- United States

- /

- Electric Utilities

- /

- NYSE:ALE

ALLETE (ALE) Margin Decline Raises Dividend Concerns Despite Five-Year Earnings Growth

Reviewed by Simply Wall St

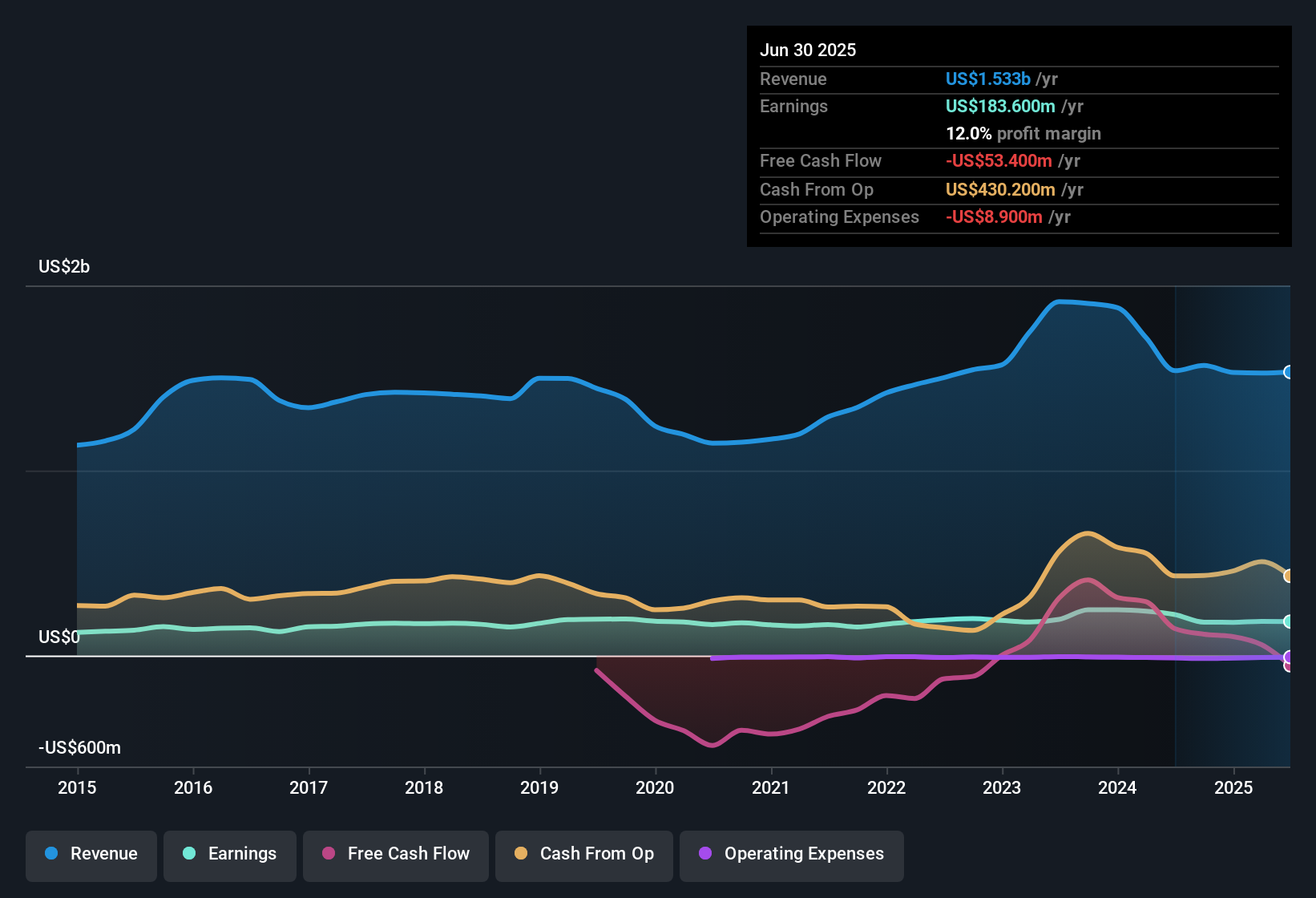

ALLETE (ALE) reported a net profit margin of 12%, down from 14.4% a year earlier. Earnings have grown at an average rate of 4.7% per year over the past five years. Shares currently trade at $67.33, which is above an estimated fair value of $51.34. The P/E ratio of 21.3x aligns with peers and the wider US utilities sector. Despite the company’s high-quality past earnings, concerns about dividend sustainability and financial strength may weigh on investor sentiment as current profit margins face pressure.

See our full analysis for ALLETE.Next up, we will pit these headline results against the core narratives driving ALLETE’s market sentiment to see which stories hold up and which ones might get shaken.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Squeeze Continues

- Net profit margin slipped to 12% this period, down from 14.4% in the same stretch last year, reflecting increased pressure on profitability even as the headline rate remains positive compared to many utilities.

- What is surprising is that, according to the prevailing market view, steady operational results and continued investments in renewables still help support sentiment,

- However, the margin decline calls into question how much “green transition” spending may be driving up costs rather than immediately boosting future returns.

- Investors keen on stable dividends may want to monitor if this lower margin is a blip or the start of a trend, given the sector’s focus on cash distribution and capital discipline.

Five-Year Earnings Growth Holds Steady

- ALLETE’s average annual earnings growth of 4.7% across the last five years underscores its track record for delivering consistent, if moderate, bottom-line expansion.

- Prevailing market view suggests these growth figures signal resilience in a low-growth, regulated utility setting,

- but the fact that multiple risk triggers, especially around dividend sustainability and financial strength, are active in available assessments means that investors cannot take this growth path for granted.

- Bulls might see regulated, stable growth as defensible. However, these flagged risks highlight potential headwinds to the outlook for continued payout reliability and financial health.

Valuation Premium Is Hard to Ignore

- Shares are trading at $67.33, which is about $16 above the DCF fair value estimate of $51.34, and the P/E ratio of 21.3x remains aligned with sector norms, suggesting the stock commands a healthy premium over modeled intrinsic value.

- This valuation gap stands out, as prevailing market view observers note moderate optimism on renewable transition and sector stability,

- yet the combination of active risk signals and a price above modeled fair value means that even stable, risk-averse investors may question whether there is enough upside left at this level.

- Sector context, where utilities often trade close to intrinsic value due to limited growth, heightens the scrutiny around paying a premium for ALLETE shares today.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ALLETE's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

ALLETE faces valuation pressures, margin compression, and active risk signals. This raises questions about whether its price justifies the risk of further downside.

Seeking better value or stronger upside? Check out these 832 undervalued stocks based on cash flows to quickly find stocks trading below fair value and potentially offering a more attractive entry point.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALE

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives