- United States

- /

- Electric Utilities

- /

- NYSE:POR

Portland General Electric (POR): Margin Compression Reinforces Questions on Profit Stability

Reviewed by Simply Wall St

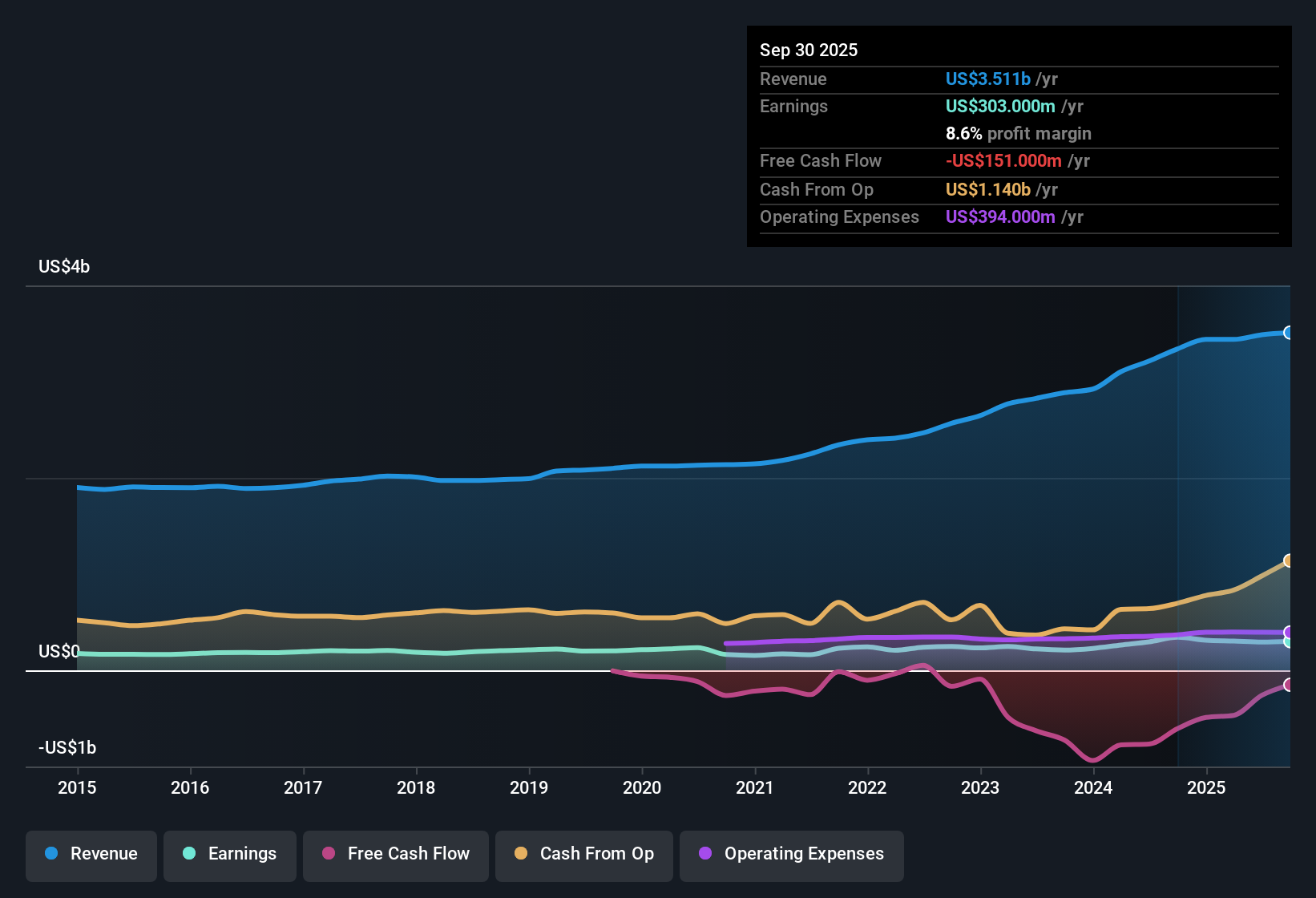

Portland General Electric (POR) is expected to grow earnings by 10.07% annually, with revenue projected to increase 5.3% a year, just below the US market’s 10.3% pace. The company’s longer-term record shows earnings growth of 13% per year over the last five years, but its most recent net profit margin narrowed to 8.4% from 9.2%. Reported earnings have turned negative in the past year. Investors now have to weigh these results against a 17x price-to-earnings ratio and the company’s noted track record of high-quality earnings, alongside clear risks including weaker financial positioning and a less secure dividend.

See our full analysis for Portland General Electric.The next section puts these results up against the key market narratives, letting us see where expectations and hard numbers align, and where the surprises might be.

See what the community is saying about Portland General Electric

Margins Projected to Rebound

- Analysts expect profit margins to improve from the current 8.4% to 12.0% within three years. This indicates a significant increase in profitability as cost controls and regulatory changes take effect.

- According to the analysts' consensus view, Portland General Electric's recent move to enhance cost management and regulatory flexibility is anticipated to help restore margins that have dipped in the last year.

- Initiatives such as the FAIR Energy Act and workforce reductions are projected to reduce operating expenses and improve net margin stability.

- Ongoing investment in renewables could create pressure if project costs overrun or recovery mechanisms fall short, which would test management's ability to deliver on expected margin gains.

- High-quality earnings delivery is important for re-rating expectations. Historical outperformance on margins now faces new headwinds from industrial decarbonization and grid modernization costs.

- Bulls note that constructive regulation and clean energy incentives should offset some risks and support a margin rebound over time.

- Bears remain cautious, pointing out that any delay in execution or unexpected resiliency costs from weather events could quickly offset these anticipated gains.

To see how analysts’ forecasts stack up against PGE’s latest operational moves and whether the consensus narrative is shifting, see the latest breakdown in the consensus narrative for Portland General Electric. 📊 Read the full Portland General Electric Consensus Narrative.

Regulatory Progress Fuels Predictability

- The passage of multiyear ratemaking reforms such as the POWER Act and FAIR Energy Act is expected to increase earnings stability and reduce regulatory lag. This will allow PGE to recover costs more efficiently over time.

- Analysts' consensus view credits regulatory improvements with making annual cost recoveries more predictable, supporting ongoing investments and limiting the impact of near-term market fluctuations.

- Implementation of flexible cost allocation reduces the risk of regulatory shortfalls and allows more stable net income as revenue needs rise.

- This predictability underpins PGE’s long-term investment case as it increases management’s confidence in executing grid modernization and clean energy transition strategies.

Fair Valuation Relative to Peers

- Portland General Electric’s 17x price-to-earnings ratio is well below the US electric utilities industry average of 21.3x and its peer group at 25x. This reflects analyst views that the stock is fairly valued for its growth rates and risk profile.

- Analysts' consensus narrative highlights that the company’s share price of $45.68 trades just below their consensus target of $47.67, which indicates modest near-term upside with the market pricing in both opportunities and risks for future profit growth.

- The relatively small premium to target price suggests investors are already factoring in likely profit improvements along with exposed risks around margin recovery and regulatory shifts.

- For valuation-focused investors, the wider discount to industry multiples provides some buffer. However, further performance will likely be needed to unlock significant share price gains.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Portland General Electric on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spotting different trends in the data? Use your own insights to shape a unique market view in just a few minutes, and Do it your way

A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Portland General Electric faces margin pressure from rising costs, recent negative earnings, and a less robust financial position compared to its peers.

If you want to focus on companies with lower leverage and greater resilience, find businesses with stronger fundamentals using our solid balance sheet and fundamentals stocks screener (1983 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POR

Portland General Electric

An integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives