- United States

- /

- Gas Utilities

- /

- NYSE:SWX

Is Southwest Gas Holdings Share Price Justified After 13% Rally and Infrastructure Investment News?

Reviewed by Bailey Pemberton

- Curious if Southwest Gas Holdings is a hidden gem or just priced for perfection? You are not alone in wanting to know whether the current share price truly reflects the company's value.

- After climbing 13.1% year-to-date and 14.1% over the last year, Southwest Gas Holdings’ stock has sparked conversations about renewed growth and possible shifts in risk perception.

- Recently, headlines have focused on the company’s ongoing efforts in infrastructure improvements and regulatory updates. These developments are helping to clarify the backdrop for recent price action. Analysts and industry watchers are especially attentive to these updates, as they could shape the company’s prospects going forward.

- For those keeping score, Southwest Gas Holdings currently clocks in at a 0/6 valuation score. This means it does not appear undervalued by any of the six standard measures right now. Let’s break down how these valuation checks work, but stick around to discover a smarter way to think about valuation that goes beyond just the numbers.

Southwest Gas Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Southwest Gas Holdings Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation method that estimates the fair value of a stock by projecting future dividend payments and discounting them back to their present value. It is especially useful for evaluating companies with consistent dividend histories, like Southwest Gas Holdings.

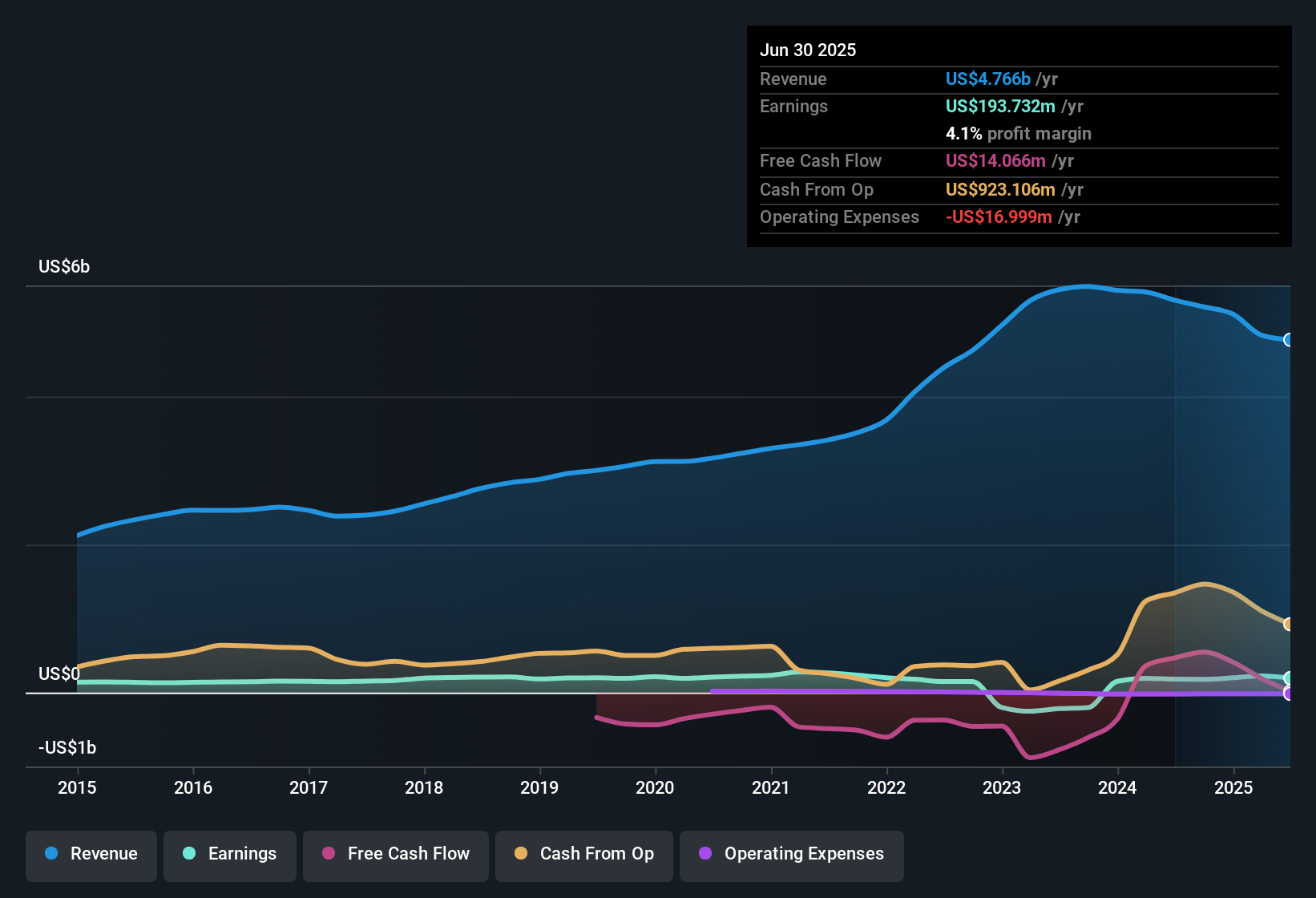

Applying the model to Southwest Gas Holdings, we see the annual dividend per share stands at $2.59. The payout ratio is currently high at 91.9%, meaning most of the company's earnings are returned to shareholders as dividends. With a return on equity of just 4.7%, the potential for meaningful dividend growth is limited, projected at a modest 0.38% annually. This conservative growth assumption is derived from the formula (1 – payout ratio) x ROE.

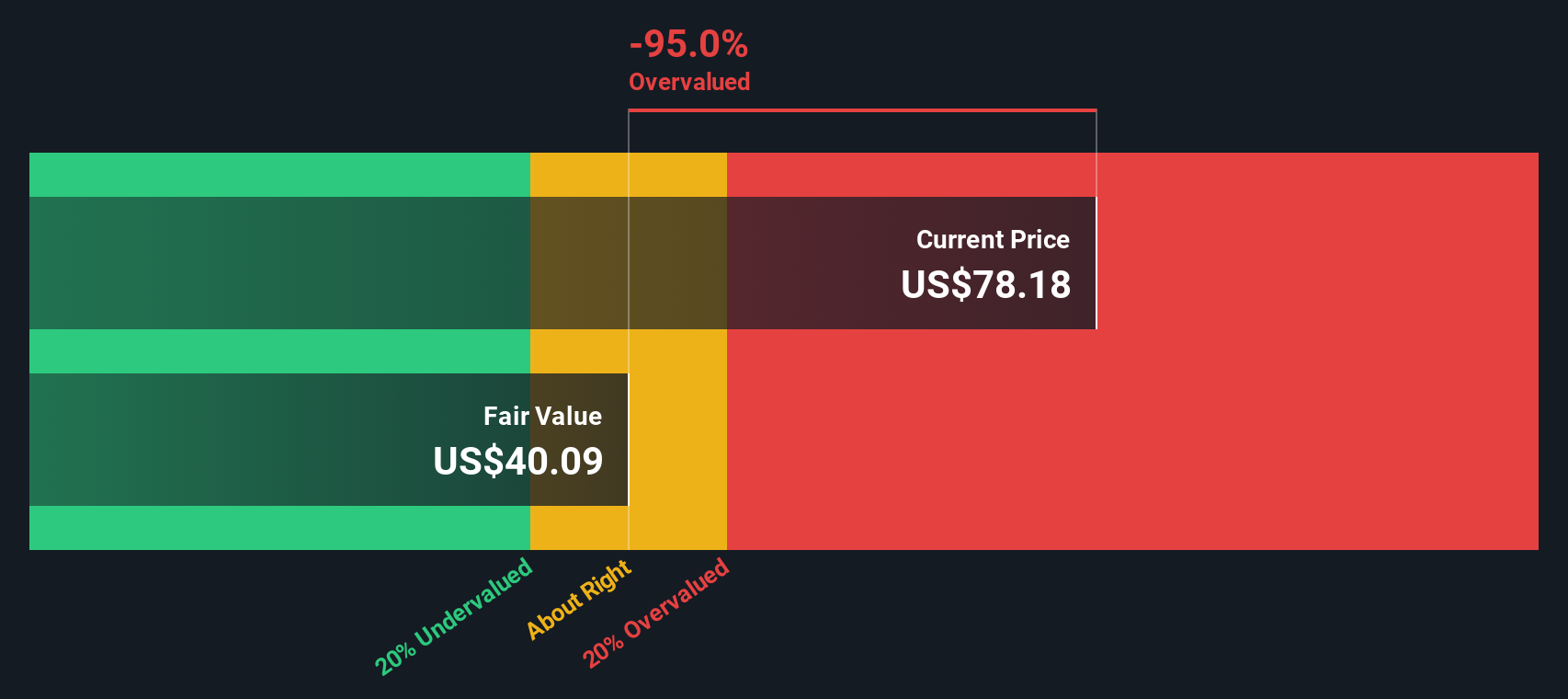

Using these inputs, the DDM estimates the intrinsic fair value of Southwest Gas Holdings at $40.48 per share. This is notably below the current share price, suggesting investors are pricing in higher growth or lower risk than current fundamentals support. According to the DDM, the stock is about 96.4% overvalued at its present level.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Southwest Gas Holdings may be overvalued by 96.4%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Southwest Gas Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it directly compares a company's market price with its net earnings. For investors, it is a quick way to gauge what the market is willing to pay today for a dollar of future earnings from Southwest Gas Holdings.

Growth expectations and risk play a big role in determining what counts as a “normal” or “fair” PE ratio. High-growth companies tend to command higher multiples, while those facing greater uncertainty or volatility might trade at lower ones. Understanding how the broader industry and direct peers are valued provides helpful context, but does not capture the whole story.

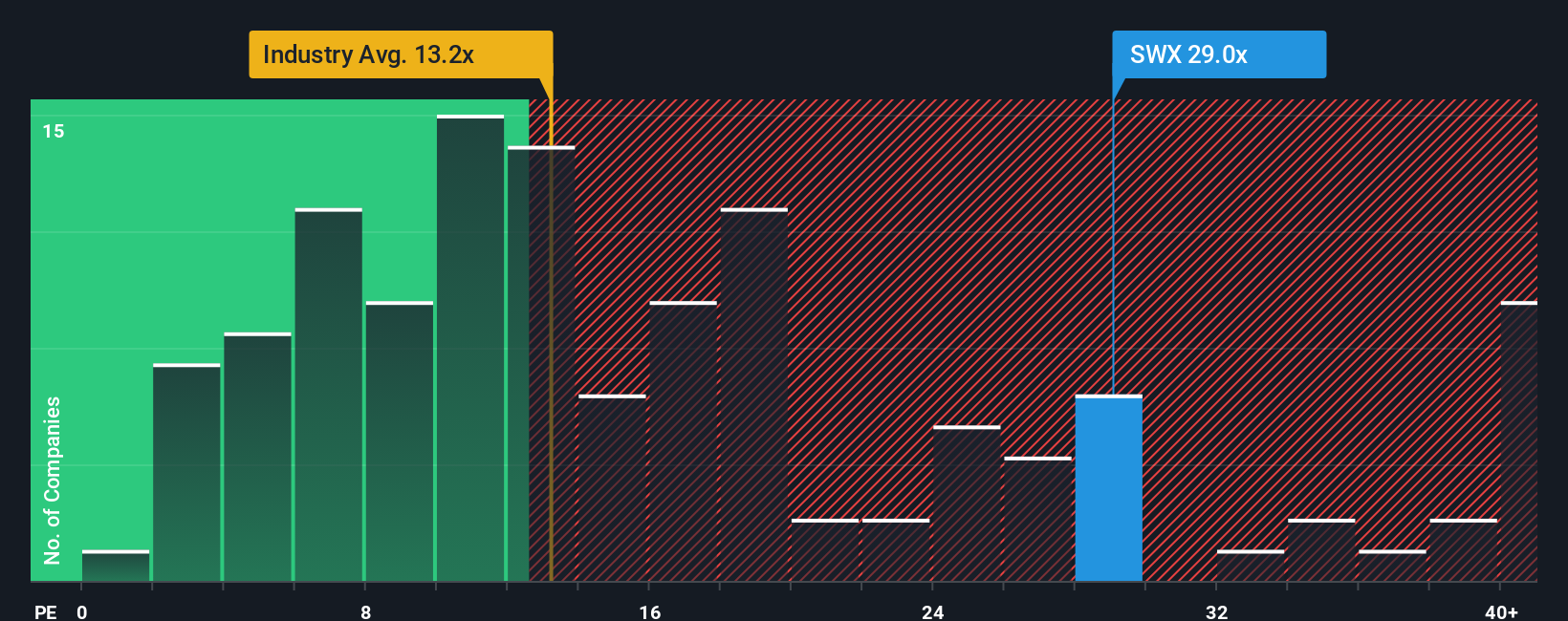

Currently, Southwest Gas Holdings trades at a PE ratio of 29.54x. That figure is noticeably higher than the Gas Utilities industry average of 13.71x and also above the peer group average of 21.19x. This suggests the market is pricing in superior prospects or lower risk than is true for most competitors in the space.

The “Fair Ratio” is a proprietary metric developed by Simply Wall St that calculates the appropriate PE multiple for a company like Southwest Gas Holdings, adjusting for its unique growth profile, risk, profit margin, industry dynamics, and company size. Unlike standard benchmarks, the Fair Ratio provides a tailored perspective on valuation by accounting for all these factors at once.

For Southwest Gas Holdings, the Fair Ratio stands at 22.89x. That is notably lower than the current PE of 29.54x, indicating the stock is trading at a substantial premium versus what is justified given its fundamentals and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Southwest Gas Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple, intuitive way to tie your perspective about a company—its story, catalysts, and risks—directly to your own financial forecasts and resulting fair value estimate. Instead of just accepting a "one size fits all" metric, Narratives on Simply Wall St’s Community page let you express your outlook for Southwest Gas Holdings by adjusting assumptions like future revenue, profit margins, and PE multiples, then instantly see how those translate into a fair value.

This approach helps bring more clarity to your investment decisions by letting you compare your custom fair value to the current share price, making it easier to decide when to buy or sell. Narratives are updated in real time as new events such as earnings reports or major company announcements come in, ensuring your view is always current. For example, one investor might build a Narrative around robust customer growth and successful infrastructure expansion, calculating a fair value of $83.67 per share, while another focuses on regulatory risks and competition, estimating a much lower fair value. Narratives put you in control, helping you make smarter, more confident investment choices with the latest information at your fingertips.

Do you think there's more to the story for Southwest Gas Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWX

Southwest Gas Holdings

Through its subsidiaries, purchases, distributes, and transports natural gas for residential, commercial, and industrial customers in Arizona, Nevada, and California.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives