- United States

- /

- Other Utilities

- /

- NYSE:BKH

Black Hills (BKH) Is Up 11.4% After Analyst Upgrades on Data Center Growth and Dividend News - What's Changed

Reviewed by Sasha Jovanovic

- Earlier this month, Black Hills Corporation reported growth in both sales and net income for the third quarter and nine months ended September 30, 2025, reaffirmed its earnings guidance, and announced a quarterly dividend for December payment.

- Strong analyst upgrades followed as major data center partnerships and expansion in Wyoming Electric drove optimism about long-term earnings from new large-load customers, such as AI developers.

- We'll explore how analyst confidence in Black Hills's data center customer growth could reshape the company's investment narrative and outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Black Hills Investment Narrative Recap

To be a shareholder in Black Hills Corporation, you need to believe in its ability to capture sustained earnings growth from new large commercial customers, particularly data centers, while effectively managing the heavy investments required for grid infrastructure. The latest analyst upgrades and strong third-quarter results underscore that anticipated data center load growth remains the main catalyst, while the company’s exposure to high infrastructure spending and reliance on regulatory approval continues to be the key risk. Based on recent disclosures, this news does not materially shift those dynamics for the short term.

The reaffirmation of Black Hills’s full-year earnings guidance, projecting an adjusted EPS range of US$4.00 to US$4.20, is the most relevant announcement right now. It gives further clarity and confirmation on the near-term outlook, especially as the company executes a US$1 billion capital plan tied to major projects like the Ready Wyoming transmission expansion, which directly relates to the anticipated growth in high-volume data center customers.

In contrast, investors should be aware that even with high-profile customer wins, exposure to large, concentrated loads can bring…

Read the full narrative on Black Hills (it's free!)

Black Hills' outlook anticipates $3.0 billion in revenue and $375.9 million in earnings by 2028. This reflects a 10.3% annual revenue growth rate and a $91.7 million earnings increase from current earnings of $284.2 million.

Uncover how Black Hills' forecasts yield a $73.50 fair value, in line with its current price.

Exploring Other Perspectives

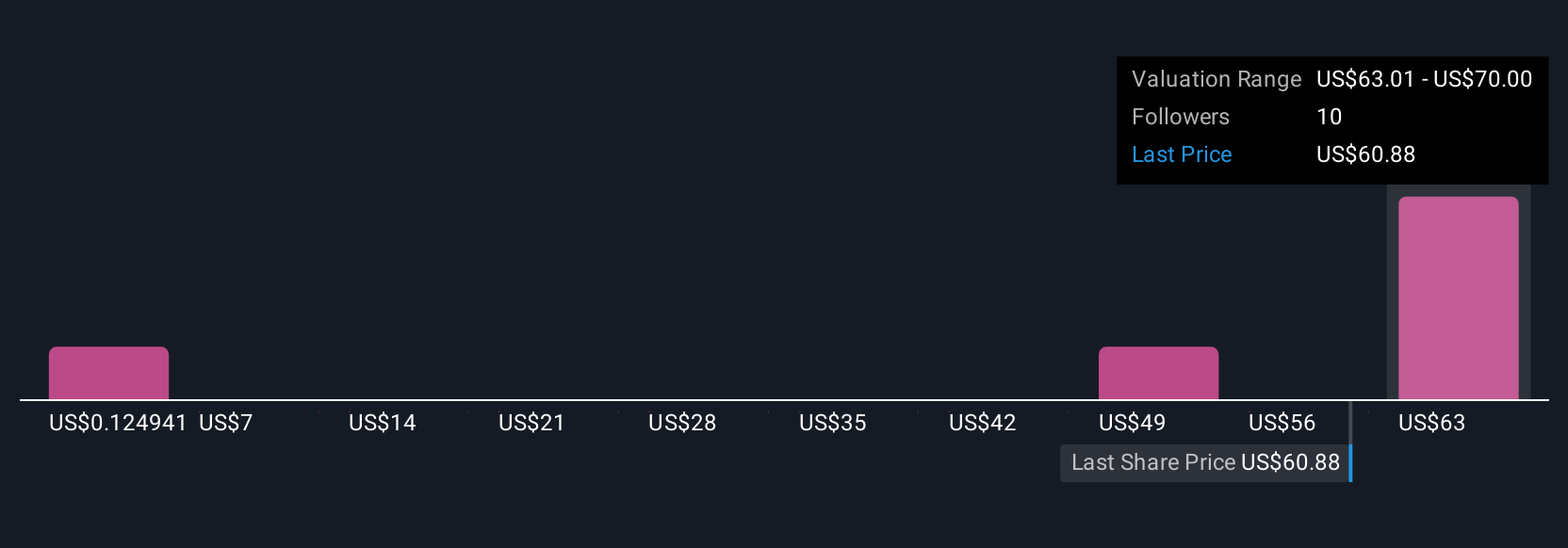

Six different fair value estimates for Black Hills from the Simply Wall St Community span a dramatic range from US$0.49 to US$73.50. As you weigh this variation, remember that the company’s increasing dependence on data center demand could make future outcomes highly sensitive to just a handful of major customer commitments, prompting varied interpretations across the market.

Explore 6 other fair value estimates on Black Hills - why the stock might be worth as much as $73.50!

Build Your Own Black Hills Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Hills research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Black Hills research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Hills' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Hills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKH

Black Hills

Through its subsidiaries, operates as an electric and natural gas utility company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives