- United States

- /

- Electric Utilities

- /

- NYSE:PNW

Assessing Pinnacle West Capital's (PNW) Valuation: Is There More Upside After Recent Price Stability?

Reviewed by Simply Wall St

Pinnacle West Capital (PNW) shares have edged higher over the past week, showing a 0.5% gain. However, the stock is down about 3% for the month. Investors appear to be weighing recent performance against the company’s longer-term track record.

See our latest analysis for Pinnacle West Capital.

Over the past year, Pinnacle West Capital’s share price has climbed steadily, with a 6% gain year-to-date reflecting gradually improving sentiment and a solid 3-year total shareholder return of 33%. This suggests a consistent track record even as short-term momentum varies.

If you’re curious to see what other sectors are showing strong growth or insider confidence, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With steady returns and improving fundamentals, the big question for investors is whether Pinnacle West Capital’s current value understates its future growth potential or if the stock’s recent performance means much of that optimism is already reflected in its price.

Most Popular Narrative: 7% Undervalued

Pinnacle West Capital's most recent fair value estimate is $96.07, roughly 7% above the last close of $89.34. With cautious optimism, the most widely followed narrative weighs robust future growth drivers against execution risks, setting the stage for deeper insights.

The ongoing influx of large commercial and industrial customers (notably data centers and manufacturers), along with a backlog of nearly 20 GW in uncommitted customer interconnection requests, signals substantial upside potential for volumetric sales and rate base expansion. This is expected to positively impact revenue and long-term earnings. The company's progress on regulatory modernization, including proposals for formula rate mechanisms and rate design adjustments to ensure large customers pay their full share, should improve cost recovery, reduce regulatory lag, and stabilize net margins as future capital investments come online.

Want to see what's driving this premium valuation? Industry growth, customer demand, and new regulatory frameworks are being baked into bold profit projections. The real surprise is that the narrative hinges on aggressive assumptions about future earnings expansion. Are you ready to uncover the numbers shaking up Wall Street?

Result: Fair Value of $96.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on fossil fuels and regulatory lag could pose headwinds that may challenge the bullish case for Pinnacle West Capital's long-term outlook.

Find out about the key risks to this Pinnacle West Capital narrative.

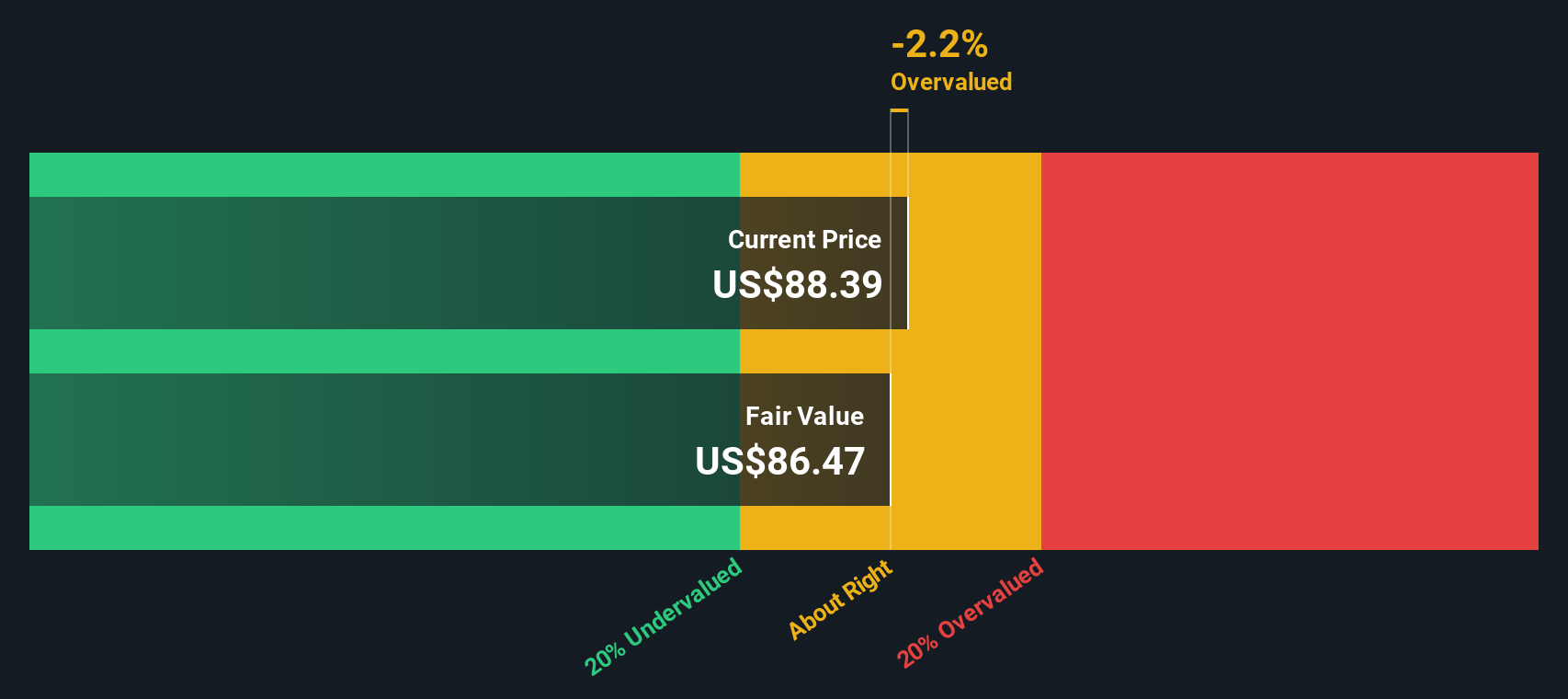

Another View: SWS DCF Model Offers a Cautious Contrast

While the analyst consensus points to Pinnacle West Capital being undervalued, our DCF model arrives at a more measured estimate, placing fair value slightly below the current share price. This introduces a note of caution: could market optimism be outpacing fundamental cash flow prospects?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pinnacle West Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pinnacle West Capital Narrative

If you’d rather chart your own course or question these conclusions, the tools are here for you to dive in and shape your own view. Do it your way

A great starting point for your Pinnacle West Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More High-Potential Investment Opportunities?

Smart investors never stop at a single stock. Act now and unlock a new realm of possibilities using these powerful screeners trusted by the Simply Wall Street community.

- Jump on emerging digital trends and see which companies are transforming finance and technology with these 81 cryptocurrency and blockchain stocks.

- Catch stable income streams by checking out these 16 dividend stocks with yields > 3%, delivering yields above 3% for reliable returns.

- Tap into the AI revolution with these 25 AI penny stocks, reshaping industries and introducing market-defining innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNW

Pinnacle West Capital

Through its subsidiary, provides retail and wholesale electric services primarily in the state of Arizona.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives