- United States

- /

- Other Utilities

- /

- NYSE:SRE

Sempra (SRE): Assessing Valuation as Stable Earnings and LNG Project Progress Draw Investor Focus

Reviewed by Simply Wall St

See our latest analysis for Sempra.

Sempra’s share price has picked up momentum over the past quarter with a solid 13.6% gain, and its 1-year total shareholder return of 6.7% underscores how the market is rewarding stable earnings growth. While recent price movements have been modest, that longer-term performance highlights investor confidence in Sempra’s fundamentals as it adapts to a fast-evolving utilities sector.

If you’re curious about what other companies are quietly gaining ground, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

But with Sempra’s strong fundamentals now on display, is the market leaving room for further upside, or has recent performance already accounted for the company’s future growth story?

Most Popular Narrative: 3.9% Undervalued

With Sempra's fair value pegged at $96.53, about $3.75 above its recent close, market expectations are being nudged higher as analysts update their targets. This small premium over the current price has sharpened focus on the company's growth levers.

The rollout and completion of major LNG export projects (ECA Phase 1 nearing completion, Port Arthur Phase 1 advancing, and strong commercial momentum for Phase 2) positions Sempra to benefit from sustained global demand for U.S. LNG as a transition fuel, significantly increasing future cash flows and long-term revenue generation.

Curious about the math behind this price boost? One powerful driver, future profit growth, could put Sempra into a financial league that surprises many. Want to see which forecasts might shatter expectations? The catalysts, assumptions, and projected industry moves are all revealed in the full narrative.

Result: Fair Value of $96.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected regulatory changes in Texas or California, or volatility in global LNG demand, could quickly shift Sempra’s outlook and stall its growth.

Find out about the key risks to this Sempra narrative.

Another View: Pricing by Market Multiples

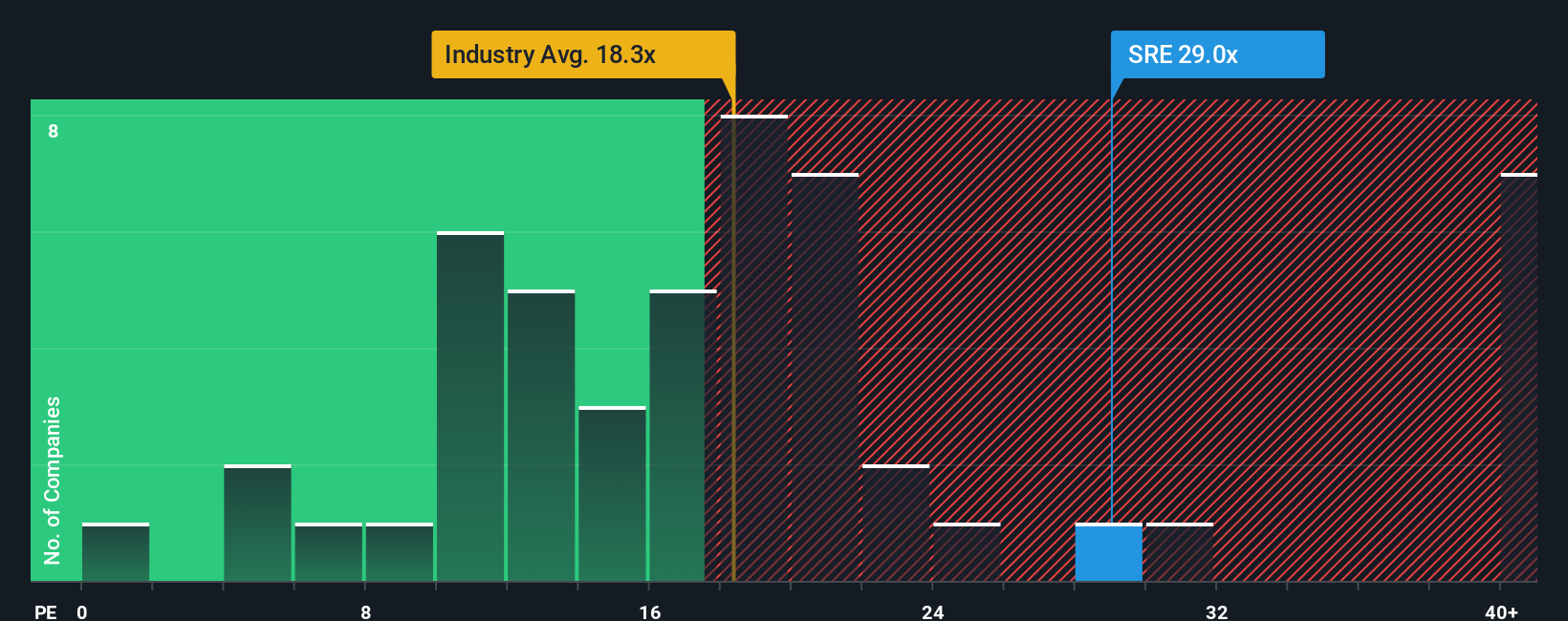

While the fair value suggests Sempra is modestly undervalued, traditional market pricing tells a different story. Sempra’s price-to-earnings ratio stands at 28.7x, which is significantly higher than the industry’s 18.1x and its own fair ratio of 27.7x. This premium signals that investors have already priced in much of the optimism, which may potentially increase valuation risk compared to peers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sempra Narrative

If you see things differently or want to dive deeper into the numbers, you can shape your own perspective and narrative in just a few minutes. Do it your way

A great starting point for your Sempra research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Open the door to new opportunities and position yourself ahead of the crowd by zeroing in on high-potential stocks you might not have considered yet.

- Target steady income streams by tapping into these 17 dividend stocks with yields > 3%, which have a track record of rewarding shareholders with robust yields.

- Ride the artificial intelligence wave and catch emerging growth trends through these 24 AI penny stocks, transforming everything from healthcare to automation.

- Capitalize on future tech innovations with these 28 quantum computing stocks, driving advancements in security, computing power, and next-level problem solving.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRE

Sempra

Operates as an energy infrastructure company in the United States and internationally.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives