- United States

- /

- Electric Utilities

- /

- NYSE:PNW

Pinnacle West Capital (PNW): Margin Decrease Reinforces Dividend and Financial Stability Concerns

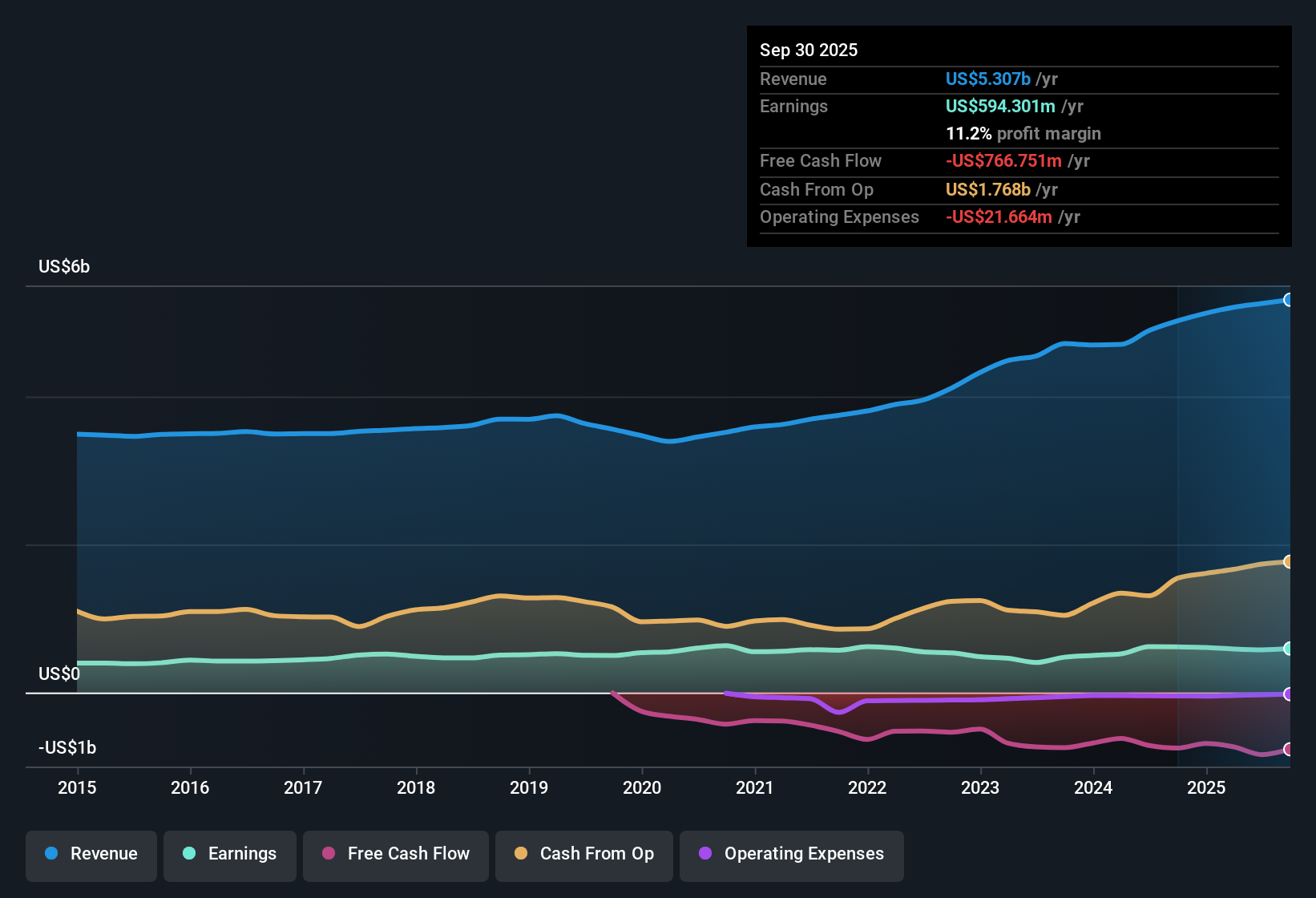

Pinnacle West Capital (PNW) is forecast to grow revenue at 4.7% per year, which trails behind the US market's expected 10.5% annual growth. Earnings are set to rise at a rate of 10.4% per year, while net profit margins have slipped to 11% from 12.7%. Over the past five years, earnings have averaged a 0.9% per year decline. Trading at $89.45 with a Price-To-Earnings Ratio of 18.5x, the stock sits just below its estimated fair value. Strong earnings quality and expectations of profit growth are keeping investors optimistic, despite some concerns over dividend sustainability and financial stability.

See our full analysis for Pinnacle West Capital.Next, we will compare these numbers with the prevailing narratives to determine whether the community view is supported or challenged by the actual results.

See what the community is saying about Pinnacle West Capital

Margin Recovery on the Horizon

- Analysts expect net profit margins to increase from 11.0% today to 13.0% by 2026, signaling a potential turnaround after the recent slip from 12.7%.

- According to the analysts' consensus view, forthcoming regulatory modernization and grid upgrades are seen as key levers to stabilize and improve margins, especially as these measures support better cost recovery and lessen the impact of regulatory lag.

- Consensus narrative notes that proposals for formula rate mechanisms and rate design reforms should help reduce lag, directly addressing margin pressures from recent capital projects.

- Grid modernization investments, such as wildfire mitigation and automation, are positioned as margin-friendly, helping insulate future profitability against rising operating and maintenance expenses.

- Consensus narrative suggests that this earnings momentum, if realized, could provide a stable foundation for long-term growth expectations, especially if forecasts for commercial and industrial demand materialize strongly.

Dividend and Debt Risks Resurface

- Pinnacle West Capital’s dividend sustainability and overall financial strength continue to be called into question, as risk screenings have flagged these areas for negative outcomes this period.

- Consensus narrative points to two underlying risks: first, that the ongoing reliance on fossil fuel infrastructure could raise long-term costs. Second, major regulatory decisions may not accommodate future capital recovery as quickly as needed.

- Bears highlight that cost recovery for large capital investments may lag behind, as the next significant rate relief is not expected until late 2026 and is tied to 2024 data, putting near-term margin improvement at risk.

- The lack of positive outcomes for dividend and financial position flags that even with profit growth forecasts, investors face uncertainty regarding cash distributions and balance sheet resilience.

Valuation Edge Versus Peers

- The current Price-To-Earnings Ratio of 18.5x stands below both sector (20.4x) and broader industry (21.5x) levels. With shares trading at $89.45, they sit just under the DCF fair value of $90.97.

- Consensus narrative sees this discount as making Pinnacle West Capital attractive in relative terms, with the 8.5% gap to the $95.79 analyst price target suggesting modest market upside if growth and margin improvements are achieved.

- The valuation gap could narrow if Pinnacle West delivers projected margin gains and revenue growth, which are both seen as credible by analysts despite recent earnings declines.

- Still, the close distance to fair value implies the stock is reasonably priced rather than a deeply undervalued opportunity. This reinforces the consensus that future results must deliver on improvement forecasts to justify upside.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Pinnacle West Capital on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Shape that insight into your own narrative in just a few minutes. Do it your way.

A great starting point for your Pinnacle West Capital research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Pinnacle West Capital faces uncertainty around its dividend reliability and overall financial health. Risk flags highlight concerns about balance sheet resilience and future cash distributions.

If you want more dependable fundamentals, check out solid balance sheet and fundamentals stocks screener (1978 results) to quickly spot companies with stronger balance sheets and robust financial footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNW

Pinnacle West Capital

Through its subsidiary, provides retail and wholesale electric services primarily in the state of Arizona.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Spotify - A Fundamental and Historical Valuation

Very Bullish

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.