- United States

- /

- Renewable Energy

- /

- NasdaqGS:RNW

ADB-Backed $331 Million Funding Might Change The Case For Investing In ReNew Energy Global (RNW)

Reviewed by Sasha Jovanovic

- ReNew Energy Global Plc recently secured a US$331 million financing commitment from the Asian Development Bank as part of a US$477 million package to fund a large-scale clean energy project in Andhra Pradesh, integrating 837 MWp of wind and solar with a 415 MWh battery storage system.

- This milestone underscores growing international support for ReNew's blueprint of integrating renewable generation with storage, designed to deliver firm clean power and enhance grid reliability in India.

- We'll examine how ReNew’s access to significant ADB-backed capital amplifies its growth narrative and positions it within India's energy transition.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

ReNew Energy Global Investment Narrative Recap

To be a shareholder in ReNew Energy Global, you need to believe that large-scale renewables operators in India can reliably deliver firm clean power and maintain profitability even as competition tightens and margins face pressure. The recent US$331 million ADB financing strengthens ReNew’s project execution and access to capital, which may help address near-term project delivery risks; however, competitive pricing in auctions remains a material challenge to watch, and this news does not mitigate it fully.

Earlier this year, ReNew’s US$2.5 billion investment plan for a 2.8 GW hybrid energy complex in Andhra Pradesh set the stage for its integrated renewables-plus-storage strategy. This large-scale project, featuring entirely domestically produced components, underpins ReNew’s push to deliver reliable green power, supporting its key catalyst of securing and executing new long-term PPAs that drive top-line growth and margin expansion.

Yet, while funding enhances project certainty, investors should not overlook that intensifying competition and declining auction tariffs could...

Read the full narrative on ReNew Energy Global (it's free!)

ReNew Energy Global's narrative projects ₹195.5 billion revenue and ₹15.7 billion earnings by 2028. This requires 20.0% yearly revenue growth and an increase of ₹7.0 billion in earnings from current earnings of ₹8.7 billion.

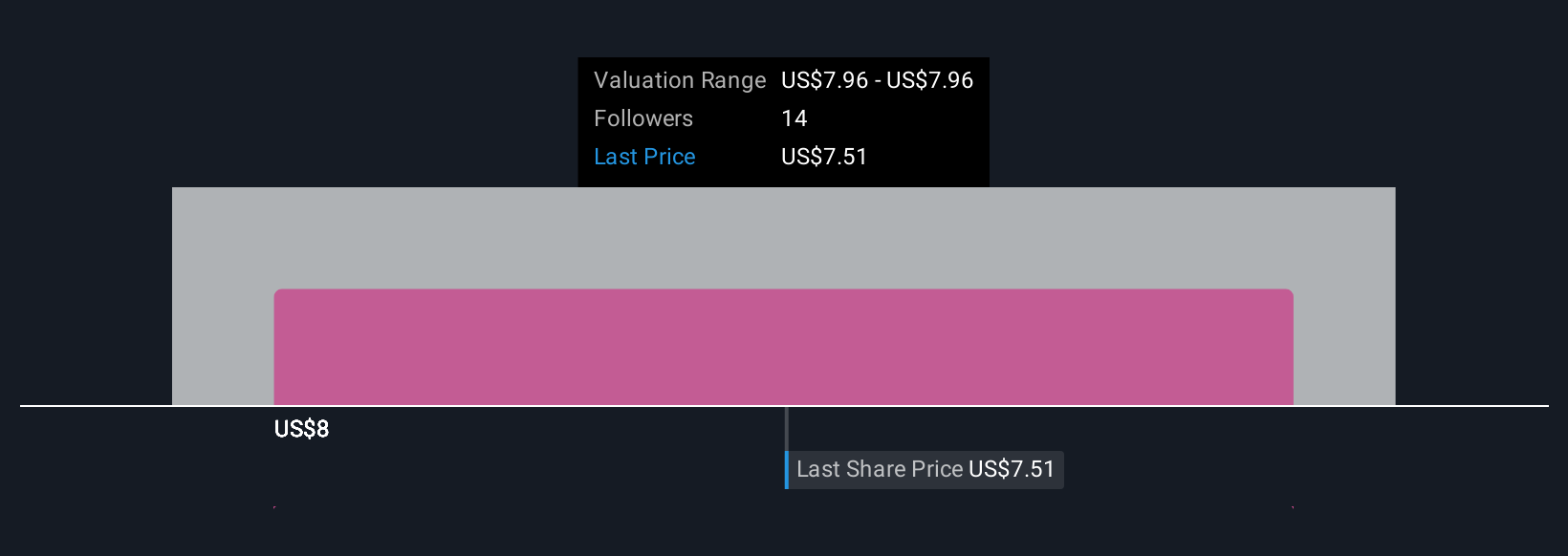

Uncover how ReNew Energy Global's forecasts yield a $7.96 fair value, a 5% upside to its current price.

Exploring Other Perspectives

One fair value estimate from the Simply Wall St Community pegs ReNew at US$7.96 per share, showing a singular perspective ahead of recent ADB funding. In contrast, tight competition in project bidding could impact margins and earnings momentum, so reviewing different community opinions may be valuable for your own research.

Explore another fair value estimate on ReNew Energy Global - why the stock might be worth just $7.96!

Build Your Own ReNew Energy Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ReNew Energy Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ReNew Energy Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ReNew Energy Global's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RNW

ReNew Energy Global

Engages in the generation of power through non-conventional and renewable energy sources in India.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives