- United States

- /

- Electric Utilities

- /

- NYSE:DUK

What Does Duke Energy’s Recent Grid Modernization News Mean for Its 2025 Valuation?

Reviewed by Bailey Pemberton

- Curious whether Duke Energy stock actually offers solid value right now? You are not alone, and with all the market buzz, this is the perfect time to dig into what the numbers really mean.

- The stock has climbed an impressive 16.1% year-to-date and is up 12.6% over the past year, even though it has dipped 1.6% in the last week. This hints at shifting market sentiment.

- This recent churn follows news about Duke Energy's ongoing grid modernization investments and the announcement of a new partnership in clean energy development. Together, these headlines have kept the spotlight squarely on the company and its future prospects.

- Duke Energy currently scores a 3 out of 6 on our key valuation checks. Numbers alone do not always tell the full story, so let's break down the traditional approaches first, then look at an even better way to judge value by the end of this article.

Find out why Duke Energy's 12.6% return over the last year is lagging behind its peers.

Approach 1: Duke Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a classic valuation tool that estimates a stock's intrinsic value based on the future dividends it is expected to pay. In this approach, Duke Energy’s ability to consistently pay and grow dividends is central to determining its fair value.

Duke Energy currently pays an annual dividend per share of $4.49. Important dividend sustainability metrics raise some red flags. The company’s payout ratio sits at 101.89%, meaning it pays out more than its net income as dividends. This high payout, combined with a return on equity of 8.48%, results in a projected dividend growth rate that is essentially flat at -0.16%. This figure is calculated as (1 - 101.89%) x 8.48%, signaling that analysts do not expect meaningful dividend growth going forward.

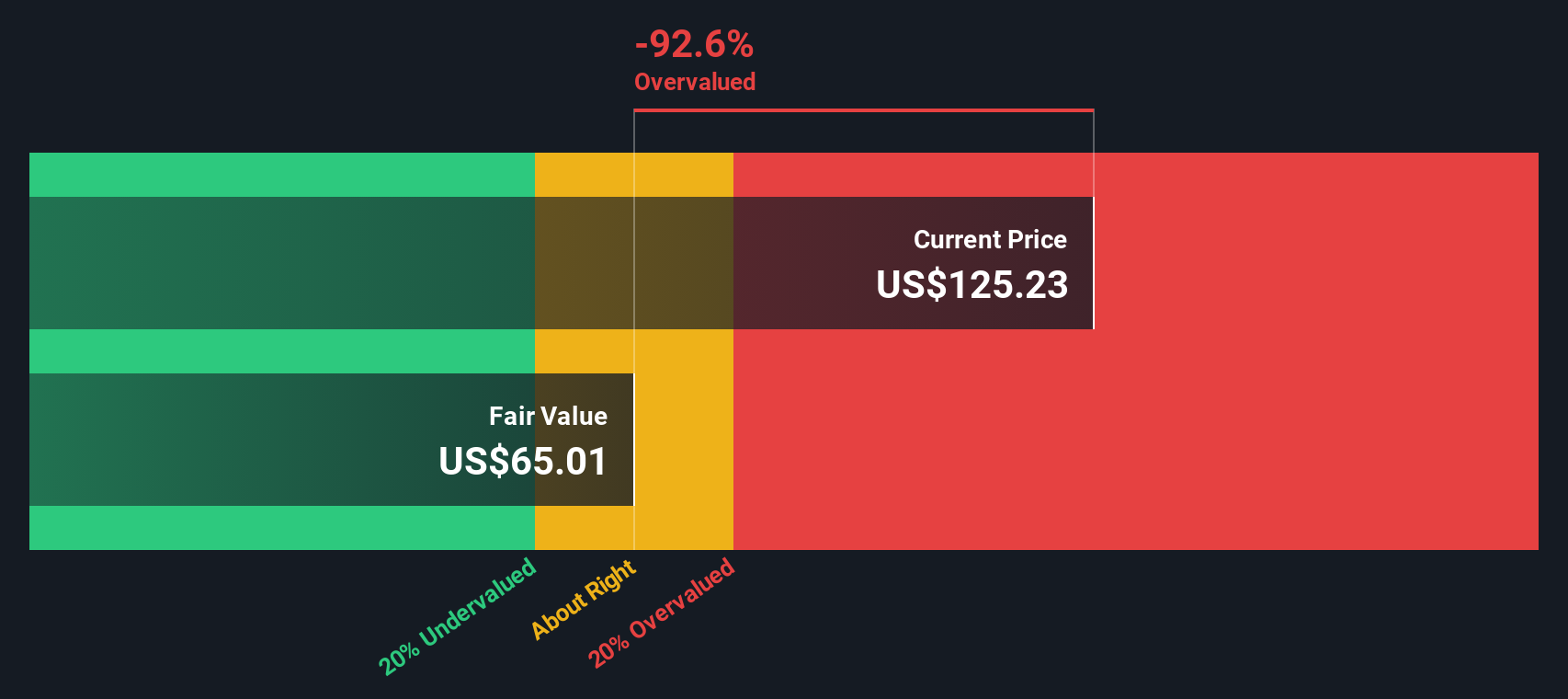

Applying the DDM to these figures, Simply Wall St estimates Duke Energy’s intrinsic value at $64.74 per share. Comparing this to the current share price, the model implies the stock is about 93.4% overvalued. This suggests a significant disconnect between market optimism and fundamental dividend growth prospects.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Duke Energy may be overvalued by 93.4%. Discover 837 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Duke Energy Price vs Earnings

Price-to-Earnings (PE) is the go-to valuation tool for established, profitable companies like Duke Energy. It helps investors weigh how much the market is willing to pay today for a dollar of current earnings, making it a direct way to compare companies and sectors.

What counts as a “normal” PE ratio depends on factors such as a company’s growth outlook, risk profile, stability, and industry trends. High-growth or lower-risk companies justify higher PE ratios, while mature or riskier firms tend to trade on lower multiples.

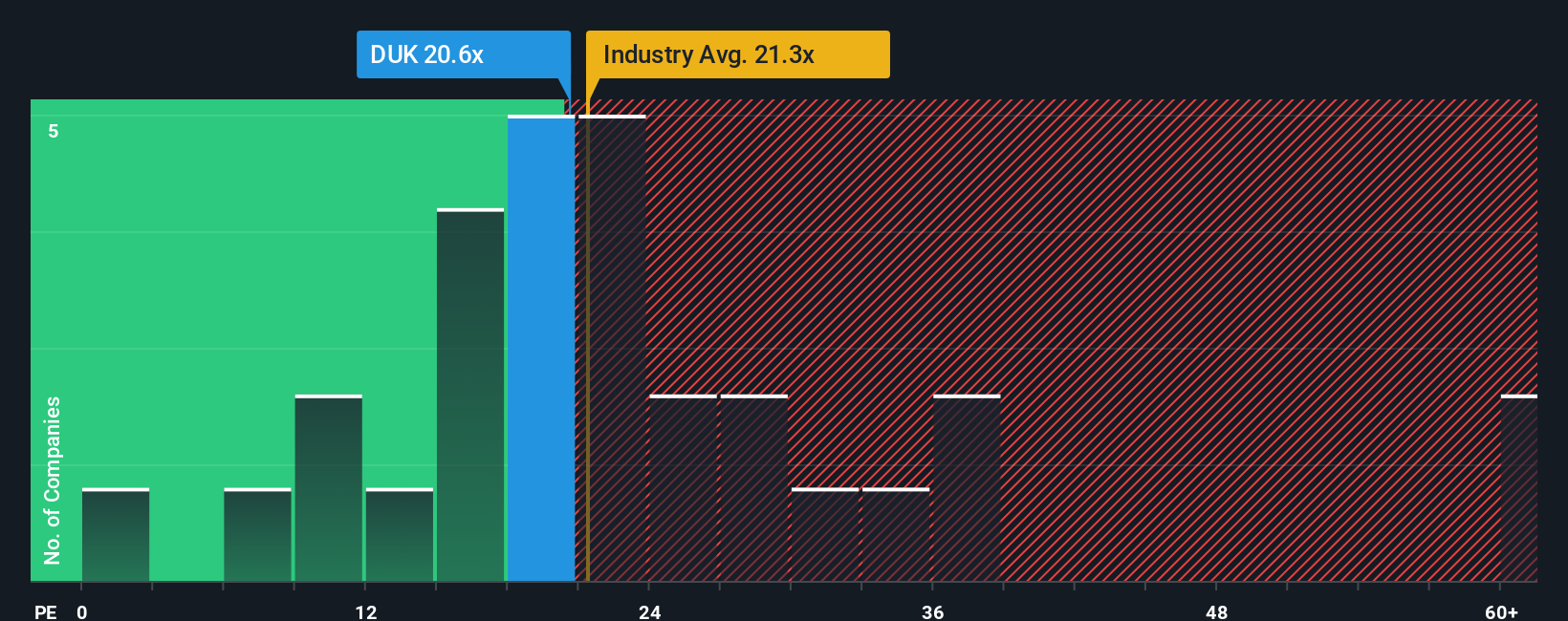

Duke Energy currently trades at a PE ratio of 20.58x. That is slightly below the industry average for electric utilities, which sits at 21.30x, and also under the peer average of 27.02x. This suggests the stock is not trading at an excessive premium relative to its direct competitors.

Simply Wall St's “Fair Ratio” metric takes this a step further by blending Duke Energy’s specific growth rate, profit margins, industry position, and risk to estimate what the multiple should be given the full context. Its Fair Ratio for Duke Energy is 22.08x, which is close to the current PE and just above it.

Because the difference between the Fair Ratio and Duke Energy’s actual PE is less than 0.10, the company appears to be valued about right compared to what would be expected for its position and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Duke Energy Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are the stories you tell about a company, connecting your perspective on its strengths, risks, and future directly to your own fair value estimate and forecasts for revenue, earnings, and margins.

Unlike traditional models, a Narrative neatly links Duke Energy’s business story, including its opportunities, challenges, and unique context, to a forward-looking financial forecast, which then generates a personalized fair value. Narratives are easy to create on Simply Wall St's Community page, where millions of investors are already sharing their views, and they update automatically as new information or earnings come in.

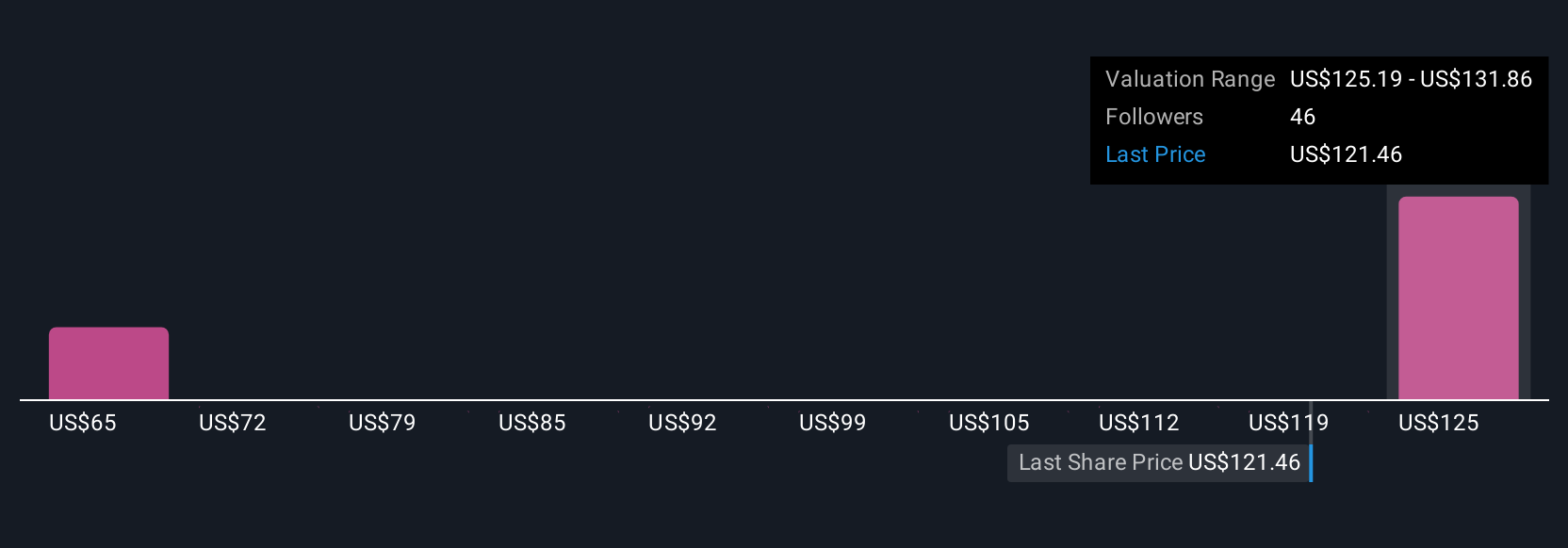

This approach empowers you to judge when to buy or sell by comparing your Fair Value with the current share price, while also making it clear how your assessment differs from the consensus. For example, some investors may build a bullish Duke Energy Narrative by projecting accelerated revenue growth from surging data center electricity demand and favorable state policies. Others may see headwinds due to regulatory risks and the pace of renewable transitions, resulting in fair values ranging from $132 to $138 per share, as seen in the latest Community perspectives.

Do you think there's more to the story for Duke Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives