- United States

- /

- Electric Utilities

- /

- NasdaqGS:LNT

A Fresh Look at Alliant Energy (LNT) Valuation as Shares Show Resilience and Momentum

Reviewed by Simply Wall St

Alliant Energy (LNT) shares have seen modest shifts lately, and investors might be curious about what is driving the utilities sector. With long-term returns and recent financial trends in mind, it is worth a closer look at the company today.

See our latest analysis for Alliant Energy.

Alliant Energy’s share price has shown resilience this year. It is currently sitting at $66.47 with a strong year-to-date share price return of 13.6%. More notably, the total shareholder return over the past year has reached 19.4%, suggesting momentum is building for long-term investors despite short-term pullbacks.

If you’re curious what else attracts both stability and opportunity, this is a great moment to broaden your view and discover fast growing stocks with high insider ownership

But with shares nearing analyst targets and recent gains already strong, the real question is whether Alliant Energy’s solid fundamentals still point to an undervalued stock or if the market has priced in much of its future growth.

Most Popular Narrative: 6.2% Undervalued

With the latest narrative fair value at $70.90, Alliant Energy’s shares are trading just below this estimate, closing last at $66.47. The narrative hinges on growth fueled by strategic infrastructure investments and massive demand from new utility clients.

Alliant's robust pipeline and high-confidence (85% close rate) on advanced negotiations for new load, including multi-phase mega data center projects, provide clear visibility into incremental load growth. This will require sizable, incremental capital investments that are likely to be accretive to earnings and free cash flow.

Want to crack the math behind this price target? The “secret sauce” might lie in far-reaching assumptions around future earnings, profit margins, and a premium profit multiple. Which optimistic projections are tipping the scales? The answer could surprise you.

Result: Fair Value of $70.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on mega data center projects and the need for ongoing regulatory approvals could quickly undermine Alliant Energy’s optimistic growth expectations.

Find out about the key risks to this Alliant Energy narrative.

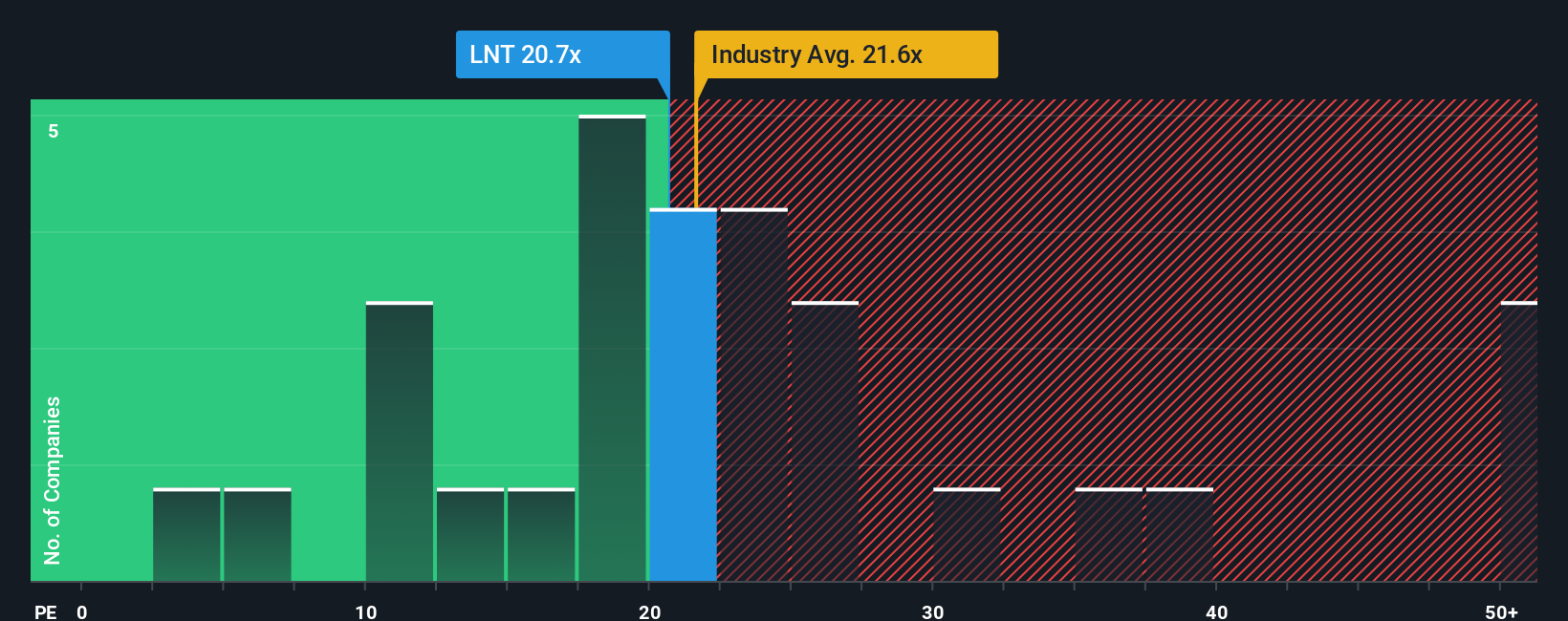

Another View: Multiples Tell a Cautious Story

Looking at the price-to-earnings ratio, Alliant Energy is trading at 20.5x, which is below the industry average of 21.5x but slightly above its peer average of 20.1x. The fair ratio is 20.4x. While not wildly expensive, this subtle premium could signal less room for upside if growth slows. Is the current optimism already priced in, or is there still hidden value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alliant Energy Narrative

If you think there’s more to the story or want to dive into the numbers yourself, you can easily craft your own narrative perspective in just a few minutes: Do it your way

A great starting point for your Alliant Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

You’ve seen what sets Alliant Energy apart, but why stop there when new market winners could be just a click away? Use the power of the Simply Wall Street Screener and don’t let the next opportunity pass you by. Your portfolio will thank you.

- Uncover untapped bargains and maximize your future gains by checking out these 843 undervalued stocks based on cash flows with strong potential based on reliable cash flows.

- Capture high-yield income streams and build wealth for tomorrow. See these 18 dividend stocks with yields > 3% offering over 3% dividend yields.

- Ride the wave of artificial intelligence innovation with these 26 AI penny stocks transforming entire industries right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LNT

Alliant Energy

Operates as a utility holding company that provides regulated electric and natural gas services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives