- United States

- /

- Electric Utilities

- /

- NYSE:NEE

Should NextEra Energy's (NEE) Google Nuclear Deal Prompt a Fresh Look from Investors?

Reviewed by Sasha Jovanovic

- In October 2025, Alphabet Inc. announced a 25-year agreement with NextEra Energy to restart Iowa’s Duane Arnold nuclear facility, providing carbon-free power for Google’s expanding AI and cloud needs.

- This partnership illustrates how major technology companies are driving demand for clean energy infrastructure, spotlighting NextEra’s ability to serve large-scale customers in the evolving electricity market.

- We’ll now explore how supplying nuclear energy for Google’s AI operations could influence NextEra Energy’s investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

NextEra Energy Investment Narrative Recap

To be a shareholder in NextEra Energy, you need to believe in the ongoing shift to clean energy and the company's capacity to lead as demand rises from technology, AI, and cloud growth. The recent 25-year deal with Alphabet to supply nuclear power for Google's Iowa data centers directly supports the demand catalyst, but does not materially reduce regulatory or interest rate risks that remain front and center for the business in the short term. A particularly relevant announcement linked to this event is the approval of the Point Beach Nuclear Plant’s license extension to 2050 and 2053. This move, along with the Duane Arnold restart, reinforces NextEra’s nuclear focus as a way to meet surging AI-driven electricity needs, aligning well with the company’s biggest catalyst: large-scale, long-term partnerships with technology giants. But in contrast, investors should be aware that interest rates have been steadily rising and the impact on project financing for infrastructure is...

Read the full narrative on NextEra Energy (it's free!)

NextEra Energy's narrative projects $35.9 billion in revenue and $9.4 billion in earnings by 2028. This requires 11.5% yearly revenue growth and a $3.5 billion earnings increase from the current $5.9 billion.

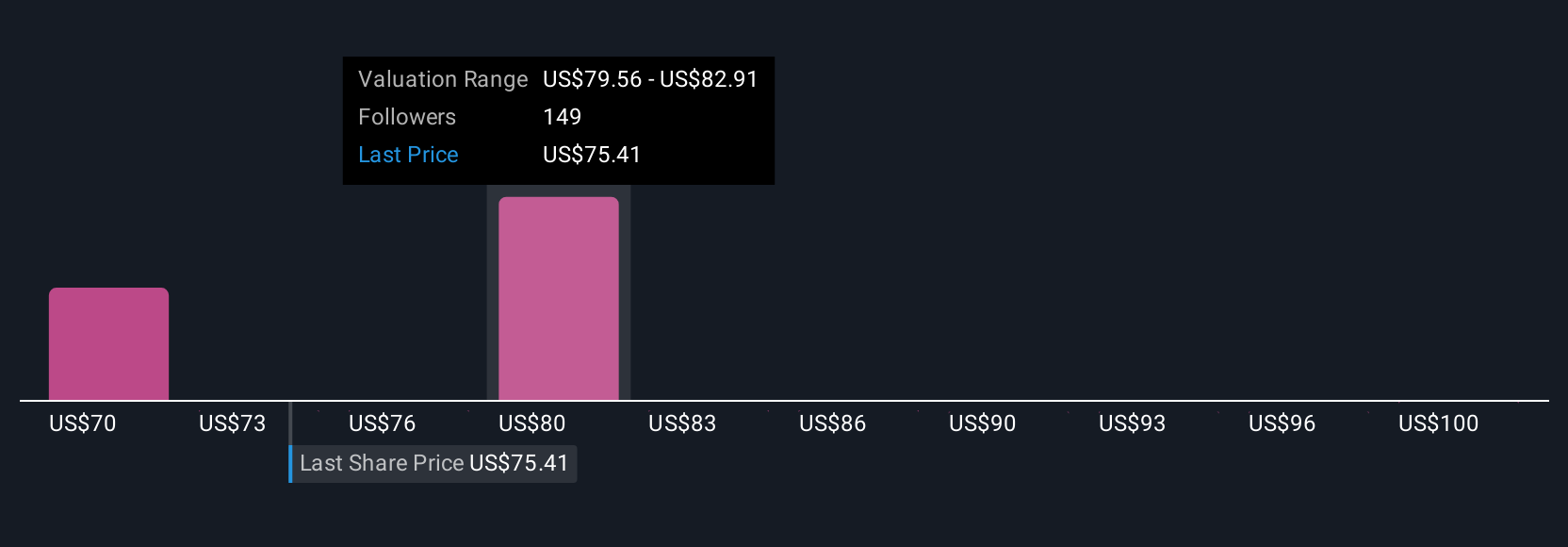

Uncover how NextEra Energy's forecasts yield a $91.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

While consensus analysts expect steady growth for NextEra, the most optimistic cohort previously forecast annual revenue up to US$40,100 million by 2028 and outsized earnings growth. These higher forecasts rest on the belief that NextEra’s aggressive storage and nuclear investments could create lasting margin gains, especially as competitors struggle to scale. You may see wide differences in opinion and should examine several views, as any major new deal, like the Google partnership, could shift these narratives.

Explore 11 other fair value estimates on NextEra Energy - why the stock might be worth 18% less than the current price!

Build Your Own NextEra Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NextEra Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextEra Energy's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026