- United States

- /

- Electric Utilities

- /

- NYSE:FE

Assessing FirstEnergy After Its 18% 2025 Rally and Grid Modernization Focus

Reviewed by Bailey Pemberton

Wondering what to do with FirstEnergy stock today? If you’re tracking utilities, you’ve probably noticed FirstEnergy’s recent moves have caught more attention than usual. After a nearly 9% jump over the last month and a robust 18% return year to date, it’s natural to question whether there’s still room for your portfolio to grow with this stock, or if the easy gains are already in the rearview mirror. Despite a slight dip of 0.9% over the past week, FirstEnergy shares are still up an impressive 11.9% over twelve months, and if you zoom out to five years, the stock has returned 74%.

What’s fueling the optimism? Much of the recent lift comes after FirstEnergy made strategic investments in grid modernization, a move applauded by regulators and analysts alike. The company’s commitment to upgrading its infrastructure and focusing on renewable integration has shifted some of the risk perceptions surrounding the stock. This narrative has kept interest high even as the broader utilities sector faces uncertainty. On the valuation front, FirstEnergy checks the box for being undervalued in three of the six key measures we track, giving it a value score of 3 out of 6.

So, is FirstEnergy as attractively priced as it looks, or does some risk still lurk behind the strong performance numbers? Let’s break down exactly how the major valuation models stack up for FirstEnergy, and at the end, I’ll share a perspective on valuation that might outshine even the standard financial ratios.

Why FirstEnergy is lagging behind its peers

Approach 1: FirstEnergy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) centers on the idea that a stock's value comes from its future dividend payments, which are projected and then discounted back to their value today. This approach is a favorite for utility stocks like FirstEnergy because their business models prioritize stable, ongoing dividend payments.

For FirstEnergy, recent numbers show a dividend per share (DPS) of $1.91 and a payout ratio of 99.18%, indicating nearly all of FirstEnergy's profits are returned to shareholders. The calculated growth rate in dividends is minimal, just 0.07% annually. This figure is derived using the expected growth formula, which takes into account the retention rate (1 minus payout ratio) and return on equity (ROE). For FirstEnergy, that's (1 minus 99.18%) x 9.15%.

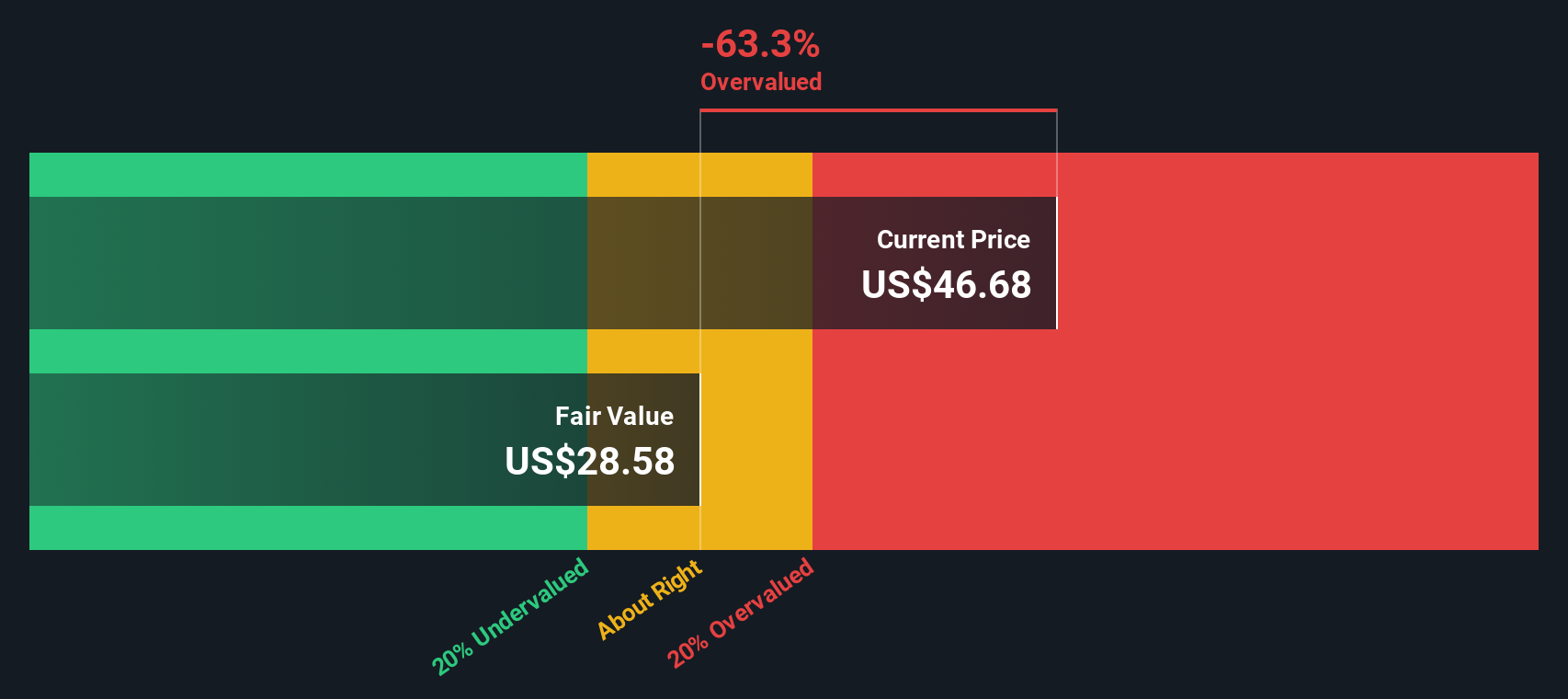

Based on these conservative projections, the DDM assigns an intrinsic fair value of $28.57 per share to FirstEnergy. However, comparing this figure to the current share price reveals a substantial overvaluation. The DDM suggests FirstEnergy is trading at a 64.8% premium to its calculated fair value. Investors should note this sharp disconnect between price and long-term dividend value.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests FirstEnergy may be overvalued by 64.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: FirstEnergy Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to valuation metric when analyzing profitable companies like FirstEnergy. This is because it relates the company's current share price to its per-share earnings, providing a straightforward snapshot of how much investors are willing to pay for each dollar of profit. A reasonable PE ratio reflects expectations for growth and incorporates the perceived risk of owning the stock in this sector.

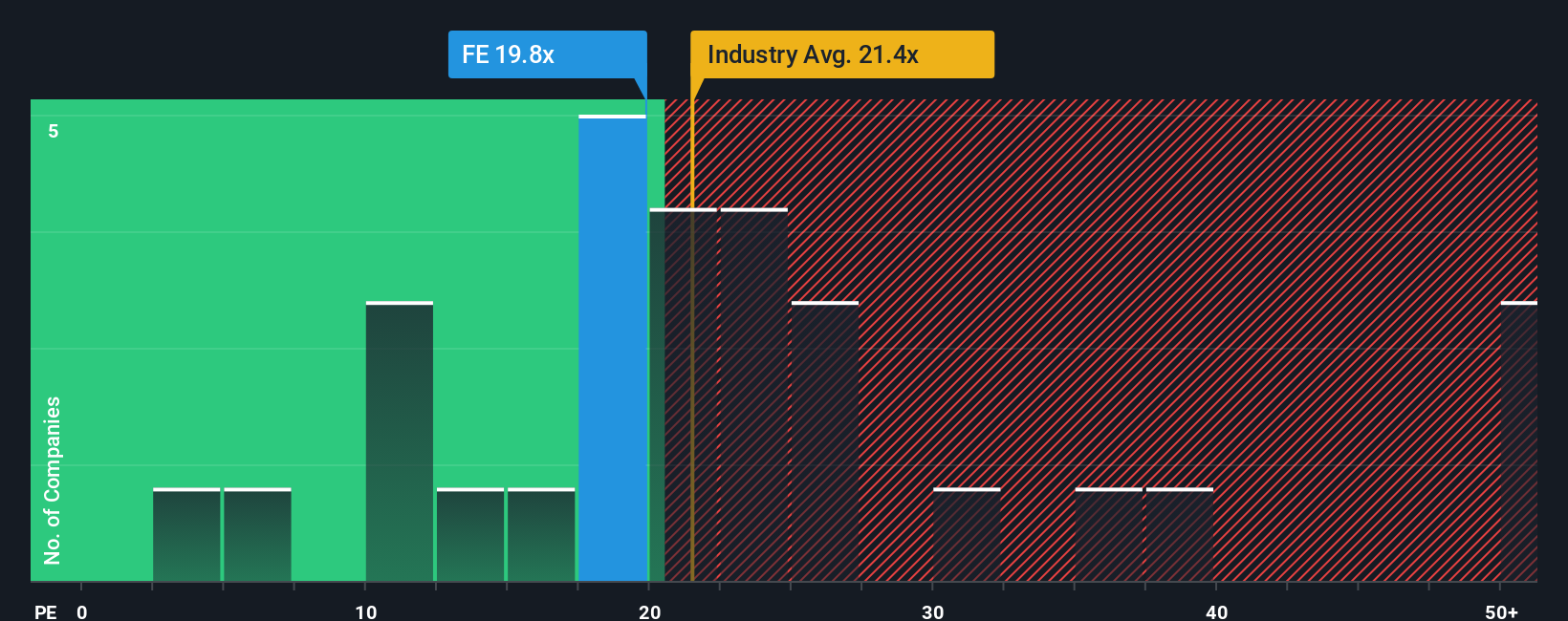

FirstEnergy’s current PE ratio sits at 20.8x, which is largely in line with both the Electric Utilities industry average of 21.4x and its peer group, which averages 21.0x. At face value, this suggests the market currently prices FirstEnergy similarly to comparable companies. However, these broad benchmarks do not fully account for FirstEnergy's specific growth profile, risk factors, and profit margins.

This is where Simply Wall St’s "Fair Ratio" comes in. For FirstEnergy, the Fair Ratio is calculated to be 20.8x. Unlike simple comparisons with peers or industry norms, the Fair Ratio integrates the company’s unique earnings outlook, its risk characteristics, profit margins, industry dynamics, and overall market cap. This holistic approach aims to deliver a more tailored and realistic sense of value.

With FirstEnergy trading at almost exactly its Fair Ratio, the conclusion is that the stock appears appropriately valued when based on earnings power and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FirstEnergy Narrative

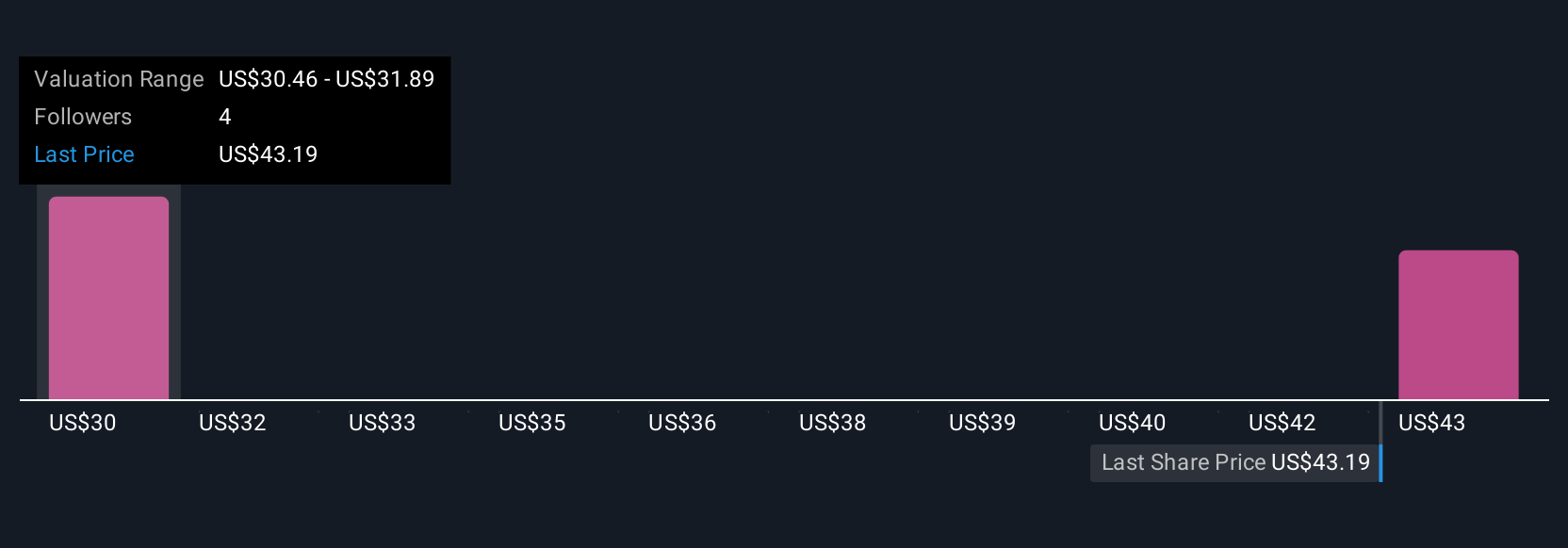

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you assign to FirstEnergy. It reflects your perspective on how the company’s future will unfold by combining your expectations for its revenue, earnings, and profit margins into one evolving view. Rather than relying only on one-size-fits-all ratios, Narratives link this story directly to financial forecasts and translate it into a fair value, helping you see beyond the raw numbers.

On Simply Wall St’s Community page, Narratives are an easy and accessible tool, trusted by millions of investors, that let you create, share, and update your own viewpoint as new information arrives (like earnings or sector news). Narratives allow you to compare your estimated fair value with the current share price, bringing clarity to buy or sell decisions in a dynamic and personalized way.

- For example, some investors’ Narratives for FirstEnergy point to strong revenue growth from data center demand and $28B in grid investments, justifying a fair value as high as $46.92.

- Others see ongoing regulatory risks or higher costs from decarbonization and assign a more cautious outlook, with fair value closer to $28.57.

This approach empowers you with the flexibility to invest based on what you truly believe will drive FirstEnergy’s story and outcome.

Do you think there's more to the story for FirstEnergy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FE

FirstEnergy

Engages in the generation, distribution, and transmission of electricity in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives