- United States

- /

- Electric Utilities

- /

- NYSE:PPL

PPL (PPL): Margin Growth Reinforces Bull Case but Premium Valuation Fuels Dividend Sustainability Debate

Reviewed by Simply Wall St

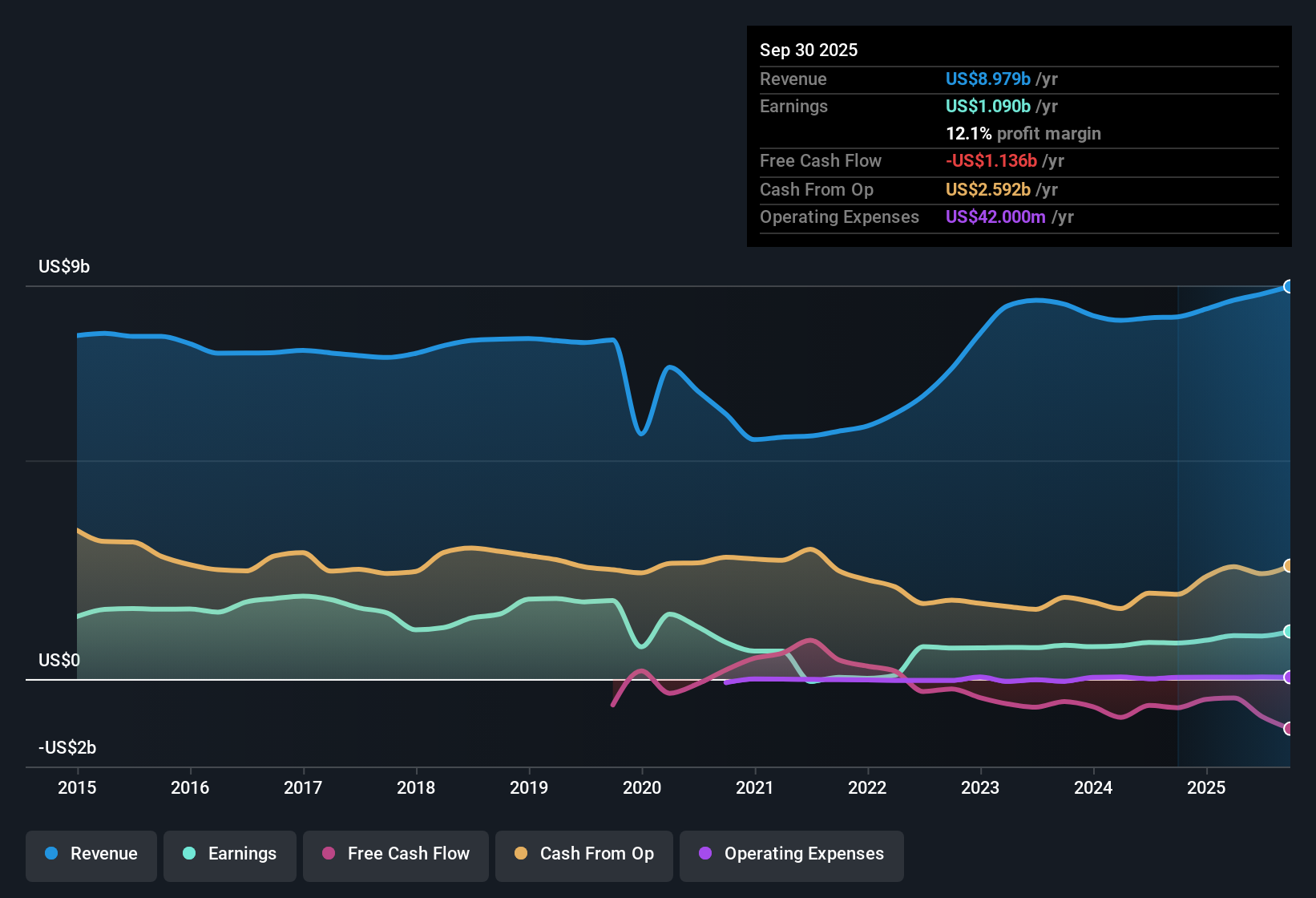

PPL (PPL) reported robust earnings growth, with EPS surging 17.5% for the year and a five-year annualized earnings growth rate of 20.9%. Net profit margin also advanced, reaching 11.2% compared to 10.2% in the prior year. Looking forward, consensus forecasts point to annual earnings growth of 12% and revenue growth around 5%. Both are trailing the broader US market. Investors must also weigh the elevated P/E ratio of 27.3x, with the stock trading well above its estimated fair value. Alongside the upbeat growth outlook, a material risk persists regarding the sustainability of PPL’s dividend. This sets the backdrop for the current debate on valuation and future returns.

See our full analysis for PPL.Next up, we’ll put these headline numbers into context by weighing them against the core narratives and sentiment that are shaping investor expectations right now.

See what the community is saying about PPL

Margin Expansion Sets Up Higher Profitability

- Profit margins improved from 10.2% to 11.2% in the past year, adding $986 million in net earnings and supporting a five-year annualized earnings growth of 20.9%.

- Analysts' consensus view highlights that these margin gains align with major grid upgrades and new joint ventures. These factors could accelerate long-term earnings stability and regulated revenue growth.

- Consensus narrative notes the $20 billion capital investment through 2028 aims to drive nearly 10% average annual rate base expansion.

- However, higher reliance on large projects and regulatory lag could impact the consistency and predictability of future net margin growth.

See how margin growth is shaping PPL's consensus narrative, including both the opportunities and key risks analysts are watching. 📊 Read the full PPL Consensus Narrative.

Dividend Sustainability Faces Pressure

- A material risk is flagged in the filing around the sustainability of PPL’s dividend, especially as large capital investment plans demand significant cash resources.

- Analysts' consensus narrative warns that while profitability and rate base are projected to grow, a heavy reliance on regulatory approval for cost recovery and potential asset write-downs could reduce the company’s flexibility to maintain or grow the dividend.

- Regulatory and policy changes in Pennsylvania and Kentucky remain wildcards. Any unfavorable decisions could potentially lower cash flows available for dividends.

- Ongoing capex and exposure to stranded asset risk may compete for capital allocation, directly impacting the dividend outlook even as earnings rise.

Valuation Stretched Versus Peers

- PPL trades at a 27.3x price-to-earnings multiple, meaningfully above both the US electric utilities industry average of 21.6x and the peer average of 18.2x. It also sits well above its DCF fair value of $27.83, with the current share price at $36.37.

- Analysts' consensus view suggests the narrow 6.7% gain to consensus price target reflects limited upside for new investors absent further upward estimate revisions. This is because current valuation already factors in expected profit and margin expansion.

- Consensus notes that for the current price to be justified, investors must believe 2028 earnings will hit $1.7 billion and margins will climb to 17.6%. This assumes successful execution of all announced projects and no material setbacks.

- With required future PE remaining higher than the industry norm at 20.6x, any slowdown in earnings trajectory or capex returns could introduce risk of valuation compression.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PPL on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Share your angle on the numbers and craft your own story in just a few minutes. Do it your way

A great starting point for your PPL research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

PPL’s premium valuation and uncertain dividend outlook raise concerns about future returns if growth or regulatory recovery do not meet expectations.

For investors seeking better value and less downside risk, check out these 836 undervalued stocks based on cash flows to discover companies currently trading well below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PPL

PPL

Provides electricity and natural gas to approximately 3.5 million customers in the United States.

Proven track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives