- United States

- /

- Electric Utilities

- /

- NYSE:POR

Should Portland General Electric’s $6.4 Billion Clean Energy Push Prompt Action From POR Investors?

Reviewed by Sasha Jovanovic

- In recent weeks, Portland General Electric completed three new utility-scale battery energy storage systems and outlined clean energy investments exceeding US$6.4 billion through 2029, while also finalizing its shortlist of solar and battery storage projects for regulatory review and contract negotiation by year-end 2025.

- These initiatives mark a significant step in expanding regional capacity and reliability, positioning the company at the forefront of Oregon’s energy transition and infrastructure modernization.

- Let’s explore how the completion of major battery storage projects could impact Portland General Electric’s investment outlook and future growth expectations.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Portland General Electric Investment Narrative Recap

To be a shareholder in Portland General Electric, you need confidence in the region’s long-term electrification and renewable energy growth, betting that substantial clean energy investments will translate into steady earnings and dividend growth. While the recent completion of three major battery energy storage systems is an important milestone, it does not immediately alter the key near-term catalyst, customer demand growth driven by Oregon’s technology and data center sectors, or reduce the heightened risk of execution delays and project cost overruns as capital spending accelerates.

The most relevant development tied to these themes is PGE's finalized shortlist of solar and battery storage projects. This move brings the company closer to new clean energy procurement, a catalyst that aligns with major grid investments aimed at supporting both system reliability and anticipated industrial demand. However, as capital spending grows, so does the margin for project-related risk...

Read the full narrative on Portland General Electric (it's free!)

Portland General Electric is projected to reach $4.0 billion in revenue and $479.0 million in earnings by 2028. This outlook is based on a 4.7% annual revenue growth rate and a $185 million increase in earnings from the current $294.0 million.

Uncover how Portland General Electric's forecasts yield a $46.36 fair value, a 7% upside to its current price.

Exploring Other Perspectives

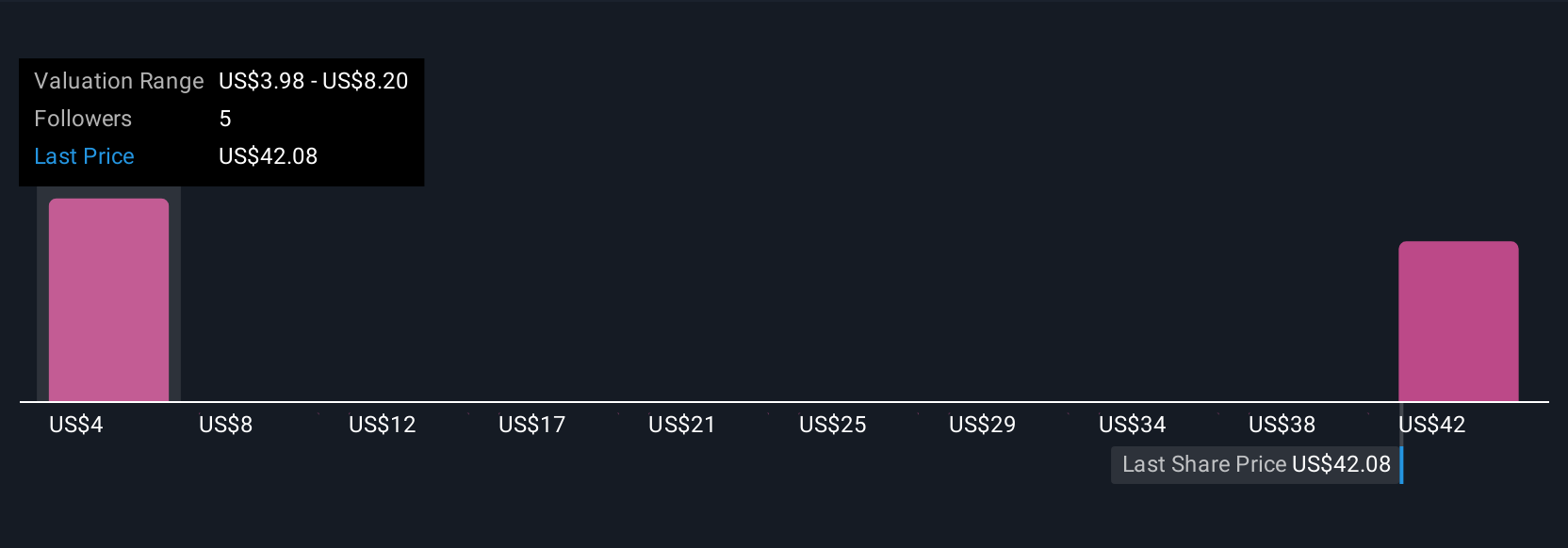

Fair value estimates for Portland General Electric from three Simply Wall St Community members span from just US$4.01 to US$54.07, highlighting contrasting views. In comparison, analysts remain focused on whether robust demand growth can outweigh growing risks tied to cost recovery and project execution, explore several alternative viewpoints for a broader outlook.

Explore 3 other fair value estimates on Portland General Electric - why the stock might be worth as much as 25% more than the current price!

Build Your Own Portland General Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Portland General Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Portland General Electric's overall financial health at a glance.

No Opportunity In Portland General Electric?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POR

Portland General Electric

An integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives