- United States

- /

- Electric Utilities

- /

- NYSE:NRG

Assessing NRG Energy (NRG) Valuation After Recent Share Price Consolidation

Reviewed by Simply Wall St

NRG Energy (NRG) shares have moved modestly over the past month, declining around 2%, even as the stock has climbed 11% over the past 3 months. Investors may be watching for what is next after this recent price action.

See our latest analysis for NRG Energy.

Despite some recent volatility, NRG Energy’s share price return is up a remarkable 73% year-to-date. This reflects how shifting market sentiment and improving company performance have fueled significant momentum in both the short and long term. That is backed up by an impressive 67.87% total shareholder return over one year and over 475% for those holding steady over five years.

If NRG’s momentum has you curious about what else is surging, now is your chance to uncover new opportunities by checking out fast growing stocks with high insider ownership.

With such strong returns and a share price still trading below analyst targets, the key question now is whether NRG remains undervalued or if today’s price already reflects all of its future potential. Is there still a buying opportunity?

Most Popular Narrative: 22.6% Undervalued

NRG Energy’s narrative fair value stands significantly above its last close, with analysts projecting upside well beyond current market levels. This large gap is based on future-focused catalysts that investors can’t afford to ignore.

Analysts are assuming NRG Energy's revenue will grow by 5.5% annually over the next 3 years. NRG is executing on integrating digital and decentralized technologies, with rapid adoption of smart home offerings (Vivint platform) and residential Virtual Power Plant (VPP) initiatives performing far better than expected. This is likely to drive incremental cross-sell revenue, customer retention, and higher recurring EBITDA in coming years.

Want to see what’s fueling this bold upside? The narrative is driven by powerful earnings growth, ambitious revenue targets, and a profit multiple that challenges electric utility norms. Find out the detailed projections and the tension points behind this valuation in the full narrative.

Result: Fair Value of $207.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are real concerns around NRG’s growing reliance on natural gas and the potential impact of increased regulatory or decarbonization pressures.

Find out about the key risks to this NRG Energy narrative.

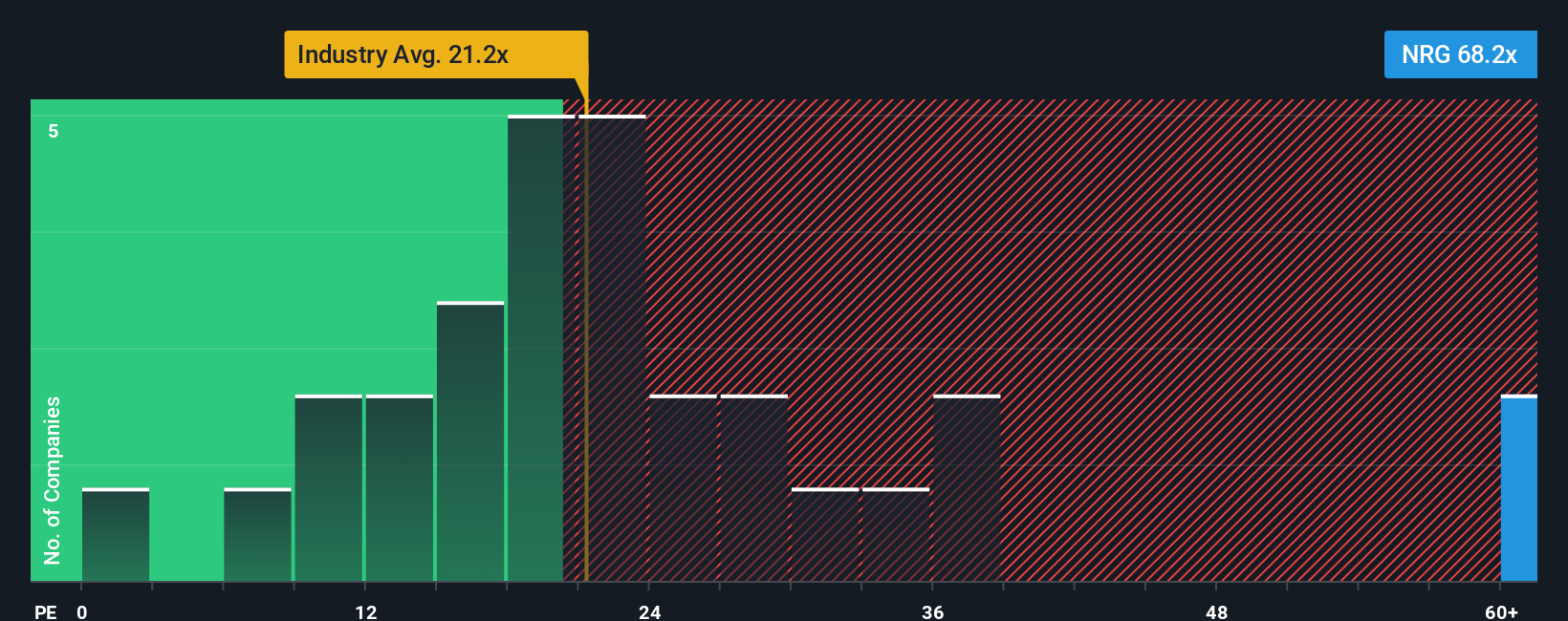

Another View: Valuation Through Multiples

Looking at traditional valuation metrics, NRG trades at a price-to-earnings ratio of 22.4x. This is higher than both the US Electric Utilities industry average of 20.5x and the peer average of 19.7x, but it remains below its fair ratio of 39.8x. This suggests the market is cautious, possibly pricing in some risk or uncertainty despite strong growth. Does this signal room for further upside or a warning to tread carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NRG Energy Narrative

If you want to see the numbers from a different angle or prefer hands-on analysis, you can craft your own view in just a few minutes: Do it your way.

A great starting point for your NRG Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity slip by. Uncover stocks with powerful growth or stable returns tailored just for your strategy using these handpicked ideas:

- Spot game-changers in artificial intelligence by using these 25 AI penny stocks to find companies pushing the boundaries of innovation.

- Secure steady income streams by tapping into these 16 dividend stocks with yields > 3% featuring top picks with yields above 3% for consistent rewards.

- Catch major trends early by exploring these 81 cryptocurrency and blockchain stocks where blockchain leaders are shaping tomorrow’s digital landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives