- United States

- /

- Electric Utilities

- /

- NYSE:TXNM

A Fresh Look at TXNM Energy’s Valuation Following TNMP’s Major Regulatory Rate Filing

Reviewed by Simply Wall St

TXNM Energy has made headlines as its subsidiary, TNMP, submitted a major regulatory filing to recover a larger rate base, request a higher return on equity, and seek additional funding for hurricane recovery. This is the first such move in seven years and could directly influence future earnings.

See our latest analysis for TXNM Energy.

Between TNMP’s large-scale rate request and steady dividend payouts from its New Mexico operations, TXNM Energy is drawing renewed attention. The stock’s 18.4% year-to-date share price return is already impressive, and a robust 25.9% total shareholder return over the past year suggests investors are sensing both defensive strength and long-term growth potential as system investments ramp up.

If you want to see where else the action is, now is an ideal time to broaden your perspective with fast growing stocks with high insider ownership

With shares already posting strong returns and system investments accelerating, the key question becomes: is TXNM Energy still undervalued given its growth outlook, or has the market already priced in the coming gains?

Most Popular Narrative: 4.7% Undervalued

With TXNM Energy’s narrative fair value of $60.63 sitting just above its last close at $57.80, the consensus paints a picture of slight undervaluation, suggesting that analysts believe some upside remains as future earnings potential unfolds.

Approval and timely cost recovery of over $546 million in capital improvements through resiliency plans and transmission upgrades will boost the regulated rate base, driving predictable increases in EBITDA and net income via scheduled rate hikes.

If you want to know how these system investments set the foundation for TXNM’s valuation debate, look closer at this narrative. The fair value leans heavily on a set of earnings and margin forecasts usually reserved for leaders in fast-changing sectors. Curious which financial levers drive analysts’ confidence? The full story reveals the specific profit expansion assumptions the market is watching.

Result: Fair Value of $60.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory hurdles and mounting infrastructure costs could still challenge the optimistic outlook and may put future margin expansion at risk.

Find out about the key risks to this TXNM Energy narrative.

Another View: Multiples Raise Questions

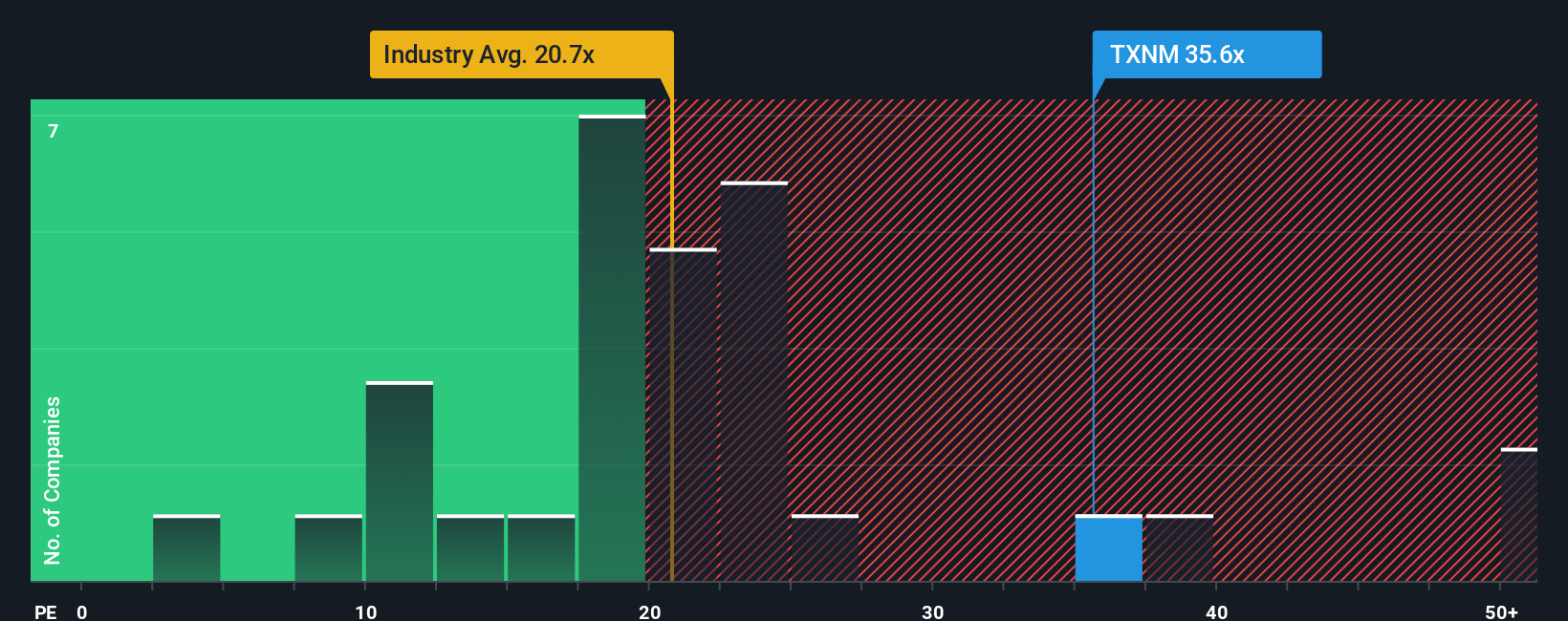

Looking at TXNM Energy’s price-to-earnings multiple offers a very different perspective. The company trades at 35.6 times earnings, which is not only higher than its peers at 20.4x and the industry average at 20.7x, but also above its fair ratio of 30.4x. This gap suggests that investors are paying a premium, which could expose the stock to downside risk if growth expectations slip. Where do you think the valuation will head next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TXNM Energy Narrative

If you see TXNM Energy’s story unfolding differently or want to dig deeper, feel free to examine the figures and shape your own perspective in just a few minutes. Do it your way

A great starting point for your TXNM Energy research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for Your Next Investment Opportunity?

Don’t settle for just one idea when you could be ahead of the crowd. The Simply Wall Street Screener empowers you to act on high-potential trends before others do.

- Capture untapped growth as you uncover these 26 quantum computing stocks, positioned to benefit from breakthroughs in quantum computing and advanced tech adoption.

- Boost your portfolio’s income stream by targeting these 18 dividend stocks with yields > 3%, which features reliable yields above 3% and financial strength.

- Spot tomorrow’s winners by checking out these 27 AI penny stocks, designed to thrive in the accelerating AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TXNM Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TXNM

TXNM Energy

Through its subsidiaries, provides electricity and electric services in the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives