- United States

- /

- Electric Utilities

- /

- NYSE:POR

Could Dividend Growth and Data Center Demand Signal a Turning Point for Portland General Electric (POR)?

Reviewed by Simply Wall St

- Portland General Electric announced its second quarter 2025 financial results, revealing US$807 million in revenue and US$62 million in net income, up from US$758 million in revenue but down from US$72 million in net income a year prior.

- The company highlighted strong industrial demand from data centers, ongoing infrastructure investments, and sustained 19-year dividend growth, reinforcing its focus on both operational progress and shareholder returns.

- We'll take a closer look at how rising data center demand and dividend consistency could influence Portland General Electric's investment outlook.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Portland General Electric Investment Narrative Recap

To believe in Portland General Electric, I think you need confidence in persistent industrial demand, especially from data center clients, as well as the company’s continued ability to translate that into stable, long-term shareholder returns. The recent Q2 2025 results showcased record revenue on strong industrial load, but a slip in net income highlights margin pressures that could limit the near-term boost from these catalysts; importantly, there’s no material impact yet on the biggest concern: cost recovery amid growing regulatory and energy transition pressures.

Of the recent company moves, the follow-on equity offering tied to its Dividend Reinvestment Plan stands out. By issuing new shares, PGE is reinforcing shareholder participation while strengthening its balance sheet to support both infrastructure upgrades and the reliability improvements necessary to meet rising demand. This action is closely linked to supporting the business drivers that matter most right now, even as execution risks around grid modernization may remain.

Yet, in contrast to the industrial growth story, investors should not overlook the ongoing risk that mounting capital investments may...

Read the full narrative on Portland General Electric (it's free!)

Portland General Electric is projected to reach $4.0 billion in revenue and $473.6 million in earnings by 2028. This outlook assumes a 4.8% annual revenue growth rate and a $179.6 million increase in earnings from the current $294.0 million.

Uncover how Portland General Electric's forecasts yield a $46.17 fair value, a 9% upside to its current price.

Exploring Other Perspectives

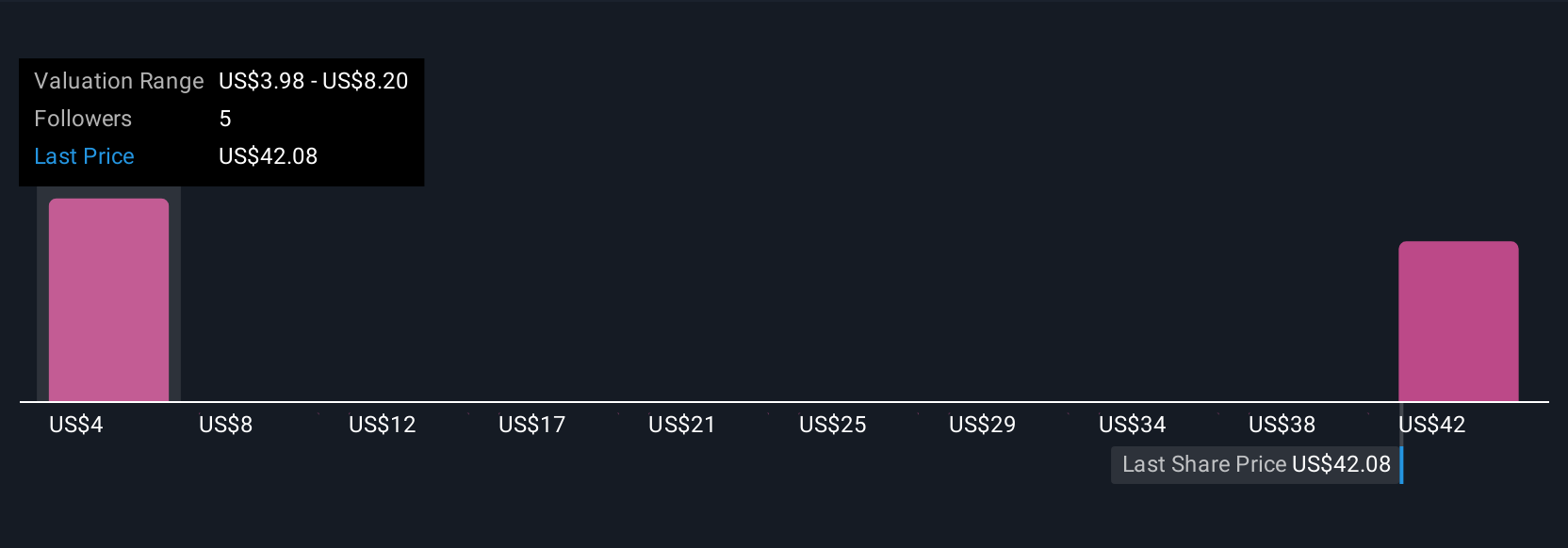

Simply Wall St Community members offered fair value estimates for PGE ranging from as low as US$4.20 to US$46.16 based on 2 different forecasts. Looking beyond these divergent opinions, heavier investment in grid modernization could drive further upside or pose risks if costs outpace expectations, so it pays to compare several viewpoints before you decide.

Explore 2 other fair value estimates on Portland General Electric - why the stock might be worth as much as 9% more than the current price!

Build Your Own Portland General Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Portland General Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Portland General Electric's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POR

Portland General Electric

An integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives