- United States

- /

- Electric Utilities

- /

- NYSE:NRG

A Look at NRG Energy’s Valuation Following $1.25 Billion Capital Raise

Reviewed by Simply Wall St

NRG Energy just raised $1.25 billion through a fixed-income offering of senior unsecured notes, maturing in 2034 with a 5.75% coupon. For investors, this kind of large-scale capital raise can shape expectations around the company’s funding strategy and future flexibility.

See our latest analysis for NRG Energy.

With momentum picking up, NRG Energy has caught investor attention by not just raising capital, but also affirming its quarterly dividend and increasing its industry visibility at a key power symposium. The share price has reached $173.14, with an 86.7% year-to-date climb and a total shareholder return of over 94% in the past year. Performance like this suggests rising confidence in the company’s growth prospects and its ability to balance robust distributions with future-ready funding.

If this kind of strong showing makes you curious about what else is out there, now’s the perfect moment to broaden your view and discover fast growing stocks with high insider ownership

With shares soaring and fundamentals improving, investors now face a critical question: is NRG Energy still trading at a discount to its potential, or has the market already captured future growth in its current valuation?

Most Popular Narrative: 11.1% Undervalued

The most popular narrative suggests NRG Energy’s fair value is $194.77, notably higher than its last close of $173.14. This signals an opportunity in the eyes of market-watchers, as their assumptions point to material upside if projections play out.

Disciplined capital allocation is shown by strong share repurchases, focus on debt reduction, and strategic asset purchases. This directly supports higher EPS and sustained shareholder value creation given NRG's robust free cash flow generation. Demand from electrification trends and grid reliability concerns (such as those reinforced by Texas Senate Bill 6 and state capacity programs), combined with NRG's capability to rapidly deploy new capacity, support higher load growth projections and price signals. This underlines potential for outsized growth in revenue and operating income relative to current expectations.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is rapid free cash flow generation and strategic moves that could dramatically transform earnings. Curious which assumptions make analysts this bullish? Unpack the fair value logic and see the ambitious projections driving it.

Result: Fair Value of $194.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a heavier focus on natural gas and greater debt could increase costs or pressure earnings if regulations tighten or if market conditions worsen.

Find out about the key risks to this NRG Energy narrative.

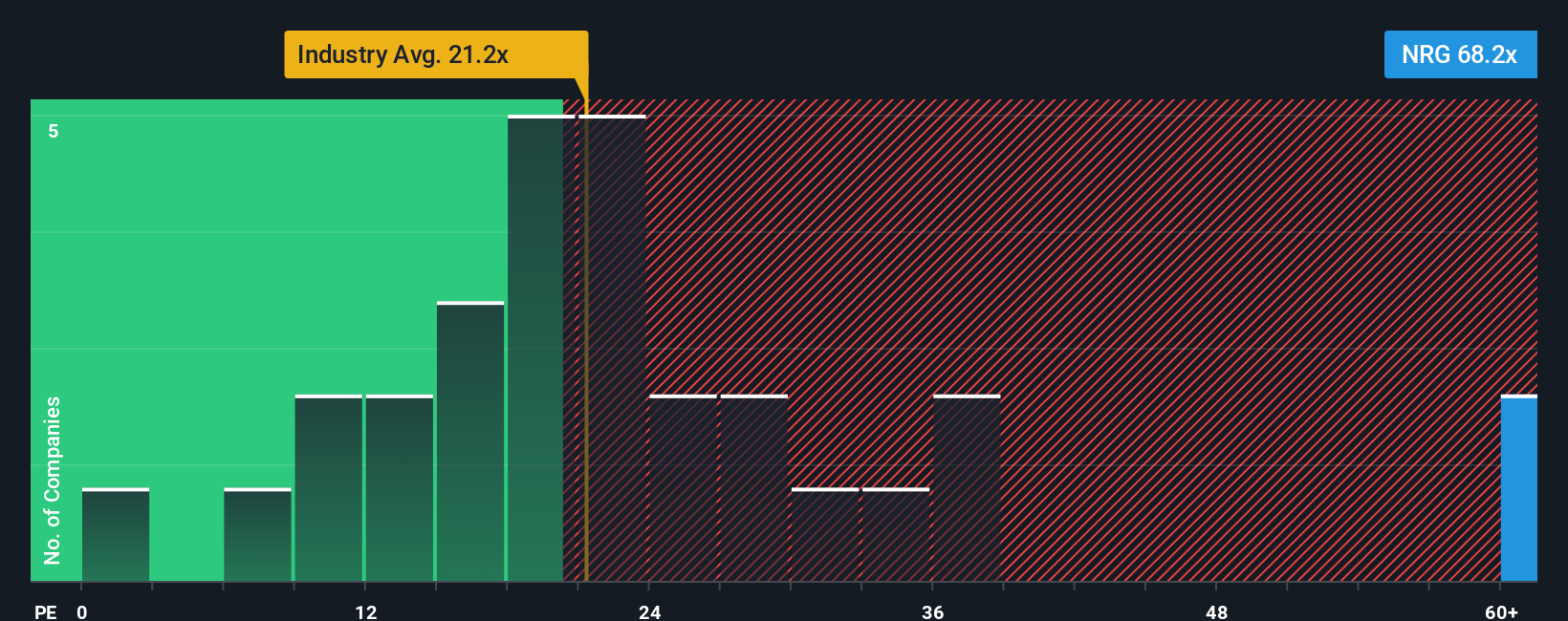

Another View: Multiples Signal Overvaluation

Looking at earnings multiples as an alternative, NRG’s price-to-earnings ratio is 73.6x, which is much higher than both the industry average of 21.3x and a fair ratio of 41.6x. This suggests the market may be pricing in more growth than peers. How much runway is really left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NRG Energy Narrative

If you see things differently or want to dig into the numbers on your own terms, you can shape your own NRG Energy story in just a few minutes, so why not Do it your way

A great starting point for your NRG Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop here; some of the year’s brightest opportunities are just a click away. You’ll want to catch these themes before everyone else does.

- Get ahead of AI’s explosive growth by reviewing these 26 AI penny stocks with the power to change entire industries through automation and intelligent technology.

- Tap into reliable potential with these 24 dividend stocks with yields > 3% that offer steady income and attractive yields well above the market average.

- Ride the wave as digital assets reshape finance. Check out these 81 cryptocurrency and blockchain stocks targeting innovation in blockchain, payments, and secure transactions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives