- United States

- /

- Gas Utilities

- /

- NYSE:NWN

Increases to CEO Compensation Might Be Put On Hold For Now at Northwest Natural Holding Company (NYSE:NWN)

As many shareholders of Northwest Natural Holding Company (NYSE:NWN) will be aware, they have not made a gain on their investment in the past three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 27 May 2021. They could also influence management through voting on resolutions such as executive remuneration. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Northwest Natural Holding

Comparing Northwest Natural Holding Company's CEO Compensation With the industry

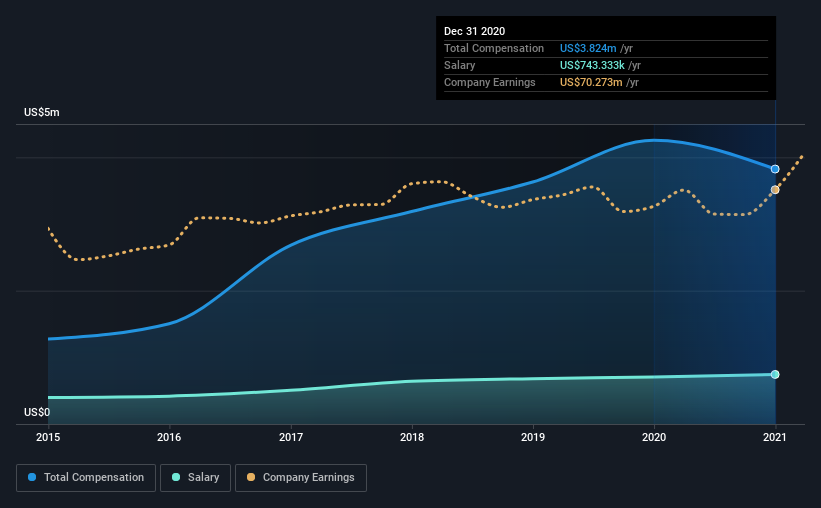

According to our data, Northwest Natural Holding Company has a market capitalization of US$1.6b, and paid its CEO total annual compensation worth US$3.8m over the year to December 2020. Notably, that's a decrease of 10% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$743k.

On examining similar-sized companies in the industry with market capitalizations between US$1.0b and US$3.2b, we discovered that the median CEO total compensation of that group was US$955k. Hence, we can conclude that David Anderson is remunerated higher than the industry median. Furthermore, David Anderson directly owns US$5.9m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$743k | US$706k | 19% |

| Other | US$3.1m | US$3.5m | 81% |

| Total Compensation | US$3.8m | US$4.3m | 100% |

On an industry level, around 19% of total compensation represents salary and 81% is other remuneration. There isn't a significant difference between Northwest Natural Holding and the broader market, in terms of salary allocation in the overall compensation package. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Northwest Natural Holding Company's Growth Numbers

Northwest Natural Holding Company's earnings per share (EPS) grew 1.7% per year over the last three years. It achieved revenue growth of 7.8% over the last year.

We're not particularly impressed by the revenue growth, but we're happy with the modest EPS growth. Considering these factors we'd say performance has been pretty decent, though not amazing. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Northwest Natural Holding Company Been A Good Investment?

With a three year total loss of 0.07% for the shareholders, Northwest Natural Holding Company would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would be keen to know what's holding the stock back when earnings have grown. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Northwest Natural Holding you should be aware of, and 1 of them doesn't sit too well with us.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Northwest Natural Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Northwest Natural Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:NWN

Northwest Natural Holding

Through its subsidiary, Northwest Natural Gas Company, provides regulated natural gas distribution services to residential, commercial, and industrial customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives