- United States

- /

- Gas Utilities

- /

- NYSE:SR

Will Regulatory Tailwinds and Tennessee Acquisition Change Spire's (SR) Growth Narrative?

Reviewed by Sasha Jovanovic

- In the past week, Spire attracted multiple analyst upgrades, fueled by positive regulatory shifts in Missouri and the acquisition of gas utility assets in Tennessee.

- Analysts noted that these regulatory developments and portfolio additions are likely to enhance Spire’s earnings stability and support future growth.

- We'll examine how Missouri's evolving regulatory environment, cited by analysts, may shift Spire's investment narrative and growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Spire Investment Narrative Recap

For those considering Spire as an investment, the central investment thesis is the company's ability to deliver stable, regulated returns by expanding its gas utility footprint and securing constructive rate frameworks, particularly in its core Missouri market. The recent analyst upgrades highlight positive regulatory momentum and the Tennessee asset acquisition, which could bolster near-term confidence around earnings growth, yet the largest risk remains potential headwinds from future decarbonization mandates or regulatory lag on cost recovery. If these risks remain manageable, the evolving landscape in Missouri stands to be the most meaningful short-term catalyst for shareholder value. One of the most relevant recent announcements is the expected Q4 earnings update, flagged by UBS, which may include new EPS guidance for 2026-27 that could exceed management’s current 5 to 7 percent outlooks. This is directly tied to anticipated benefits from the Missouri regulatory framework and the Tennessee acquisition, both cited as factors likely to support earnings stability and enhance growth visibility for Spire at a pivotal time. However, rising capital needs and regulatory dependencies could present challenges investors should be aware of, especially if...

Read the full narrative on Spire (it's free!)

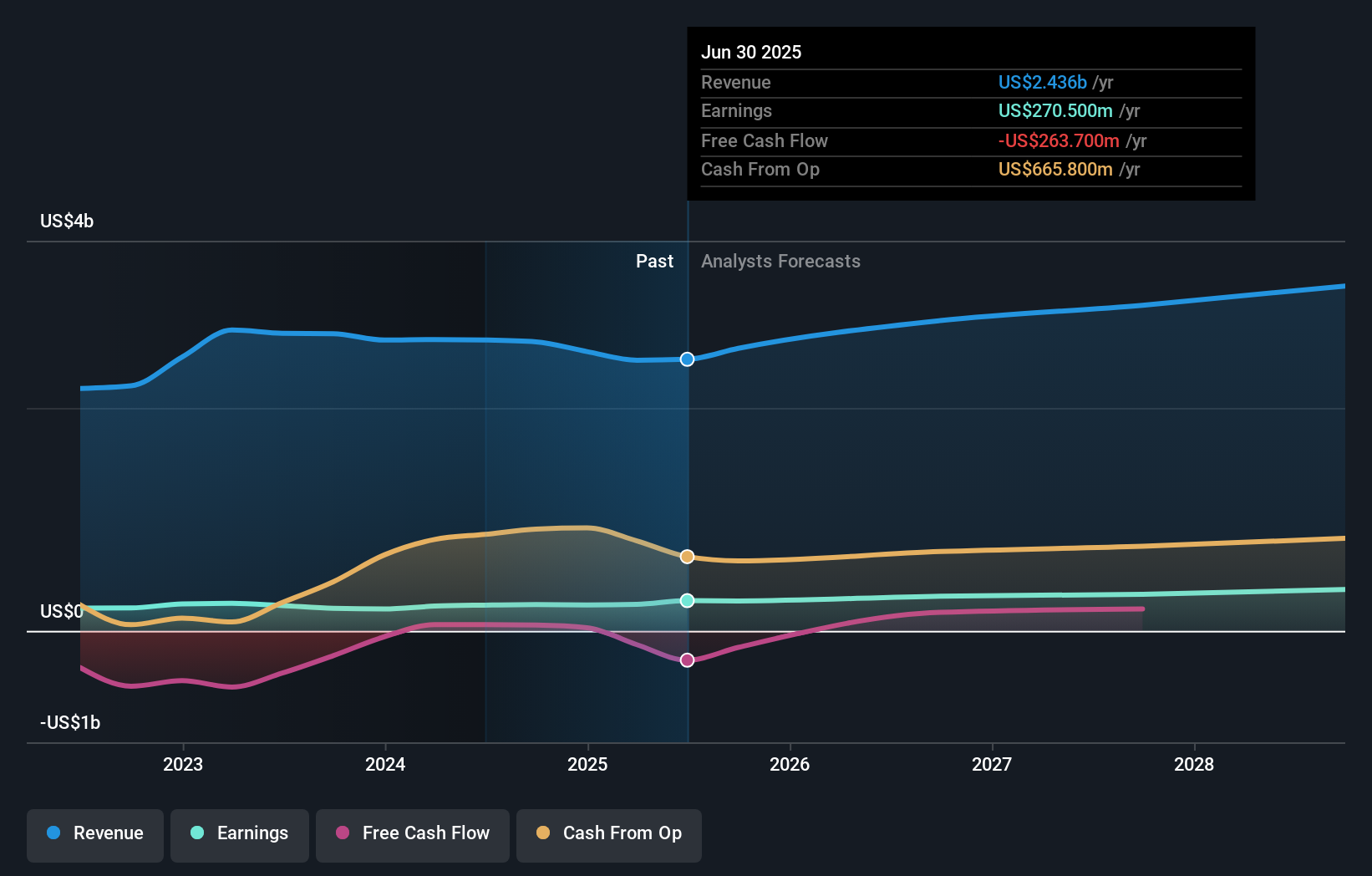

Spire's outlook anticipates $3.2 billion in revenue and $344.9 million in earnings by 2028. This scenario requires annual revenue growth of 9.4% and an earnings increase of $74.4 million from the current $270.5 million.

Uncover how Spire's forecasts yield a $83.69 fair value, a 3% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted a single fair value estimate for Spire, clustering tightly at US$99.67. While consensus suggests upside driven by Missouri’s favorable regulatory changes, investors should weigh how evolving policy and future investment hurdles could impact results. Explore differing viewpoints and implications for Spire’s future.

Explore another fair value estimate on Spire - why the stock might be worth just $99.67!

Build Your Own Spire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spire research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Spire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spire's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SR

Spire

Engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives