- United States

- /

- Renewable Energy

- /

- NYSE:SPRU

Lacklustre Performance Is Driving Spruce Power Holding Corporation's (NYSE:SPRU) Low P/S

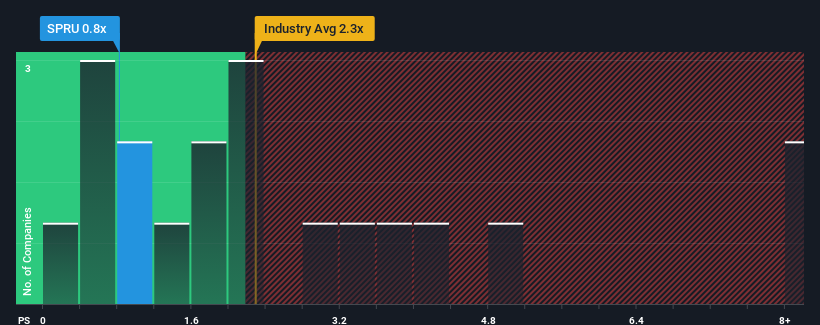

Spruce Power Holding Corporation's (NYSE:SPRU) price-to-sales (or "P/S") ratio of 0.8x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Renewable Energy industry in the United States have P/S ratios greater than 2.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Spruce Power Holding

What Does Spruce Power Holding's P/S Mean For Shareholders?

Recent times have been pleasing for Spruce Power Holding as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Spruce Power Holding's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Spruce Power Holding's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 94%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 7.1% over the next year. With the industry predicted to deliver 13% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Spruce Power Holding is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Spruce Power Holding's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 2 warning signs for Spruce Power Holding (1 makes us a bit uncomfortable!) that you should be aware of.

If these risks are making you reconsider your opinion on Spruce Power Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPRU

Spruce Power Holding

Owns and operates distributed solar energy assets in the United States.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives