- United States

- /

- Electric Utilities

- /

- NYSE:NEE

A Fresh Look at NextEra Energy's (NEE) Valuation Following Recent Investor Momentum

Reviewed by Simply Wall St

NextEra Energy (NEE) has seen its stock make steady moves in recent weeks, drawing increased investor interest. With performance picking up over the past three months, some are now re-examining how the company’s value stacks up.

See our latest analysis for NextEra Energy.

Momentum has quietly been building for NextEra Energy, with a 14.8% gain in the past three months and a 12.9% total shareholder return over the last year. This suggests that confidence is returning and investors are looking past near-term uncertainty toward long-term potential.

If you're weighing your next move, now's a great time to broaden your search and discover fast growing stocks with high insider ownership

With recent gains and rising optimism, the question now is whether NextEra Energy’s current price already factors in all its upcoming potential, or if there is still a buying opportunity for investors seeking future growth.

Most Popular Narrative: 6.8% Undervalued

NextEra Energy's latest fair value estimate stands at $91.05 per share, a notable jump from its last close of $84.83. This suggests a valuation premium in the eyes of the most-watched narrative. With the consensus calling for further growth, the following outlook reveals what is driving that optimism.

Accelerating and sustained demand growth for electricity, driven by AI, data center expansion, and electrification of sectors like transportation and heating, positions NextEra to grow volumes and capture higher average revenue per MWh as utilities compete to provide essential infrastructure for hyperscalers and traditional customers. This is expected to support robust revenue growth.

Curious what's really fueling this bullish view? The forecast is based on aggressive expansion in earnings and revenue, with bold assumptions about market dominance, margin growth, and future cash flows. The math behind this valuation targets surprisingly ambitious financial performance. Get the inside details on the metrics only insiders are watching.

Result: Fair Value of $91.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent policy uncertainty and the threat of higher financing costs could quickly dampen NextEra’s growth outlook if these risks materialize.

Find out about the key risks to this NextEra Energy narrative.

Another View: Price Ratios Raise Questions

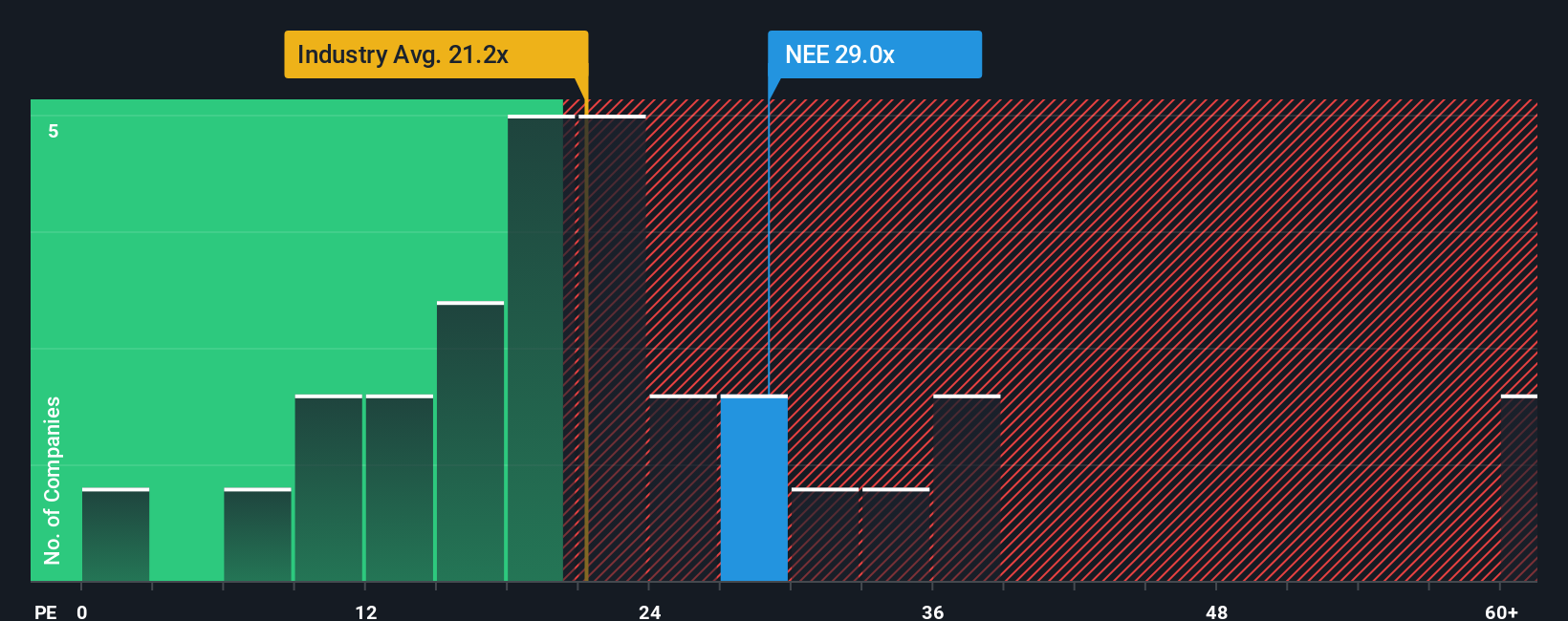

Looking at market price-to-earnings ratios offers another angle on NextEra Energy’s value. With a P/E of 27.2x, the company trades above both its industry average of 20.9x and peers at 24.8x. Though its fair ratio based on underlying fundamentals is 28.7x, the premium to peers signals greater valuation risk if market expectations shift. Is this pricing justified by growth, or could it cap future upside?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NextEra Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NextEra Energy Narrative

If this perspective doesn't match your take, or you'd rather draw your own conclusions from the numbers, you can easily build your own view in just minutes. Do it your way.

A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t stop at NextEra Energy. The market is full of high-impact opportunities right now, and you’ll want to see what’s out there before they get away.

- Uncover value with these 924 undervalued stocks based on cash flows, where you’ll spot stocks trading below their true worth and seize potential bargains others might miss.

- Tap into tomorrow’s breakthroughs by checking out these 26 quantum computing stocks, your shortcut to companies at the forefront of quantum computing innovation and growth.

- Secure steady returns as you browse these 14 dividend stocks with yields > 3%, featuring stocks with attractive yields that can strengthen your portfolio’s income stream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success