- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Duke Energy (DUK): Is the Utility Stock Trading Below Its True Value?

Reviewed by Simply Wall St

See our latest analysis for Duke Energy.

With Duke Energy’s share price now at $124.3, the broader story is one of steady momentum. Its 15.28% year-to-date share price return and 14.56% total shareholder return over the past year mark a notable climb, especially when you factor in a robust 52% total return for shareholders across three years. That kind of long-term resilience continues to keep Duke firmly on the watchlist of income and stability-focused investors.

If you’re curious about other resilient performers in today’s market, now’s a great time to broaden your scope and discover fast growing stocks with high insider ownership

With Duke Energy riding a wave of steady returns, the key question for investors is whether the current price offers hidden value or if the market has already accounted for all its future growth prospects.

Most Popular Narrative: 9.7% Undervalued

Duke Energy’s most widely followed valuation narrative places the fair value at $137.60, notably above the last closing price of $124.30. This sets the stage for a closer look at the long-term core drivers powering this outlook.

Significant infrastructure and grid modernization investment (for example, over $4 billion incremental CapEx in Florida) is positioned to capitalize on growing needs for digitalization and grid resilience. This enables Duke to enhance operational efficiency and reliability, which benefits both net margins and future rate base growth.

Want to understand the logic behind this bold valuation? The narrative hinges on transformative spending, efficiency upgrades, and aggressive forecasts for profit expansion. Unpack which future expectations are fueling this view, and see the numbers that shape this story.

Result: Fair Value of $137.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating customer adoption of distributed energy and Duke's reliance on legacy fossil infrastructure could challenge both its revenue growth and margin expansion in the years ahead.

Find out about the key risks to this Duke Energy narrative.

Another View: Testing the DCF

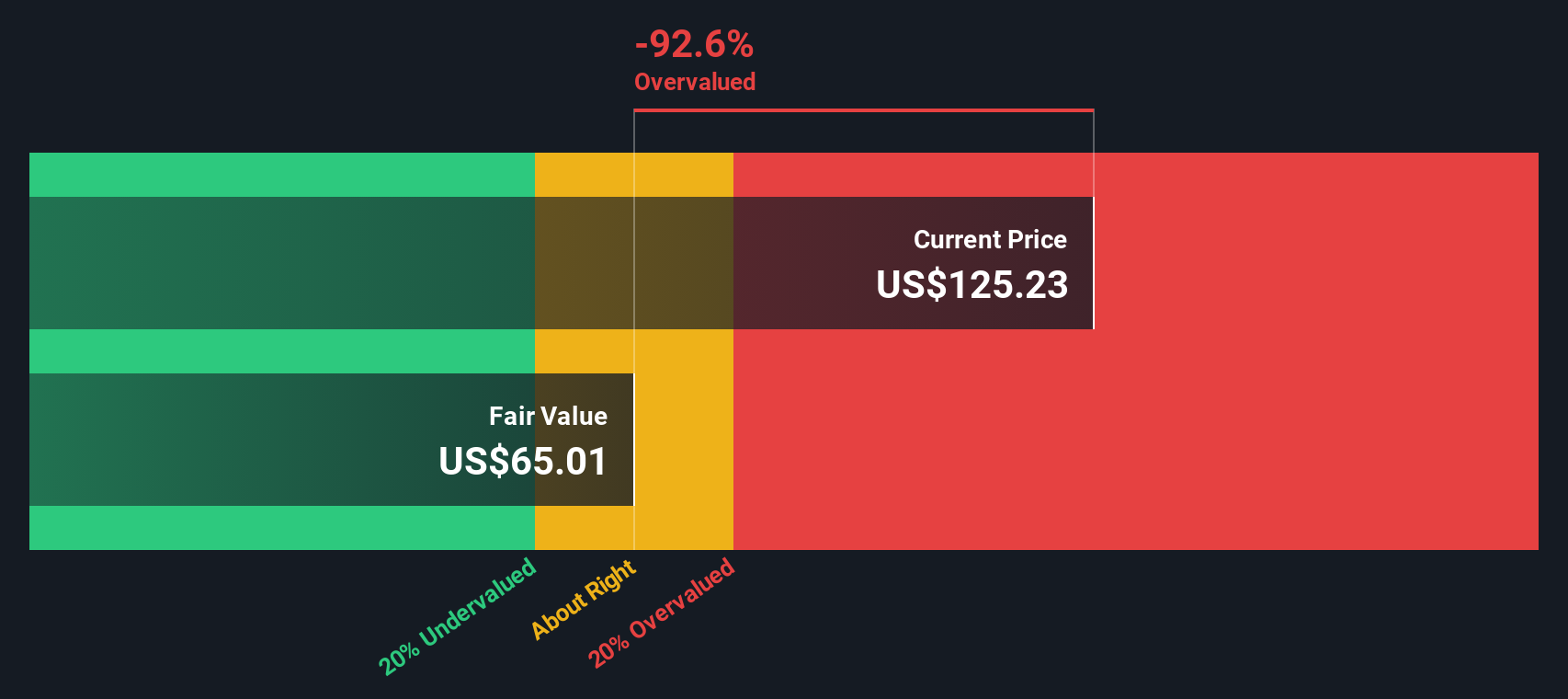

Looking at Duke Energy through our DCF model, a different perspective emerges. The SWS DCF model suggests the shares might be overvalued, with the current price sitting above its estimated fair value. This highlights a gap between market expectations and projected future cash flows. Could the optimism priced in today be too high?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Duke Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 836 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Duke Energy Narrative

If you would rather follow your own path or believe a different story is emerging, it’s easy to analyze the figures independently and share your perspective in just minutes. Go ahead, Do it your way.

A great starting point for your Duke Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay a step ahead by branching out beyond their usual picks. Don’t let the best opportunities slip by when you can act now.

- Maximize your income potential by checking out these 20 dividend stocks with yields > 3%, which features yields above 3 percent and strong payout histories.

- Accelerate your portfolio’s innovation with these 27 AI penny stocks, where artificial intelligence is transforming the industries with the fastest growth potential.

- Capitalize on value gaps with these 836 undervalued stocks based on cash flows to spot stocks trading for less than what their fundamentals suggest they may be worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives