- United States

- /

- Electric Utilities

- /

- NYSE:POR

Portland General Electric (POR): Exploring Valuation After Recent Outperformance in Utilities Sector

Reviewed by Simply Wall St

Portland General Electric (POR) shares have delivered a 9% gain over the past month, outpacing the broader utilities sector. The company’s consistent performance is drawing attention from investors who are curious about its steady outlook and ongoing growth story.

See our latest analysis for Portland General Electric.

The past year has seen Portland General Electric maintain a solid trajectory, capped by a 9.5% share price return over the past month and a 14% gain over the previous quarter. Looking at the bigger picture, the company’s 8.4% total shareholder return over twelve months and strong multi-year performance suggest that momentum is building as investors grow more confident in its fundamentals and growth prospects.

If you’re interested in broadening your search, consider checking out fast growing stocks with high insider ownership for more opportunities with impressive growth dynamics and management alignment.

Despite recent gains and steady fundamentals, the key question remains: is Portland General Electric currently undervalued in light of its growth, or is the market already factoring in all of its future potential?

Most Popular Narrative: Fairly Valued

Portland General Electric's widely followed narrative assigns a fair value right in line with the latest close, suggesting expectations and market pricing have converged. This sets up an intriguing look at the catalysts and quantitative assumptions underpinning the consensus view.

Constructive regulatory progress, including the passage of the POWER Act and the FAIR Energy Act, implements multiyear ratemaking, flexible cost allocation, and contemporary cost recovery mechanisms. This increases earnings predictability and reduces the regulatory lag, directly benefiting net margins and earnings stability.

Want to know the math driving this no-surprises valuation? The secret lies in a consensus of analyst projections, ambitious margin targets, and a future profit benchmark lower than today’s. Discover which numbers are quietly tilting the scales behind this “just right” price tag.

Result: Fair Value of $48.33 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapidly rising costs for grid modernization or unexpected regulatory hurdles could quickly challenge the current consensus of “fair value” around Portland General Electric.

Find out about the key risks to this Portland General Electric narrative.

Another View: Competitive Ratios Offer a Different Perspective

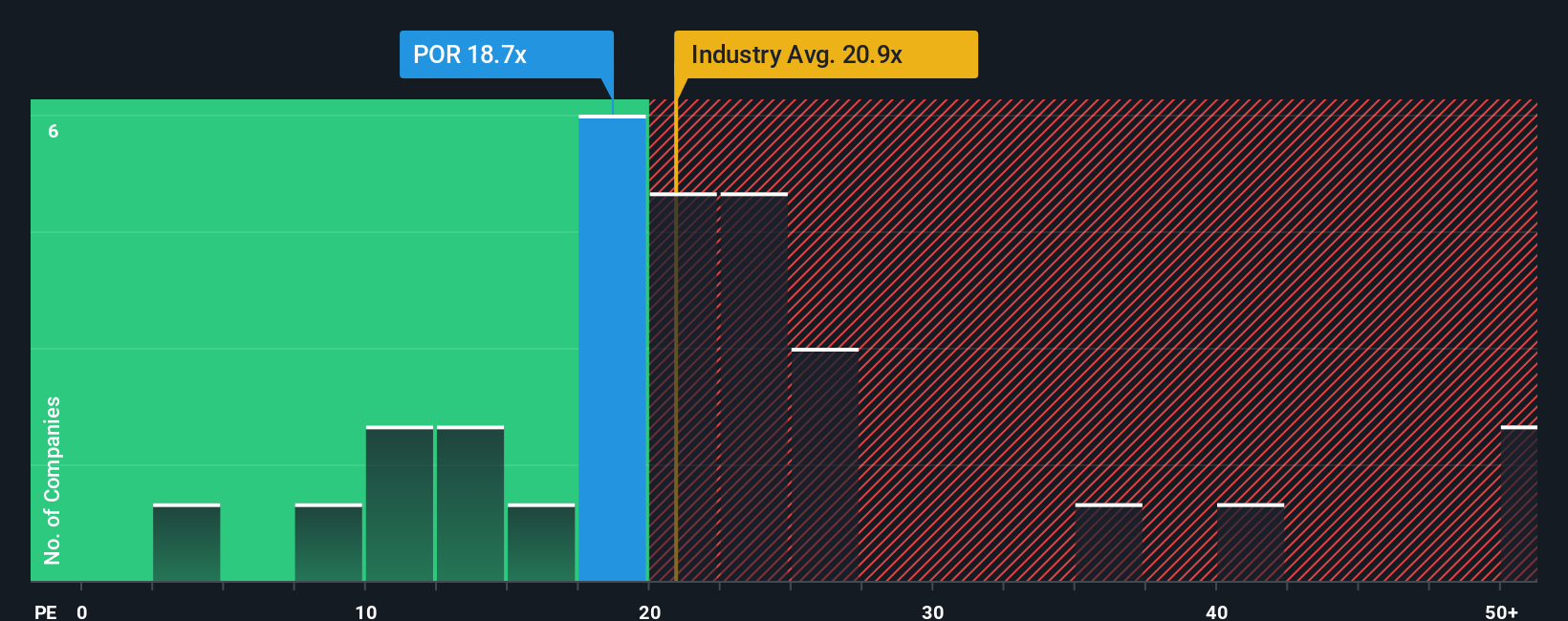

Looking at Portland General Electric through the lens of market ratios, its price-to-earnings stands at 18.3x, noticeably below both the Electric Utilities industry average of 20.5x and the peer group average at 24.7x. The current figure is even lower than the fair ratio of 20.1x, suggesting the market may be overlooking upside potential. Does this gap mark an opportunity that investors should not ignore, or is there a reason for caution in the numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Portland General Electric Narrative

If you’d rather dig into the data and develop your own conclusions, you can build a personal view in just a few minutes. Do it your way

A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to uncover high-potential stocks you might otherwise overlook and put yourself ahead of the crowd with these distinctive screener picks curated for investors seeking the next big win.

- Accelerate your portfolio growth by taking action on these 918 undervalued stocks based on cash flows, which offer attractive entry points based on compelling cash flow signals.

- Capitalize on surging healthcare innovation when you check out these 30 healthcare AI stocks, harnessing powerful AI for breakthroughs in patient outcomes and medical diagnostics.

- Supercharge your quest for steady income and stability with these 16 dividend stocks with yields > 3%, featuring robust yields that outperform the market’s ordinary payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POR

Portland General Electric

An integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives