- United States

- /

- Other Utilities

- /

- NYSE:BIP

How Investors May Respond To Brookfield Infrastructure Partners (BIP) Fifth Consecutive Year of Dividend Increases

Reviewed by Sasha Jovanovic

- The Board of Directors of Brookfield Infrastructure Partners L.P. has declared a quarterly distribution of US$0.43 per unit, payable December 31, 2025, representing a 6% increase versus the prior year and affirming regular quarterly dividends for multiple preferred share series.

- This marks the fifth dividend increase in five years and reinforces Brookfield Infrastructure Partners’ consistent pattern of returning value to shareholders, with the company currently offering a dividend yield above industry averages.

- We will now consider how this continued dividend growth and strong yield profile further supports Brookfield Infrastructure Partners’ broader investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Brookfield Infrastructure Partners Investment Narrative Recap

To be a shareholder of Brookfield Infrastructure Partners, you need to believe in the enduring value of essential infrastructure and the company’s disciplined approach to owning and operating a globally diversified portfolio. While the recent dividend increase highlights Brookfield’s focus on returning cash to investors, it does not materially impact the short-term catalyst: continued earnings growth driven by data infrastructure investments. However, the main risk for the business remains elevated leverage and potential exposure to higher refinancing costs as new debt is taken on for acquisitions.

Among the latest company announcements, the issuance of US$700 million in medium-term notes stands out in light of ongoing dividend growth. This new financing reflects Brookfield’s ongoing need to fund expansions and acquisitions, supporting its growth strategy but also reinforcing the importance of monitoring debt levels and future borrowing costs relative to rising global interest rates. This is particularly relevant as the company’s yield premium depends on sustainable cash flows and prudent capital structure management.

On the other hand, investors should keep in mind the heightened refinancing risk if interest rates...

Read the full narrative on Brookfield Infrastructure Partners (it's free!)

Brookfield Infrastructure Partners is projected to generate $14.5 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes a 12.3% annual decline in revenue, but an increase in earnings of about $1.06 billion from the current $38.0 million.

Uncover how Brookfield Infrastructure Partners' forecasts yield a $40.55 fair value, a 18% upside to its current price.

Exploring Other Perspectives

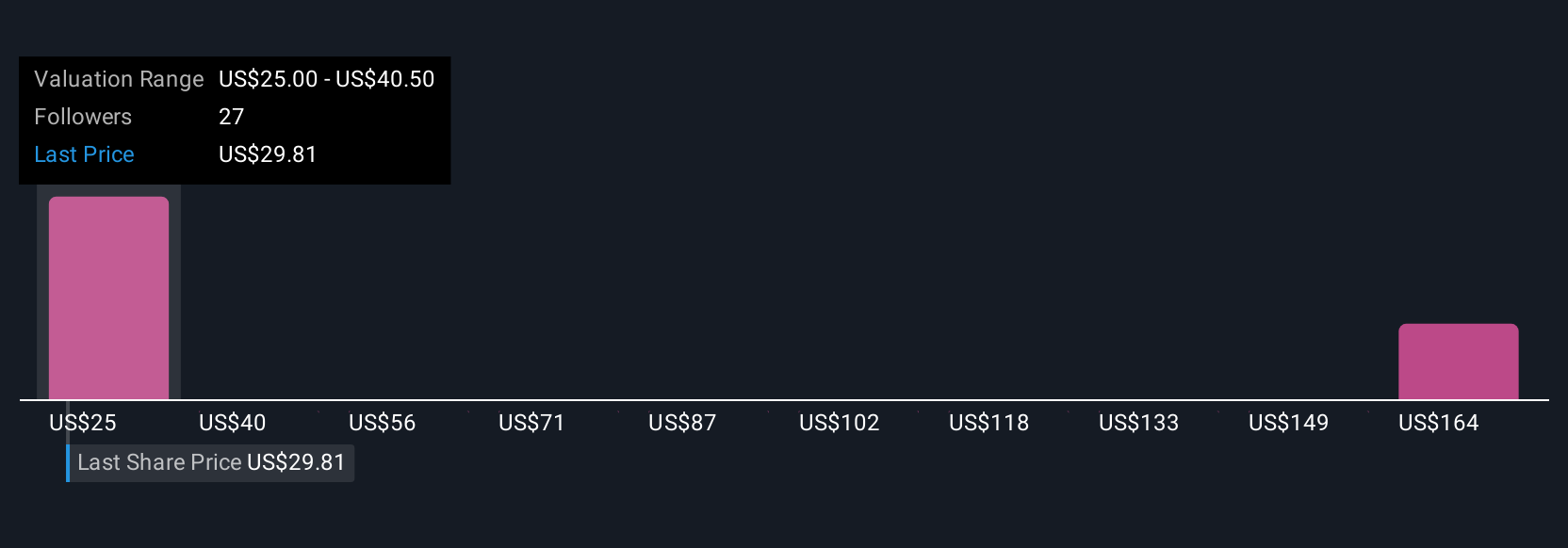

Fair value estimates from the Simply Wall St Community span from US$25.03 to US$169.58 across 6 retail investor perspectives. With ongoing capital deployment and increased leverage, opinions on Brookfield Infrastructure Partners’ performance and risk profile can vary widely, consider multiple viewpoints before making decisions.

Explore 6 other fair value estimates on Brookfield Infrastructure Partners - why the stock might be worth over 4x more than the current price!

Build Your Own Brookfield Infrastructure Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Infrastructure Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brookfield Infrastructure Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Infrastructure Partners' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Infrastructure Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIP

Brookfield Infrastructure Partners

Engages in the utilities, transport, midstream, and data businesses.

Undervalued average dividend payer.

Market Insights

Community Narratives