- United States

- /

- Gas Utilities

- /

- NYSE:NWN

Northwest Natural (NWN) Margin Expansion Reinforces Bullish Narratives but Puts Valuation in Focus

Reviewed by Simply Wall St

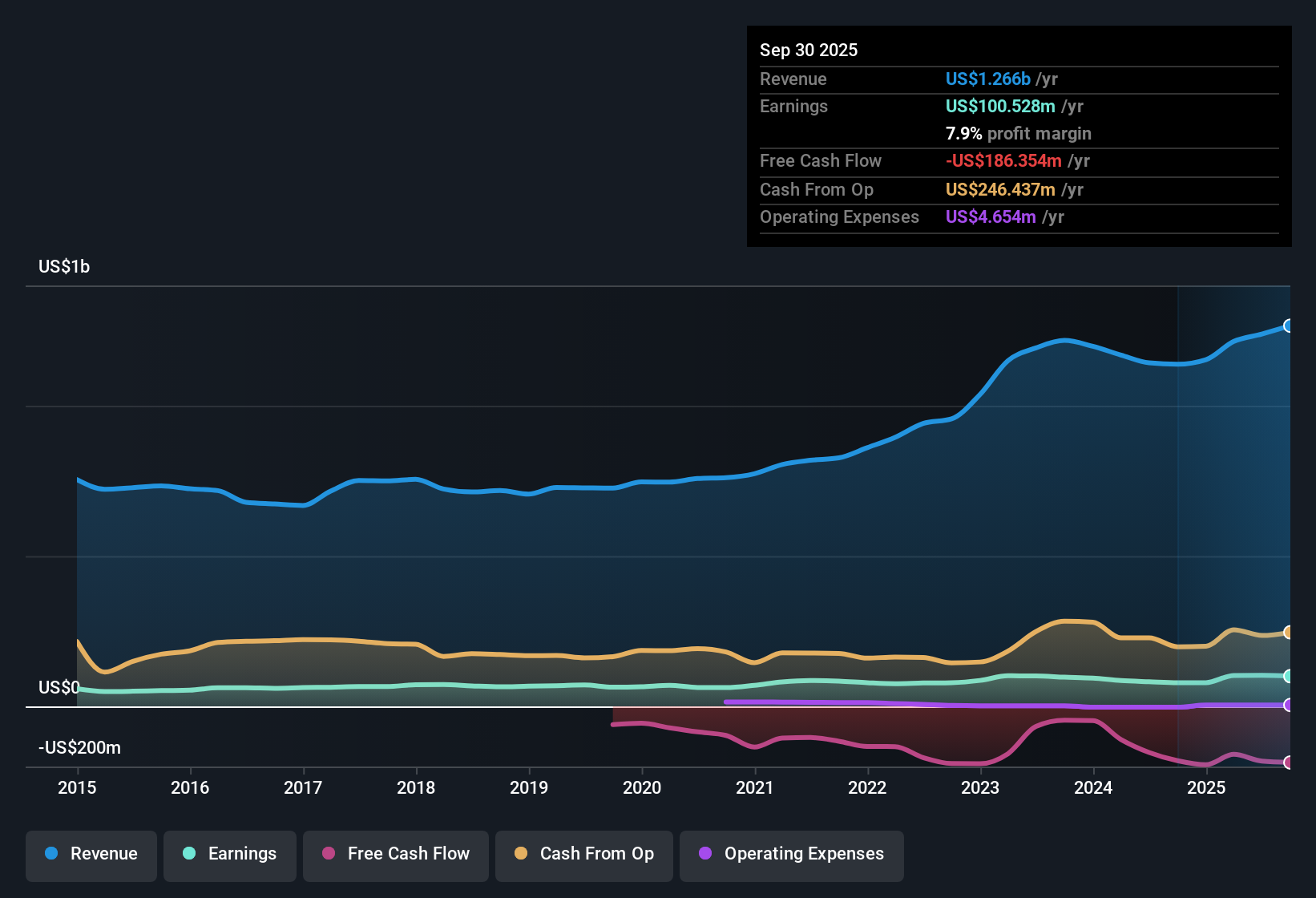

Northwest Natural Holding (NWN) booked a net profit margin of 8.3%, up from 7.2% a year ago, as earnings climbed 25.9% over the last year, well above its five-year annualized average of 5.4%. EPS momentum has picked up notably, pointing to higher-quality profits and improved operational efficiency. While these results offer reasons for optimism, investors will be weighing the sustainability of this growth against more moderate forward projections and a premium valuation.

See our full analysis for Northwest Natural Holding.The next section puts these earnings in the context of what Simply Wall St narratives say about Northwest Natural, highlighting whether the fresh numbers reinforce or challenge prevailing market views.

See what the community is saying about Northwest Natural Holding

Texas Acquisitions Drive Backlog Strength

- Northwest Natural’s Texas operations feature over 217,000 signed customer contracts in their fast-growing SiEnergy segment, pointing to lasting multi-year visibility for organic revenue growth beyond the Pacific Northwest’s more mature markets.

- Analysts' consensus view highlights how these Texas acquisitions and a strong contract backlog support the bullish case for steady, predictable revenue streams.

- Robust backlog conversion helps counterbalance risks tied to policy shifts or stagnation in legacy gas regions, with steady population and construction growth in Texas anchoring future meter additions.

- The consensus view sees backlog execution in Texas as a more reliable, diversified engine for income than the company’s historic reliance on Northwest utility demand.

- To see how strategic expansion in Texas is shaping the company’s outlook, check the full consensus on growth and risks in the narrative below. 📊 Read the full Northwest Natural Holding Consensus Narrative.

Margin Expansion Outpaces Peers

- Profit margins are expected to climb from 8.3% today to 9.7% by 2027, while industry averages remain lower, offering a runway for further earnings quality gains if cost controls and regulatory support persist.

- Consensus narrative notes this outlook challenges persistent concerns about sector-wide pressures.

- Recent regulatory outcomes, such as a successful rate case and higher allowed return on equity, are credited by analysts for supporting margin growth even as most US gas utilities face tighter decarbonization headwinds.

- This divergence means that, for now, Northwest Natural is bucking industry cost and efficiency drags, providing investors with above-average earnings quality relative to sector trends.

Shares Priced Above DCF Fair Value

- At $46.04 per share, Northwest Natural is trading above its DCF fair value of $42.90 and slightly below the consensus price target of $52.25, while its P/E ratio of 18.3x sits higher than the global industry average of 14x but just below peer average.

- Analysts' consensus view suggests the premium valuation is justified only if the projected revenue ($1.6 billion) and earnings ($153.7 million) for 2028 are met.

- Any underperformance against these targets, especially in weaker end-markets or from regulatory setbacks, could make the current price appear rich compared to sector benchmarks.

- Still, the company’s visible growth pipeline and margin expansion provide a reasonable argument that a premium valuation can be maintained if execution tracks with forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Northwest Natural Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the recent results? Take just a few minutes to build and share your perspective. You can shape your own interpretation of the data. Do it your way

A great starting point for your Northwest Natural Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite visible growth drivers, Northwest Natural’s premium valuation leaves investors exposed if the company falls short of ambitious revenue and margin targets.

If you want to sidestep overvaluation risk and find investments with more compelling price-to-value upside, take a look at these 840 undervalued stocks based on cash flows that may offer better entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Natural Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NWN

Northwest Natural Holding

Through its subsidiary, Northwest Natural Gas Company, provides regulated natural gas distribution services to residential, commercial, and industrial customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives