- United States

- /

- Electric Utilities

- /

- NYSE:TXNM

TXNM Energy (TXNM) Earnings Soar 114%, Challenging Bearish Narratives on Profitability Turnaround

Reviewed by Simply Wall St

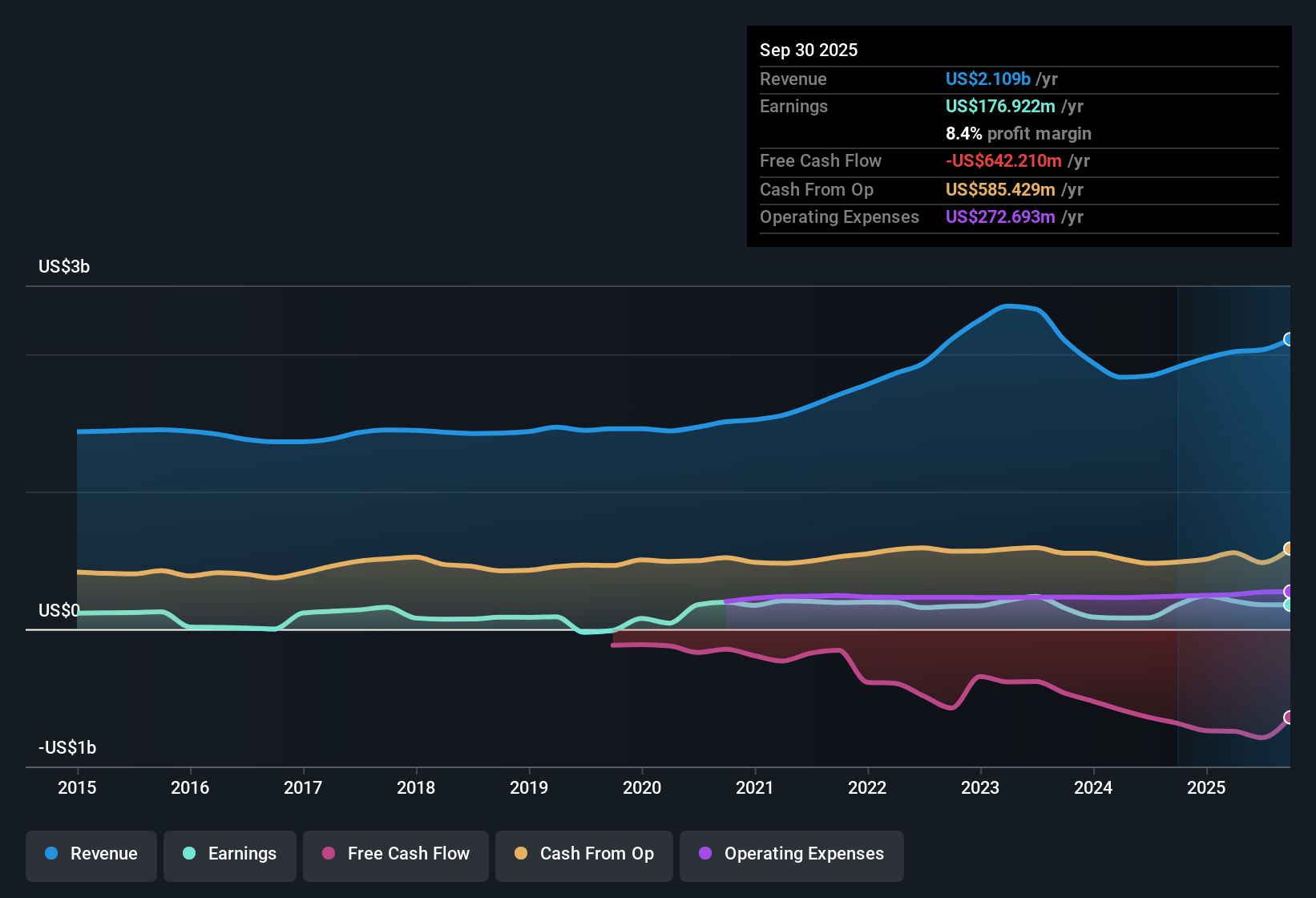

TXNM Energy (TXNM) delivered standout earnings growth this year, reporting a 114.4% jump over the past twelve months. This is a marked departure from its average annual decline of 4.1% over the last five years. Net profit margins improved to 8.7%, up from 4.5% previously. Despite the fresh momentum in profitability, the company’s longer-term performance still reflects a period of profit contraction. Investors now face a balancing act, weighing these improved results and high quality earnings against slower revenue growth prospects, recent share dilution, and a price tag that sits well above estimated fair value.

See our full analysis for TXNM Energy.Now, let’s see how the latest figures compare to the broader market narratives. Some long-held views could gain more support, while others may get tested by these results.

See what the community is saying about TXNM Energy

Capital Investment Drives Margin Expansion

- Forecast profit margins are set to rise sharply, with analysts projecting an increase from 8.7% today to 19.0% in three years.

- According to the analysts' consensus view, this growth is tied directly to state support, grid resilience plans, and over $546 million in approved upgrades.

- Scheduled rate hikes and regulatory mechanisms are expected to provide more predictable earnings as these capital projects fuel EBITDA and net income expansion.

- However, the increasing capital investment requirements may introduce pressure on free cash flow, especially with rising expenditure for grid modernization and resilience.

Momentum from Texas infrastructure spending and margin gains is fueling optimism for a multi-year earnings lift. See what else analysts think in the full consensus narrative. 📊 Read the full TXNM Energy Consensus Narrative.

Share Dilution and Dividend Sustainability Under Pressure

- The number of shares outstanding is expected to climb by 7% per year for the next three years, while analysts question the sustainability of the company’s dividend.

- The consensus narrative acknowledges that ongoing dilution and uncertain dividend coverage are meaningful concerns that could offset near-term profitability.

- Critics highlight that sustained capital outlays and higher share counts may dilute per-share gains, raising long-term risks for investor returns.

- There are also signals that the dividend may not be supported by free cash flow as grid investments accelerate, intensifying scrutiny of payout stability.

Premium Valuation vs. DCF and Peers

- The current share price of $56.8 places TXNM at a 33.7x price-to-earnings ratio, well above its peer group’s 19.5x and the industry average of 21.3x. The price also outpaces its DCF fair value of $39.18 by a wide margin.

- Analysts’ consensus sees limited upside, with the current price only 3.5% below their $60.63 target. This signals that the stock’s valuation already factors in future growth, leaving little room for positive surprise without exceeding these robust growth and margin forecasts.

- The modest gap between TXNM’s market price and the consensus price target, combined with its significant premium to fair value, puts extra emphasis on the need for sustained execution and regulatory delivery.

- Investors are cautioned that unless the profitability expansion and capital recovery materialize as forecast, the lofty multiple may prove difficult to justify, especially compared to sector norms.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for TXNM Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another angle on the results? Tell your story and shape your unique outlook on TXNM in just a few minutes. Do it your way

A great starting point for your TXNM Energy research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

TXNM faces sustainability concerns due to ongoing share dilution, premium valuation, and the risk that future growth may not justify its high market price.

If overpaying or valuation risk gives you pause, check out these 832 undervalued stocks based on cash flows to find companies trading at more attractive discounts with solid long-term prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TXNM Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TXNM

TXNM Energy

Through its subsidiaries, provides electricity and electric services in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives