- United States

- /

- Gas Utilities

- /

- NYSE:UGI

Did UGI’s (UGI) Austrian LPG Sale Mark a Shift Toward Strategic Focus and Financial Flexibility?

Reviewed by Sasha Jovanovic

- UGI International announced in the past week that it has entered a definitive agreement to sell its Austrian liquefied petroleum gas (LPG) distribution business to DCC plc, with the proceeds earmarked for debt reduction.

- This divestiture is part of UGI's ongoing effort to focus its portfolio and enhance its financial flexibility for potential future investments.

- We'll explore how the sale of the Austrian LPG business supports UGI's commitment to portfolio rationalization and improved balance sheet strength.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

UGI Investment Narrative Recap

To own UGI, you need to believe in the company's ability to adapt to changing energy markets, maintain a stable utility base, and grow through focused capital allocation. The recent sale of the Austrian LPG business aligns with the ongoing portfolio rationalization strategy, which could strengthen UGI’s balance sheet, but this move does not materially shift the main risk facing the company, persistent long-term declines in LPG demand across Europe and at AmeriGas as energy alternatives advance.

The recently announced divestiture of the Austrian LPG operations, with proceeds going directly to debt reduction, stands out among the company's updates. This move supports UGI's broader aim to streamline operations and unlock financial flexibility, both of which are essential for navigating challenges such as margin pressure and infrastructure costs in its core regulated utility segments.

However, investors should pay close attention to how structural shifts away from traditional fuels could affect...

Read the full narrative on UGI (it's free!)

UGI's narrative projects $9.0 billion revenue and $794.3 million earnings by 2028. This requires 7.0% yearly revenue growth and an increase of $376.3 million in earnings from the current $418.0 million.

Uncover how UGI's forecasts yield a $41.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

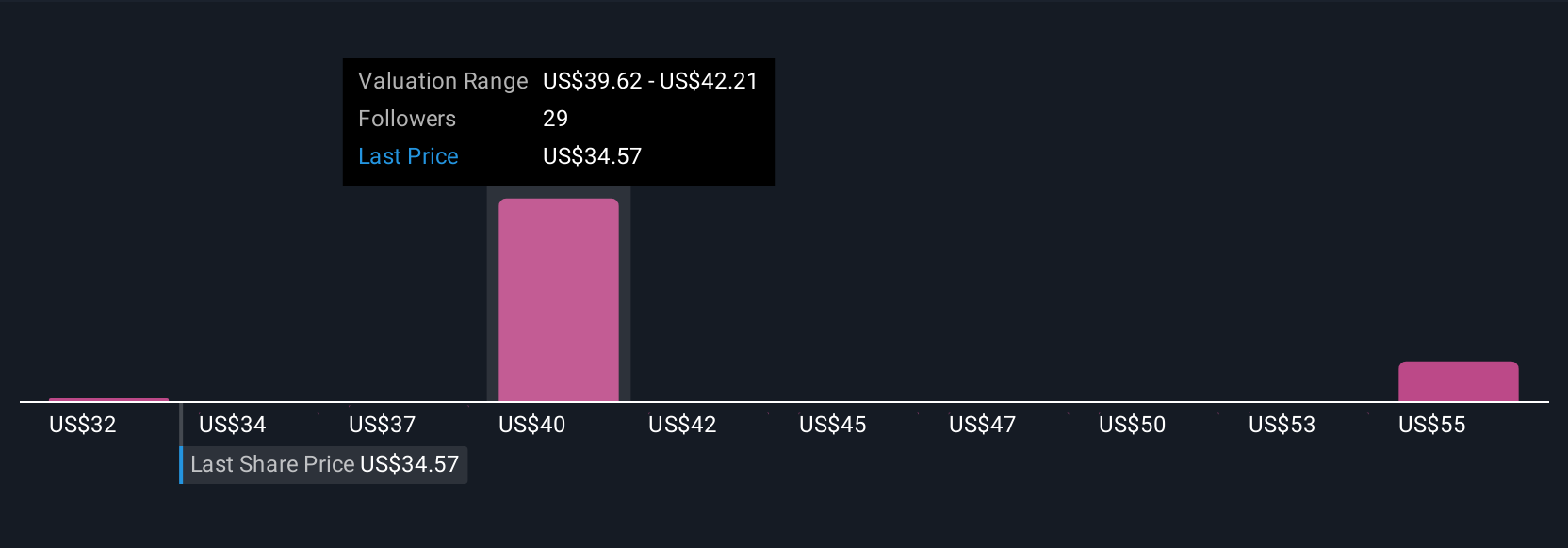

Five fair value estimates from the Simply Wall St Community range from US$31.87 to US$56.52 per share. With ongoing volume declines in core LPG markets highlighted as a key risk, investors may want to explore how these differing assumptions could shape future performance.

Explore 5 other fair value estimates on UGI - why the stock might be worth as much as 68% more than the current price!

Build Your Own UGI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UGI research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UGI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UGI's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UGI

UGI

Engages in the distribution, storage, transportation, and marketing of energy products and related services in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives