- United States

- /

- Electric Utilities

- /

- NYSE:ETR

Entergy (ETR): Assessing Valuation After a 29% Rise in the Past Year

Reviewed by Simply Wall St

Entergy (ETR) has recently caught some attention as investors take a closer look at the stock’s performance over the past year. Shares have climbed 29% in that time, which offers an interesting backdrop for anyone tracking the utility sector.

See our latest analysis for Entergy.

Momentum appears to be building for Entergy, with a strong climb over the past year reflected in a 28.75% total shareholder return and steady gains in recent months. While the utilities sector tends to move gradually, this kind of sustained performance suggests that investors are seeing growth potential or a shift in risk outlook for the stock.

If you’re interested in casting a wider net beyond utilities, now is a smart moment to broaden your search and discover fast growing stocks with high insider ownership

The big question now is whether Entergy’s impressive run still leaves room for upside, or if recent gains mean the stock’s future growth is already fully reflected in its current price. Is a buying opportunity emerging, or has the market already priced it in?

Most Popular Narrative: 6.8% Undervalued

Entergy’s most widely followed narrative believes the company is trading below its fair value, with its fair value set at $102.46 versus a last close of $95.48. With analysts projecting growth and a premium sector status, the narrative’s fair value signals room for further gains as key catalysts unfold.

"Strong growth in electricity demand and regulatory support, combined with major capital investments, are set to drive higher revenues and improve earnings consistency. Focus on renewables, grid resilience, and operational efficiency positions Entergy to benefit from decarbonization trends and sustain profitability despite rising costs."

Want to know what’s fueling these ambitious price targets and sector-beating growth projections? The real story sits beneath the headlines; one bold assumption could completely change your expectations. The full narrative reveals which future numbers analysts are betting on. Find out the surprising ingredient they think could unlock more value.

Result: Fair Value of $102.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and the threat of costly extreme weather events could quickly undermine Entergy’s optimistic outlook and future growth assumptions.

Find out about the key risks to this Entergy narrative.

Another View: Multiples Tell a Different Story

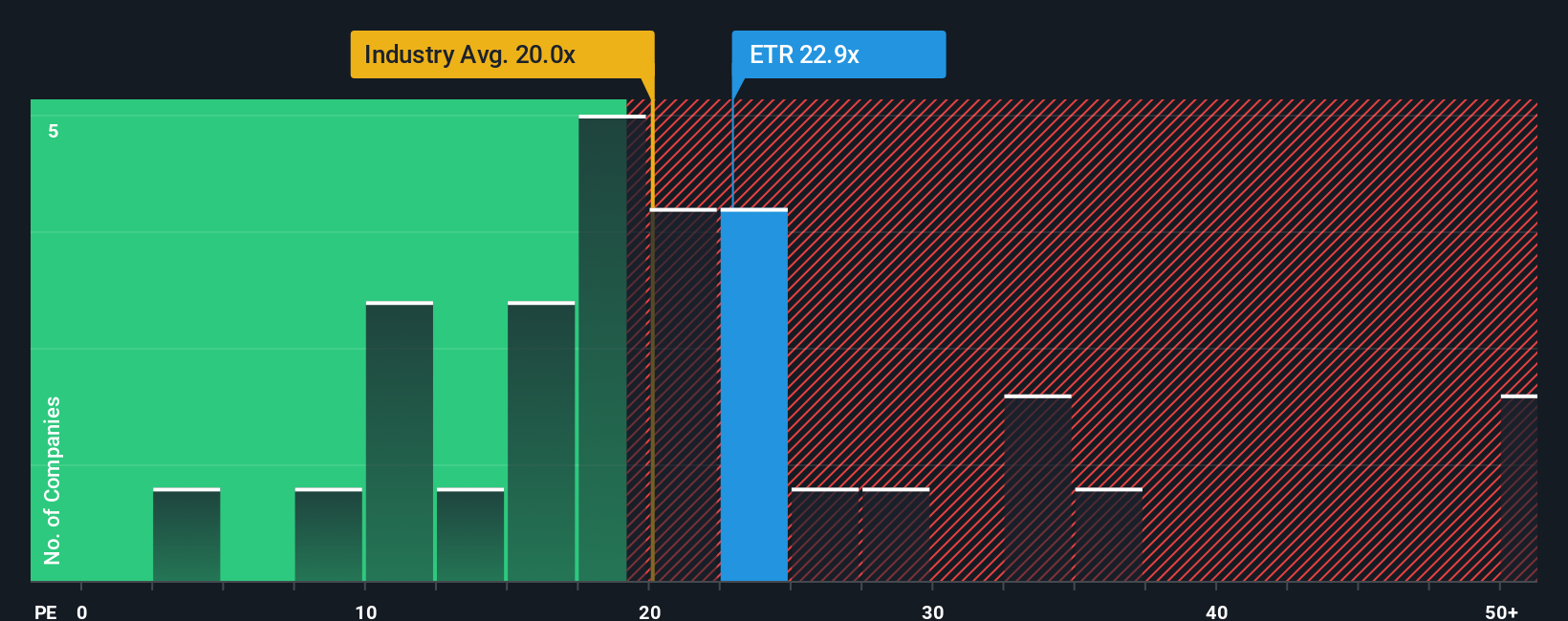

Looking at Entergy’s price-earnings ratio of 23.9 times, it stands above both its peers (19.5x) and the broader US electric utilities sector (20.6x). While this premium might reflect quality or growth, it could also signal an elevated valuation risk. What if the market starts to favor value instead of growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entergy Narrative

If you have a different perspective or want to dig into the numbers yourself, you can build your own story just as quickly and easily. Do it your way

A great starting point for your Entergy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to just one stock when the market is filled with opportunities. Unlock powerful new trends and fresh possibilities with these hand-picked options.

- Capitalize on overlooked potential by exploring these 3580 penny stocks with strong financials delivering strong financials and see which under-the-radar names could surprise the market next.

- Maximize long-term income by checking out these 14 dividend stocks with yields > 3% boasting yields above 3 percent for reliable returns and steady portfolio growth.

- Ride the wave of innovation by uncovering these 26 AI penny stocks transforming entire industries with advancements in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETR

Entergy

Engages in the production and retail distribution of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success