- United States

- /

- Electric Utilities

- /

- NYSE:NEE

Is NextEra Energy’s 16.6% Rally in 2025 Justified After Clean Energy Investment News?

Reviewed by Bailey Pemberton

- Wondering if NextEra Energy might be undervalued or ready for a rebound? You are not alone. In today's market climate, finding true value is more important than ever.

- The stock has quietly delivered a 16.6% gain so far this year and is up 13.3% over the past 12 months, although it dipped 0.5% in the past week.

- NextEra Energy’s recent share price movement comes after industry news around renewable energy investments and broader shifts in utility sector sentiment. Both of these factors are shaping short-term investor expectations. Policy momentum for clean energy continues to create headlines and can cause volatility in utility stocks like NextEra.

- Currently, NextEra Energy scores only 1 out of 6 on our core valuation checks. This number may surprise you if you have been tracking its growth story. Let us break down what this score really means and compare different ways of valuing the company, before revealing an even better perspective at the end of the article.

NextEra Energy scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NextEra Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates a company’s true worth by projecting its future dividend payments and discounting them back to today’s value. This approach is best suited for companies with predictable, sustainable dividends, such as utilities.

For NextEra Energy, the most recent annual dividend per share is $2.57, representing a 61% payout ratio. With a return on equity of 9.5%, analysts expect dividend growth to continue at a rate just above 3.2% per year. For valuation purposes, future growth is conservatively capped at this level. These inputs are central to the long-term calculation of sustainable shareholder returns.

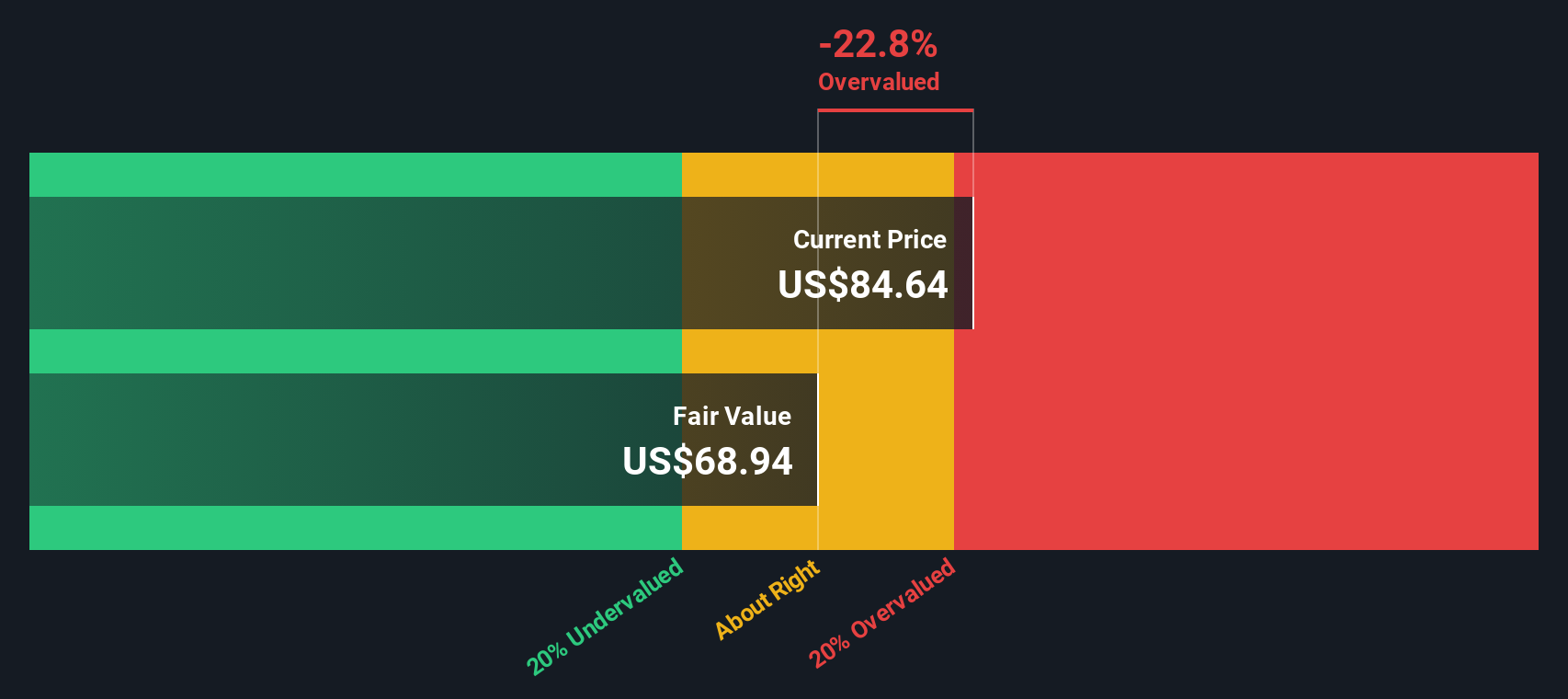

Using this model, the estimated intrinsic value for NextEra Energy is $69.51 per share. Currently, the stock trades about 20% higher than this estimate, which implies that it is overvalued by the standards of the model. The primary takeaway is that, despite NextEra’s notable growth story and robust dividend profile, buyers today are paying a premium relative to what dividend projections alone justify.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests NextEra Energy may be overvalued by 20.1%. Discover 917 undervalued stocks or create your own screener to find better value opportunities.

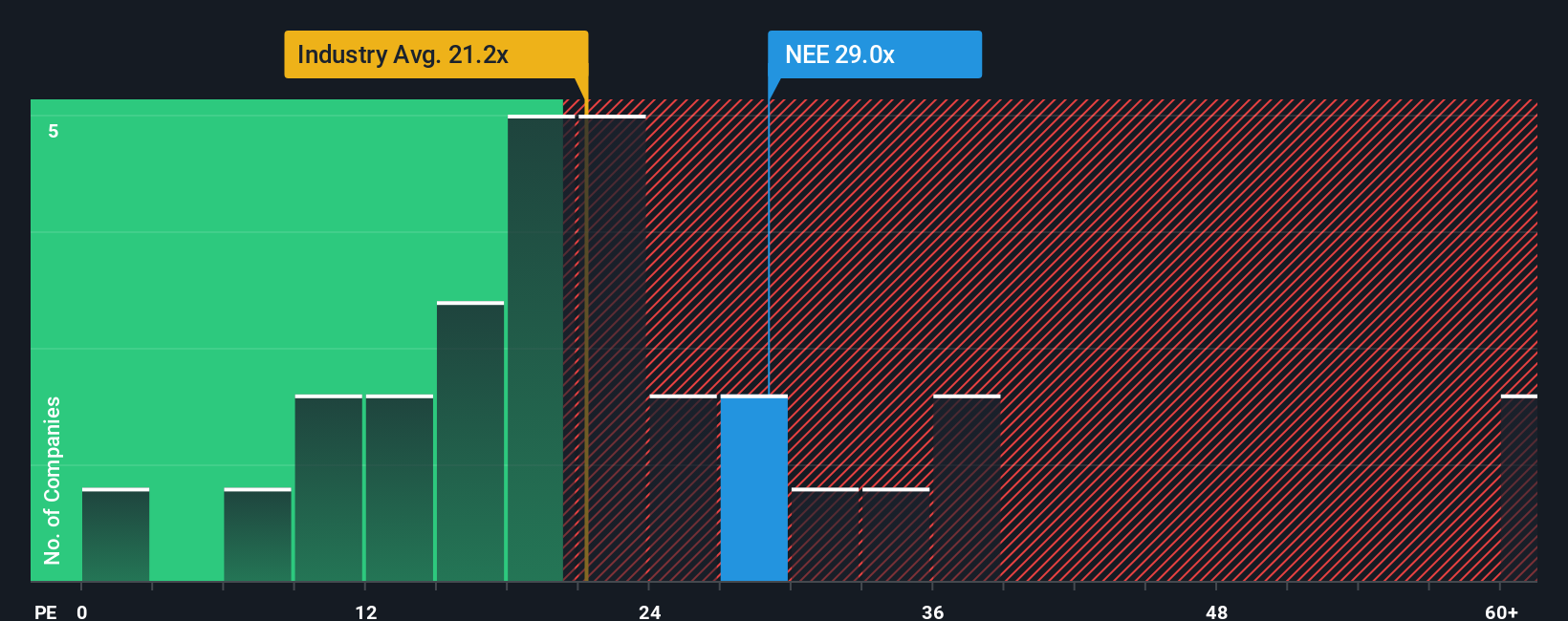

Approach 2: NextEra Energy Price vs Earnings

The Price-to-Earnings (PE) ratio is a classic and widely used metric for valuing profitable companies like NextEra Energy. It helps investors quickly assess how much they are paying for each dollar of current earnings. The PE ratio is particularly relevant for companies with stable earnings profiles, as it reflects both their profitability and investor expectations going forward.

A company’s “normal” or “fair” PE ratio should reflect not only its growth prospects, but also underlying risks relative to its peers and sector. Companies with higher anticipated earnings growth or lower risk profiles tend to warrant a higher PE, while slower growth or increased risk results in a lower fair multiple.

NextEra currently trades at a PE ratio of 26.7x, which is above the Electric Utilities sector average of 20.5x and the peer group average of 24.4x. However, Simply Wall St’s proprietary “Fair Ratio,” which accounts for specifics like NextEra’s growth, risk profile, profit margins, industry, and size, indicates a fair PE of 28.7x. The Fair Ratio offers a more comprehensive benchmark than a simple peer or sector comparison because it considers what truly distinguishes NextEra from its competitors.

Since NextEra’s current PE ratio is close to its Fair Ratio, this suggests the stock is trading at about the level justified by its fundamentals and future outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NextEra Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives.

A Narrative is your personalized story about a company. It is where you connect your view of NextEra’s business prospects to the actual numbers driving the forecast, such as future revenues, earnings, margins, and ultimately your own idea of fair value.

With Narratives on Simply Wall St’s Community page, investors of all backgrounds can quickly build and share their perspective by anchoring the story (why the company will succeed or struggle) directly to a full financial forecast and valuation.

This approach makes investing more intuitive because you can see exactly how a company’s outlook and fair value change as new information, like breaking news or earnings surprises, arrives. This helps you decide if the current share price looks attractive or not.

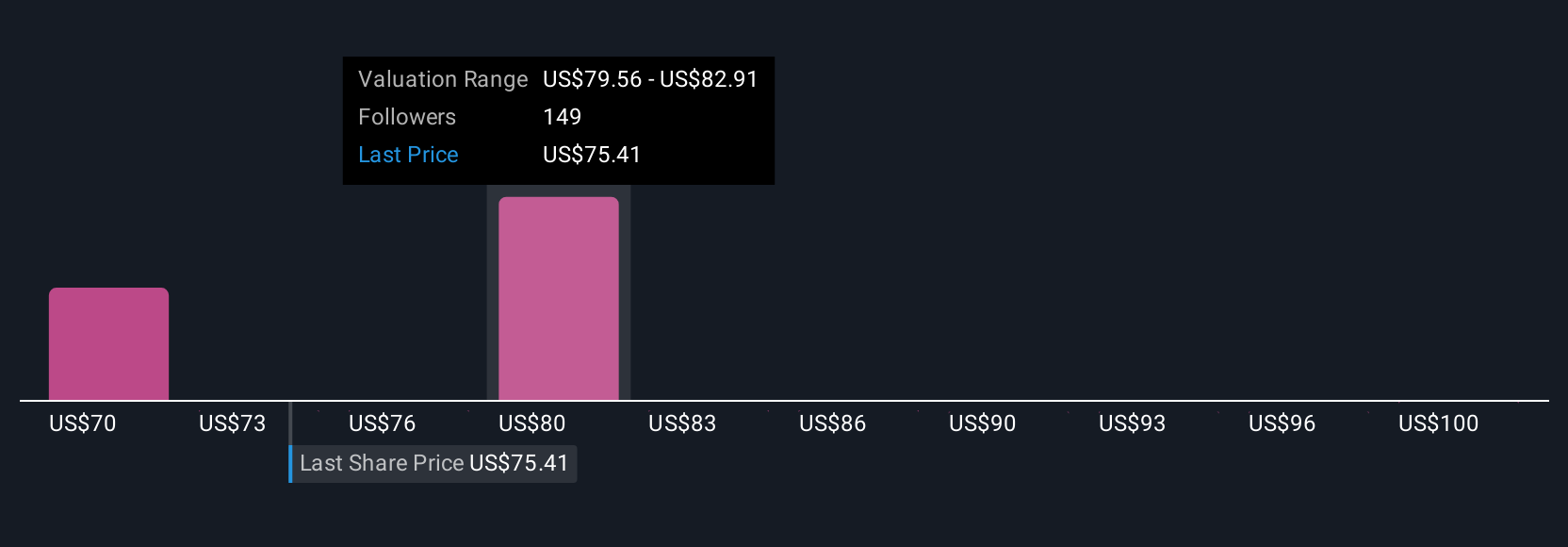

For example, some NextEra Energy Narratives expect ambitious revenue growth and margin expansion, implying a bullish fair value of $103, while more cautious Narratives see risk from policy and rates, supporting a fair value as low as $52.

Narratives empower you to decide with clarity and confidence by comparing your Fair Value to the current market Price as the story evolves in real time.

Do you think there's more to the story for NextEra Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives