- United States

- /

- Electric Utilities

- /

- NYSE:EIX

Market Still Lacking Some Conviction On Edison International (NYSE:EIX)

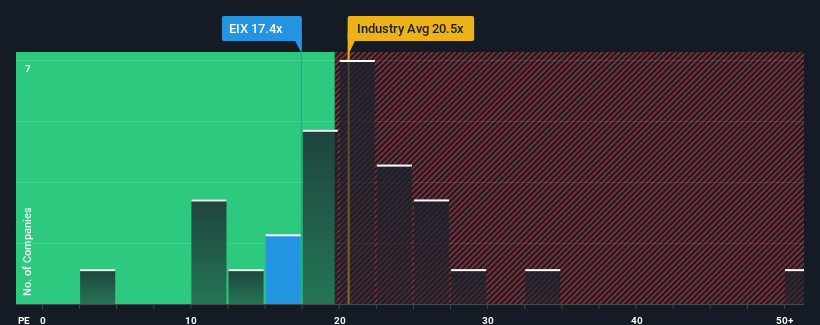

With a median price-to-earnings (or "P/E") ratio of close to 17x in the United States, you could be forgiven for feeling indifferent about Edison International's (NYSE:EIX) P/E ratio of 17.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate Edison International's and the market's earnings growth lately. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Check out our latest analysis for Edison International

Does Growth Match The P/E?

Edison International's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 6.4% last year. The latest three year period has also seen an excellent 67% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 20% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 10% per year, which is noticeably less attractive.

In light of this, it's curious that Edison International's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Edison International's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Edison International (2 don't sit too well with us) you should be aware of.

Of course, you might also be able to find a better stock than Edison International. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Edison International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EIX

Edison International

Through its subsidiaries, engages in the generation and distribution of electric power.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives