- United States

- /

- Electric Utilities

- /

- NYSE:NRG

Should NRG Energy’s (NRG) $370 Million Texas Loan for New Gas Plant Change Investor Perspectives?

Reviewed by Sasha Jovanovic

- Earlier this week, NRG Energy announced it has secured a US$370 million loan from the Texas Energy Fund to finance construction of a new 455-megawatt natural gas-fired power plant at its Greens Bayou Generating Station near Houston, with commercial operation expected in 2028.

- This loan marks NRG's third and final project supported through the Texas Energy Fund, bringing total program funding to US$1.15 billion across around 1.5 gigawatts of generation projects aimed at boosting grid reliability for one of Texas's largest electricity demand regions.

- We'll now explore how this infusion of low-interest state funding for new gas-fired capacity could influence NRG Energy's investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NRG Energy Investment Narrative Recap

NRG Energy shareholders are typically betting on sustained grid demand growth and the company’s ability to capture higher-margin opportunities as electrification accelerates, especially in major Texas markets. The newly announced US$370 million Texas Energy Fund loan increases NRG’s capacity for reliable power delivery but does not materially shift the key short-term catalyst: strong load growth and premium contract wins; nor does it resolve the business’s largest risk, which remains long-term exposure to fossil fuel regulation and debt-related financial pressure.

Among recent company developments, NRG’s expanded buyback authorization, up to US$3,000 million through 2028, is especially relevant, underscoring confidence in future cash flows supported by growth investments like the Greens Bayou plant, yet it also heightens leverage at a time of increased capital demands and sector uncertainty.

But in contrast to optimism about new capacity and share repurchases, investors should be aware of the persistent risks from rising regulatory scrutiny and the implications for NRG’s gas-heavy...

Read the full narrative on NRG Energy (it's free!)

NRG Energy's narrative projects $34.5 billion revenue and $1.6 billion earnings by 2028. This requires 5.5% yearly revenue growth and a $1.15 billion earnings increase from $455 million today.

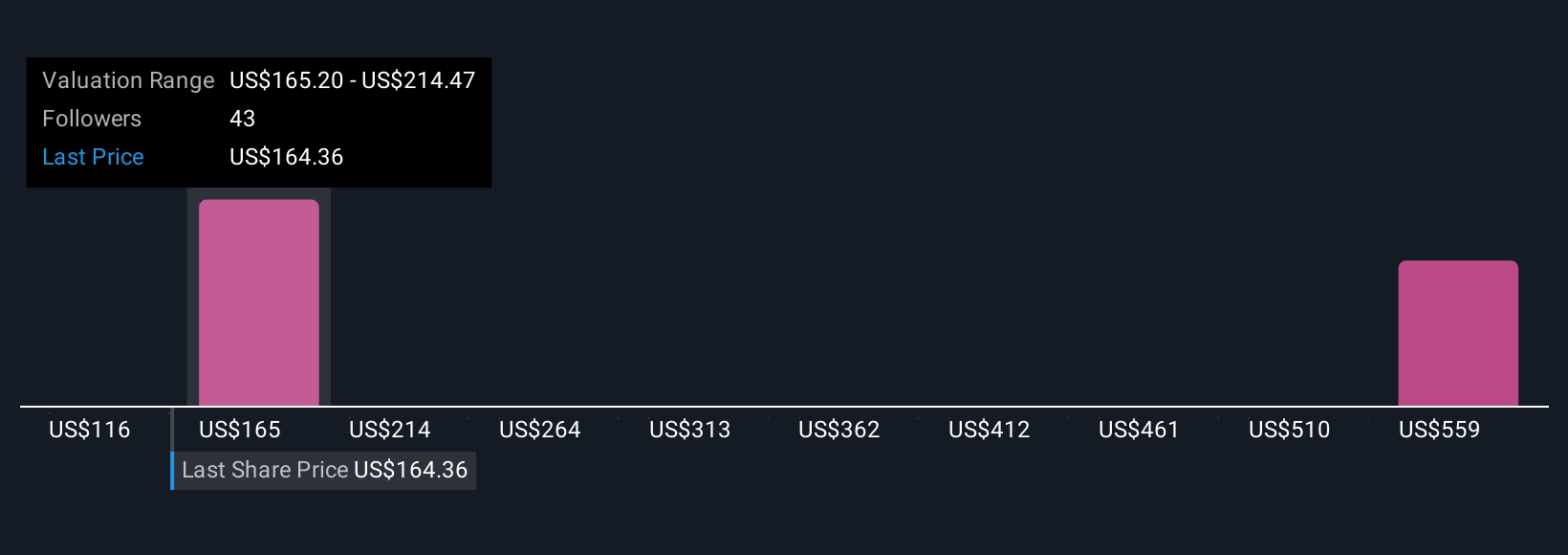

Uncover how NRG Energy's forecasts yield a $208.14 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Three fair value opinions from the Simply Wall St Community place NRG between US$203 and US$567, with some users seeing substantial upside. With such a broad range and grid growth as a prime catalyst, you can compare your own expectations against several alternative viewpoints here.

Explore 3 other fair value estimates on NRG Energy - why the stock might be worth over 3x more than the current price!

Build Your Own NRG Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NRG Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NRG Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NRG Energy's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success