- United States

- /

- Gas Utilities

- /

- NYSE:MDU

Assessing MDU Resources Group (MDU) Valuation After Its Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for MDU Resources Group.

MDU Resources Group’s steady climb over the last thirty days adds to a standout 90-day share price return, up nearly 23 percent, and contributes to a healthy year-to-date gain. While momentum is clearly building in the short term, the longer-term view is even more impressive, with a five-year total shareholder return exceeding 140 percent. This is evidence that staying invested has paid off.

If recent gains have sparked your curiosity, this could be the perfect opportunity to broaden your perspective and discover fast growing stocks with high insider ownership

With shares riding a strong upward trend and returns outpacing the broader market, the question now is whether MDU Resources Group remains undervalued or if recent gains mean all future growth is already reflected in the price.

Most Popular Narrative: 0.6% Undervalued

The most widely referenced narrative suggests MDU Resources Group is trading close to fair value, with a fair value estimate nearly even with its recent closing price. This sets the table for some bold claims about the company’s growth prospects and long-term positioning.

Strong ongoing and future investment in U.S. infrastructure, including large pipeline expansion projects and potential new transmission or generation to serve data centers, positions MDU to benefit from robust construction demand and growing energy needs, providing significant future revenue and earnings uplift.

Want a front-row seat to the transformation? The hottest assumptions such as future growth, margins, and massive project bets power this price target. Curious what MDU's next big leap hinges on? Unpack the blueprint that shapes the entire narrative by diving deeper.

Result: Fair Value of $20.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent increases in operational costs or a rapid shift toward renewable energy could undermine projections and change the growth outlook for MDU Resources Group.

Find out about the key risks to this MDU Resources Group narrative.

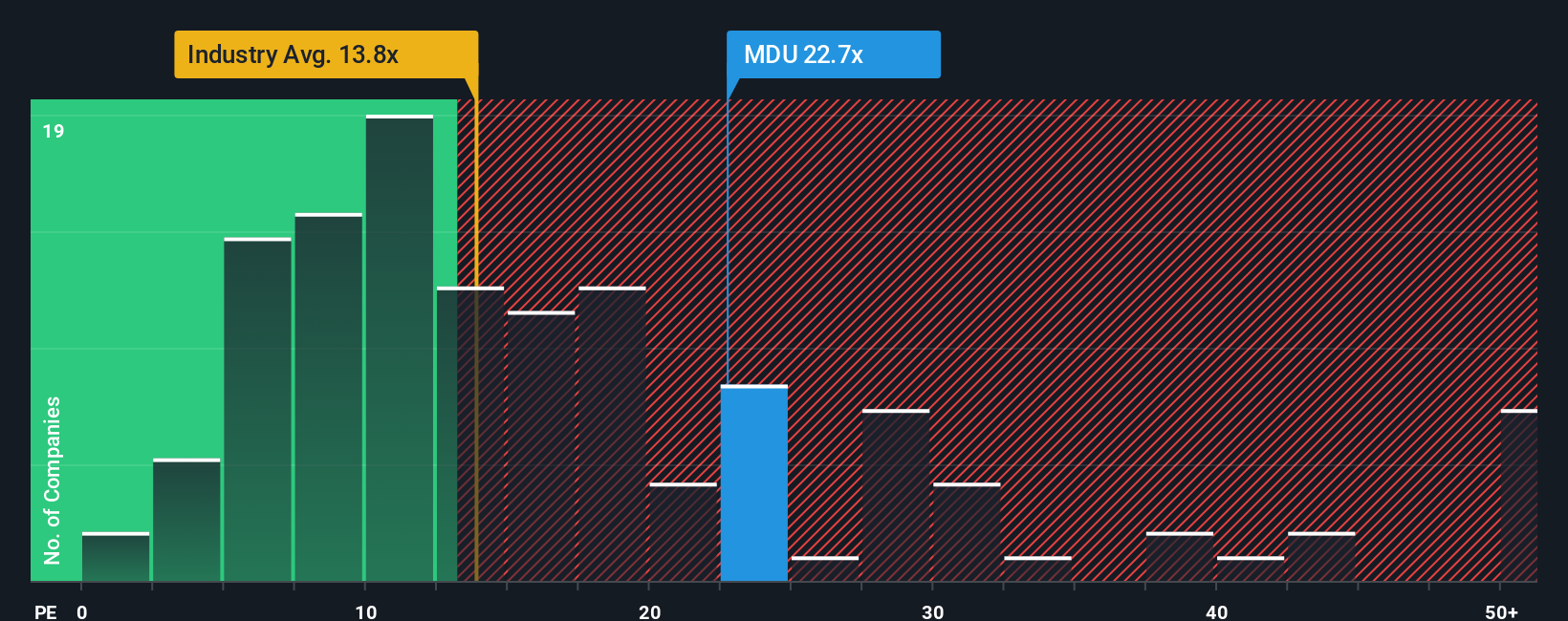

Another View: A Closer Look at Valuation Ratios

Taking a step back to compare valuation ratios, MDU Resources Group trades at a price-to-earnings ratio of 22.6x. This is notably higher than both the global industry average of 14x and its peer average of 19x. The company’s ratio is also above the fair ratio of 19.2x, signaling the market could re-rate the stock lower if expectations cool. Is there more risk here than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MDU Resources Group Narrative

Not convinced by the current story, or keen to dig into the numbers yourself? Take the reins and craft a custom narrative in just minutes: Do it your way

A great starting point for your MDU Resources Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your investment toolkit by tapping into exciting opportunities shaping the future. Don’t miss the chance to uncover what other smart investors are acting on right now.

- Tap into potential high-yield income by checking out these 16 dividend stocks with yields > 3%, which delivers reliable payouts above 3 percent.

- Catch the momentum in advanced computing breakthroughs by reviewing these 26 quantum computing stocks, a leader in quantum technology innovation.

- Find market bargains with impressive upside by scanning these 919 undervalued stocks based on cash flows, which has been identified as trading below its intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MDU

MDU Resources Group

Engages in the regulated energy delivery businesses in the United States.

Proven track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives