- United States

- /

- Electric Utilities

- /

- NasdaqGS:MGEE

MGE Energy (MGEE) Margin Expansion Reinforces Bullish Narratives Despite Premium Valuation

Reviewed by Simply Wall St

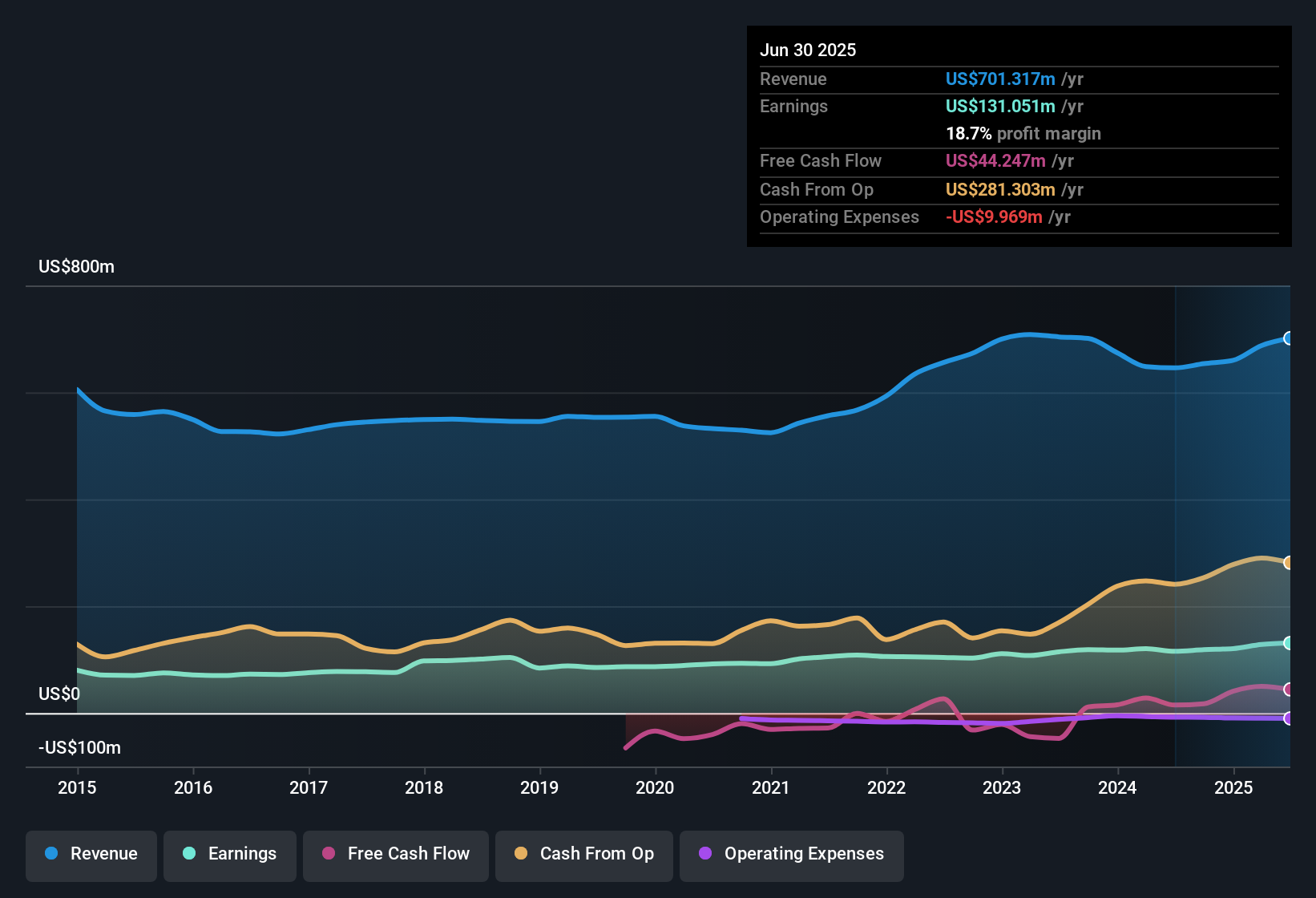

MGE Energy (MGEE) delivered a 13.4% jump in earnings over the last year, far outpacing its 5-year average growth rate of 5.9%. Net profit margin rose to 18.7% from 17.9% a year earlier, underscoring continued profitability. With earnings quality remaining high and growth steady, investors are weighing consistent performance and improved margins against a premium valuation and forecasts that trail the broader market.

See our full analysis for MGE Energy.The next section examines how these earnings results align with prevailing market narratives, highlighting areas where consensus is strong and where surprises may arise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Revenue Forecasts Trail National Pace

- MGEE's annual revenue is projected to grow by just 3.4%, which falls short of the broader US market's average growth rate.

- While steady growth may offer dependability, investors have to consider that this moderate outlook could limit upside potential.

- Progress is anchored by MGEE’s consistently high earnings quality, indicating the business model remains robust even if growth is slower than peers.

- The prevailing view recognizes MGEE as a stable long-term player but cautions that its pace will not match larger competitors in faster-moving sectors.

Premium Valuation Widens to Peers

- MGEE's share price at $84.47 trades at a Price-to-Earnings Ratio of 23.6x, which is above both the US Electric Utilities industry average (21.6x) and its closest peer group (22.2x).

- This premium reflects that investors are willing to pay more for MGEE’s steady fundamentals.

- The current valuation puts MGEE above its DCF fair value of $40.74, so anyone buying today accepts a higher price in exchange for the business’s perceived reliability and clean energy trajectory.

- Despite a valuation gap, few major risks are flagged aside from ongoing concerns about dividend sustainability and financial strength, supporting the view that its market premium comes from defensive appeal rather than strong future growth.

Margins Edge Higher Amid Steady Fundamentals

- Net profit margin increased from 17.9% to 18.7% over the latest year, highlighting that profitability remains strong and resilient.

- What stands out is that this margin expansion happens alongside consistent profit and revenue growth.

- The prevailing analysis suggests MGEE’s stable fundamentals contribute to investor confidence, even as future growth forecasts remain conservative.

- The lack of significant flagged risks underscores MGEE’s reputation as a dependable, low-risk utility rather than a high-flying growth story.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on MGE Energy's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

MGEE’s premium valuation and slower forecasted growth leave limited room for upside, especially when compared to faster-expanding peers from other industries.

Target stronger value by using these 836 undervalued stocks based on cash flows to uncover companies trading well below their fair value and with better growth potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGEE

MGE Energy

Through its subsidiaries, operates as a public utility holding company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives