- United States

- /

- Electric Utilities

- /

- NYSE:PPL

PPL (PPL) Valuation: Exploring Upside After Consistent Shareholder Returns and New Growth Initiatives

Reviewed by Simply Wall St

PPL (PPL) stock has been steadily gaining attention, with investors eyeing its one year total return of 19%. The company’s recent performance offers an interesting angle for those tracking the utilities sector.

See our latest analysis for PPL.

PPL’s share price has seen positive momentum in 2024, with a 13.5% year-to-date return and a strong one-year total shareholder return of 19.4%. While the past month’s moves have been fairly steady, the company’s three- and five-year total returns of nearly 50% and 61% indicate that long-term investors have benefited from consistent growth.

If you’re inspired by how the utilities sector is producing steady performers, now is a good moment to broaden your search and discover fast growing stocks with high insider ownership

With solid returns and continued revenue growth, the key question becomes: is PPL trading at a compelling valuation, or are investors already factoring in all future upside and leaving limited room for further gains?

Most Popular Narrative: 8.5% Undervalued

PPL’s fair value from the most followed narrative suggests upside versus the last close of $36.52, sparking debate over whether analyst projections are too conservative or just right given current performance trends.

The company's new joint venture with Blackstone Infrastructure, targeting contracted, "regulated-like" generation for hyperscalers, provides a significant new avenue for capital deployment and value creation not yet fully captured in consensus. This partnership has the potential to drive long-term earnings above base guidance as these projects come online.

Curious which bold forecast drives the fair value above the current share price? The narrative hinges on a combination of ambitious earnings targets, margin improvements, and sector-defining growth moves. Dive in to uncover the crucial assumptions fueling this optimism.

Result: Fair Value of $39.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow regulatory approval or lower-than-expected demand from major customers could easily challenge and reverse today's optimistic outlook for PPL.

Find out about the key risks to this PPL narrative.

Another View: Multiples Tell a Different Story

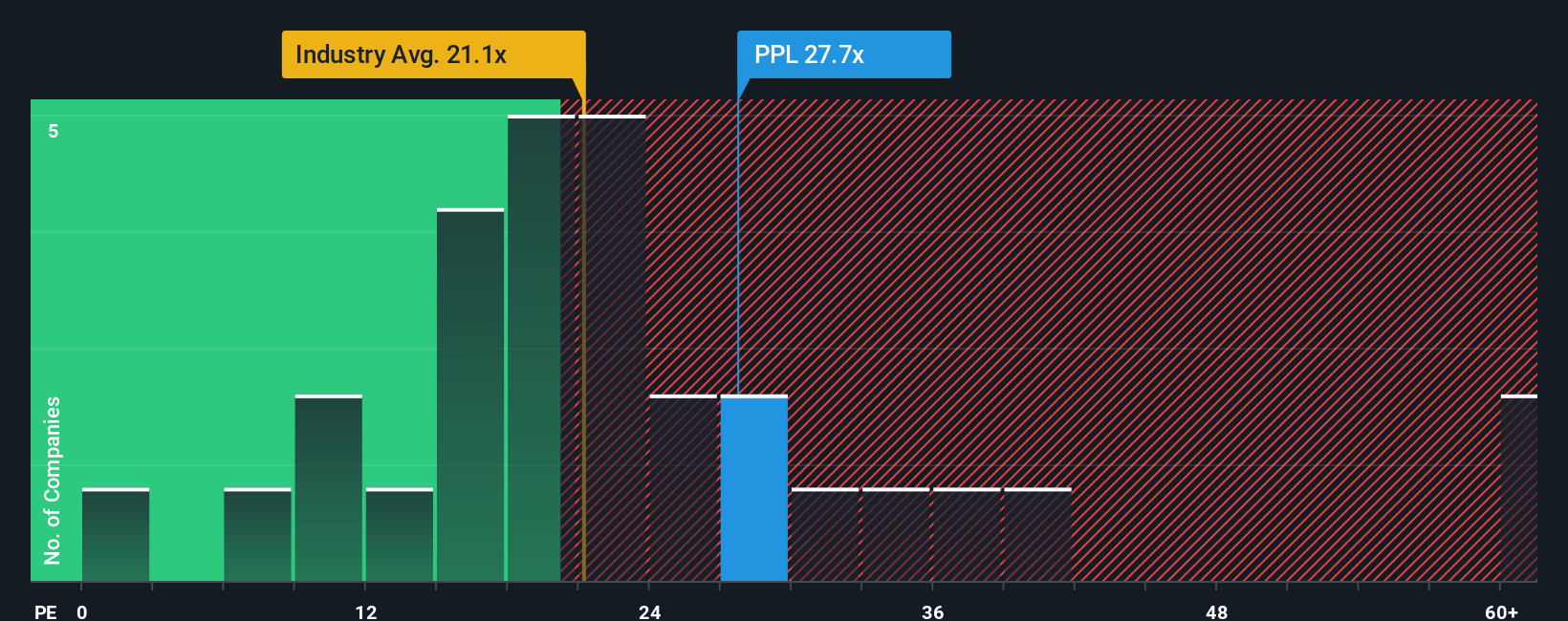

Looking at PPL’s valuation through its price-to-earnings ratio offers a more cautious angle. The company trades at 27.6 times earnings. This stands above both the fair ratio of 23.7 and the industry average of 21.2. This suggests investors are paying a premium today, which could limit future upside if results don’t meet expectations. Is this premium truly justified, or is the market overlooking potential risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PPL Narrative

If you want to dig deeper into the numbers or offer a different perspective, you can craft your own view in just a few minutes. Do it your way

A great starting point for your PPL research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let great opportunities pass you by. Expand your portfolio with stocks that are catching the attention of smart investors right now.

- Capture big yield potential by checking out these 23 dividend stocks with yields > 3%, where consistent income meets sustainable performance.

- Tap into the next wave of healthcare innovation with these 34 healthcare AI stocks and see which companies are transforming patient care using cutting-edge AI.

- Pounce on deep value with these 831 undervalued stocks based on cash flows to find options trading below what their cash flows are really worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PPL

PPL

Provides electricity and natural gas to approximately 3.5 million customers in the United States.

Solid track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives