- United States

- /

- Electric Utilities

- /

- NYSE:NEE

How Investors May Respond To NextEra Energy (NEE) Google Nuclear Deal and Duane Arnold Restart

Reviewed by Sasha Jovanovic

- Last month, NextEra Energy reported third-quarter 2025 earnings with sales rising to US$7.97 billion and net income growing to US$2.44 billion, alongside the announcement of a 25-year clean nuclear power agreement between Google and the soon-to-be-restarted Duane Arnold Energy Center in Iowa.

- This collaboration marks a significant milestone by pairing long-term, carbon-free nuclear energy supply with the rising power demands of the artificial intelligence sector, while NextEra consolidates 100% ownership of the Duane Arnold facility.

- We'll explore how the Google nuclear partnership and Duane Arnold restart shape NextEra's investment narrative for clean energy leadership.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

NextEra Energy Investment Narrative Recap

To believe in NextEra Energy as a shareholder, you need to embrace the company's commitment to meeting rising electricity demand with large-scale, clean energy solutions, including renewables and now nuclear. The recent Google partnership and Duane Arnold restart reinforce NextEra's positioning as a clean energy leader, potentially highlighting opportunities from AI-driven electricity growth in the short term, but these developments do not materially change the most pressing risks, like long-term regulatory challenges or interest rate pressures.

Among recent announcements, the steady affirmation of the quarterly dividend at US$0.5665 per share remains most relevant for those watching income reliability. This consistency is meaningful for yield-focused investors as NextEra ramps up capital investment and pursues growth catalysts tied to clean energy demand and technology partnerships.

But, in contrast to these positive trends, there are still important factors investors should be aware of, especially regarding how future regulations and interest rate volatility...

Read the full narrative on NextEra Energy (it's free!)

NextEra Energy is projected to achieve $35.9 billion in revenue and $9.4 billion in earnings by 2028. This outlook is based on an annual revenue growth rate of 11.5% and an increase in earnings of $3.5 billion from the current $5.9 billion.

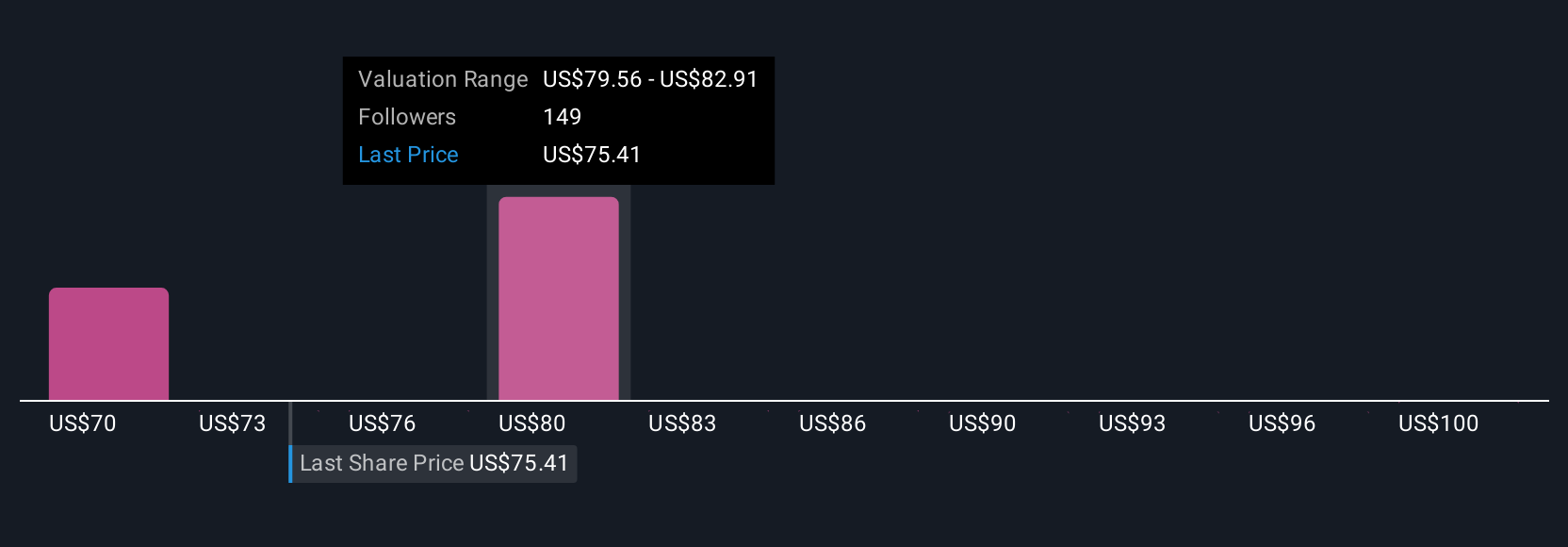

Uncover how NextEra Energy's forecasts yield a $91.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts expected NextEra to reach US$40.1 billion in revenue and US$10.7 billion in earnings by 2028, citing the company's scale and nuclear projects as catalysts for outperformance. These forecasts show just how much opinions can differ, so if your expectations are shaped by the Google partnership or Duane Arnold restart, it's worth considering how the future might look quite different from today's consensus.

Explore 11 other fair value estimates on NextEra Energy - why the stock might be worth as much as 25% more than the current price!

Build Your Own NextEra Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NextEra Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextEra Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives