with incremental growth in quarterly results and dividends, underscores the management team’s focus on balancing growth with predictability as the utility sector faces persistent regulatory and cost headwinds.

However, investors should also consider that, if credit markets remain volatile and equity issuance grows more expensive, the company’s ambitious spending plans may face a very different set of trade-offs...

Read the full narrative on WEC Energy Group (it's free!)

WEC Energy Group's narrative projects $10.8 billion revenue and $2.1 billion earnings by 2028. This requires 5.1% yearly revenue growth and a $0.4 billion earnings increase from $1.7 billion currently.

Uncover how WEC Energy Group's forecasts yield a $122.03 fair value, a 8% upside to its current price.

Exploring Other Perspectives

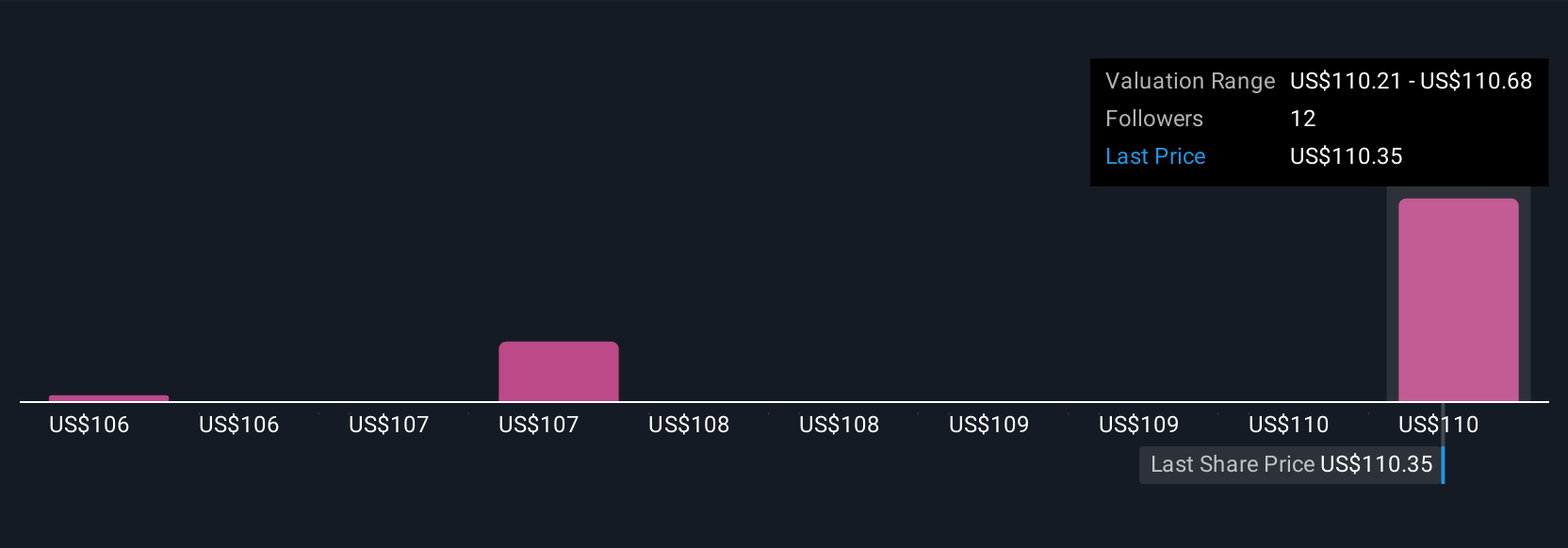

Five recent fair value estimates from the Simply Wall St Community range from US$106 to US$122 for WEC Energy Group, showing a spread of perspectives. With ambitious US$28 billion capital spending plans hinging on continued demand growth, these diverging views suggest you can benefit from exploring alternative viewpoints on key catalysts shaping WEC’s future.

Explore 5 other fair value estimates on WEC Energy Group - why the stock might be worth 6% less than the current price!

Build Your Own WEC Energy Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WEC Energy Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WEC Energy Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WEC Energy Group's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEC Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEC

WEC Energy Group

Through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives