- United States

- /

- Water Utilities

- /

- NYSE:AWK

Assessing the Valuation of American Water Works (AWK) After Recent Share Price Consolidation

Reviewed by Simply Wall St

See our latest analysis for American Water Works Company.

While American Water Works Company’s share price has edged up 1.9% over the past week, its momentum has faded compared to earlier in the year. The 30-day share price return is -8.5% and the 1-year total shareholder return is -1.6%.

If you’re rethinking your strategy in today’s market, now is the perfect time to branch out and discover fast growing stocks with high insider ownership

With shares still sitting 8.6% below analyst price targets and the company posting respectable annual growth, investors have to ask if there is real upside left in American Water Works Company or if future growth is already priced in.

Most Popular Narrative: 9% Undervalued

American Water Works Company last closed at $130.84, while the most widely followed narrative estimates fair value at $143.78. The spread signals market participants see more upside potential if certain conditions are met.

Systematic execution of a robust acquisition strategy, including the recent Nexus Water Group deal and a strong pipeline of municipal and private system takeovers, is creating scale and operational leverage. This drives margin improvement through synergies and supports non-organic revenue growth.

Want to know which underlying assumptions drive this target? The narrative pivots around aggressive expansion and anticipated profit margin gains. Find out what bold projections are fueling this fair value and how growth, costs, and future earnings stack up in their calculations.

Result: Fair Value of $143.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost pressures and potential regulatory setbacks remain key risks that could quickly challenge the optimistic outlook for American Water Works Company.

Find out about the key risks to this American Water Works Company narrative.

Another View: Examining Market Multiples

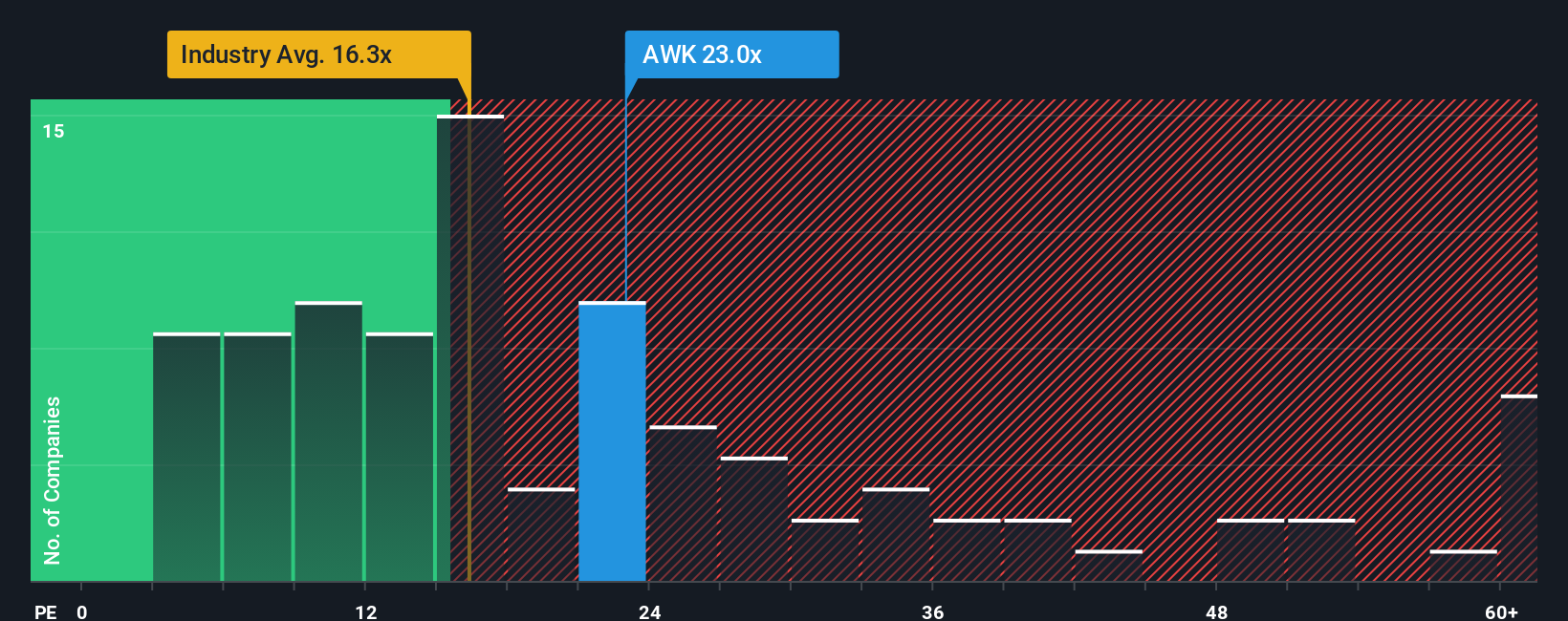

Looking at American Water Works Company’s price-to-earnings ratio reveals a less optimistic angle. Shares currently trade at 23 times earnings, higher than the global industry average of 16.3, the peer average of 18.8, and even the fair ratio of 21.9. This means investors are paying a premium, raising questions about valuation risk if future growth does not materialize. Is the faith in American Water’s future justified, or does the price already reflect too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Water Works Company Narrative

If you see things differently or want to dive into the numbers yourself, building your own narrative takes just a few minutes, so why not Do it your way

A great starting point for your American Water Works Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t sit on the sidelines. Open up new possibilities for your portfolio with fresh ideas and high-potential stocks. The next big opportunity might be just a click away.

- Capitalize on the booming healthcare revolution by uncovering these 32 healthcare AI stocks that are pushing boundaries in medical diagnostics, patient care, and AI-powered drug discovery.

- Maximize your income potential and stabilize your returns by targeting these 16 dividend stocks with yields > 3% offering yields above 3% and robust financials.

- Ride the next technology surge and position yourself for exponential growth with these 28 quantum computing stocks leading innovation in computing power, security, and futuristic applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives