- United States

- /

- Gas Utilities

- /

- NYSE:OGS

ONE Gas (OGS): Evaluating Valuation After Strong Earnings, Dividend Confirmation, and Outlook Update

Reviewed by Simply Wall St

ONE Gas (OGS) has caught investors’ attention after posting higher revenue and net income for both the third quarter and the year to date. In addition to this earnings momentum, the company confirmed its dividend and slightly updated its full-year outlook.

See our latest analysis for ONE Gas.

ONE Gas has kept up the momentum with a series of notable corporate updates this quarter, including stronger-than-expected earnings, a renewed multi-year credit agreement, and a confirmed dividend. The company's share price reflects this steady progress, climbing 19.1% year-to-date and closing at $81.43. A one-year total shareholder return of nearly 16% highlights solid value for longer-term investors.

If ONE Gas's latest results have you thinking about what else is on the move, take this opportunity to discover fast growing stocks with high insider ownership.

After such robust performance and a strong run-up in the share price, investors are left to consider if ONE Gas remains attractively valued or if the market has already priced in the next stage of growth.

Most Popular Narrative: 1.3% Undervalued

With ONE Gas trading just above its narrative-based fair value of $82.50, recent gains have brought shares closer to what leading analysts see as a justified price. This sets up a deeper look into the catalysts behind this view.

Favorable regulatory developments, particularly Texas House Bill 4384, enable full recovery of capital expenditures and reduce regulatory lag. This is anticipated to drive higher earnings and more predictable net profit margins in the coming years.

Want to know the legislative shift that's fueling optimism in this valuation? The fair value projection hangs on a crucial change in earnings, revenue growth, and margin forecasts. Curious how these pressures combine to give ONE Gas its latest price target? Dig into the full narrative to uncover the surprising growth assumptions at play.

Result: Fair Value of $82.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained high capital spending or unexpected regulatory setbacks could challenge current valuation assumptions and introduce volatility to ONE Gas's growth outlook.

Find out about the key risks to this ONE Gas narrative.

Another View: What Do Earnings Ratios Say?

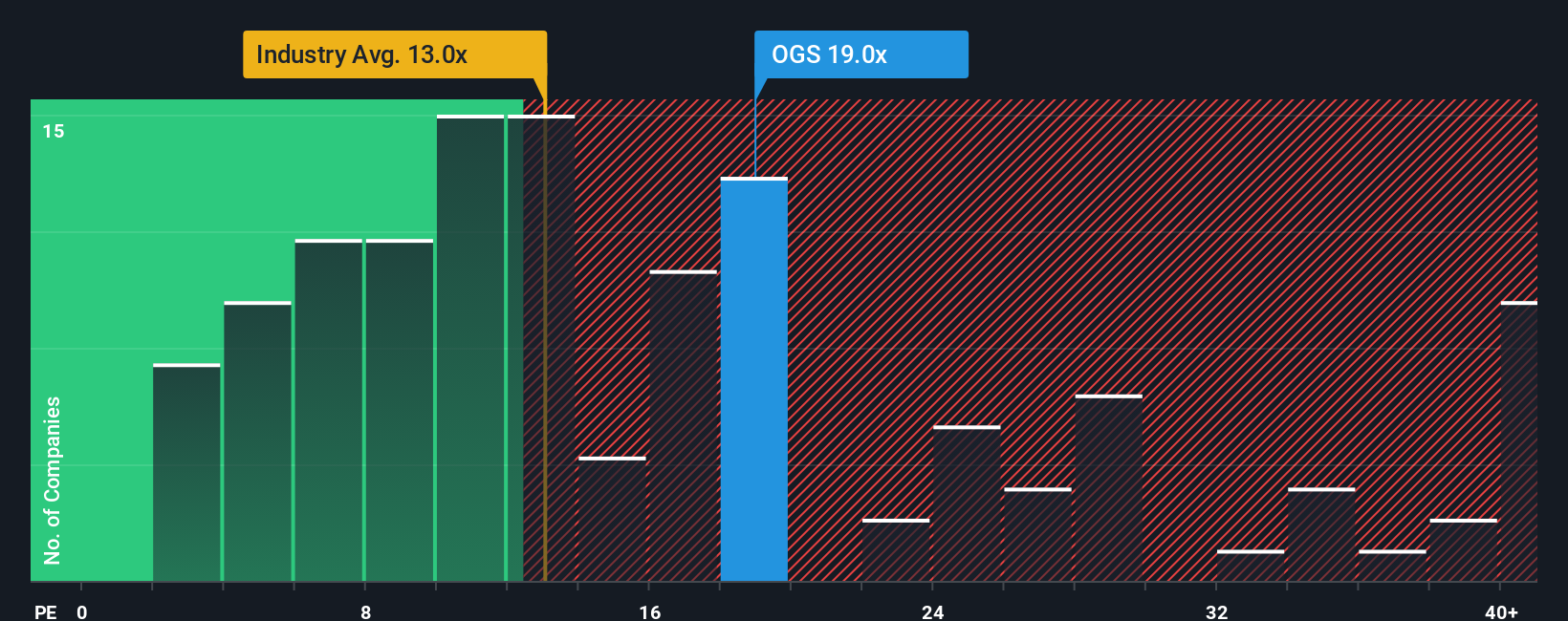

Looking through the lens of the price-to-earnings ratio, ONE Gas appears pricier than both the industry average and its peers. Shares trade at 19.2 times earnings, higher than the US Gas Utilities average of 17x and above its fair ratio of 18.6x. This premium signals investors are paying up for perceived safety and stability, but it could also add risk if expectations change. Does the current price leave much room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ONE Gas Narrative

If you see the story differently or prefer hands-on research, you can easily craft your own perspective in just a few minutes. Do it your way.

A great starting point for your ONE Gas research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Make your portfolio stand out with unique opportunities others might overlook. Use these proven screens to access fresh sectors and trends. Your next winner could be waiting.

- Tap into high-potential cash flow by targeting these 861 undervalued stocks based on cash flows companies overlooked by the market.

- Capture the energy of innovation via these 25 AI penny stocks disrupting industries with breakthrough artificial intelligence solutions.

- Lock in robust yields with these 17 dividend stocks with yields > 3% and see which businesses deliver dependable income and financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGS

ONE Gas

Operates as a regulated natural gas distribution utility company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives