- United States

- /

- Renewable Energy

- /

- NasdaqCM:HNRG

Hallador Energy (HNRG) Is Up 17.0% After Swinging to Strong Profitability in Q3 - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Hallador Energy Company recently reported its third quarter and nine-month 2025 results, highlighting a large increase in sales and a shift from a net loss to significant net income year-over-year.

- This earnings report reveals a sharp improvement in profitability, as basic earnings per share from continuing operations jumped to US$0.98 for the nine months compared to a loss of US$0.27 a year earlier.

- With robust year-over-year net income growth, we’ll explore how Hallador Energy’s improved profitability could influence its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Hallador Energy's Investment Narrative?

For anyone considering Hallador Energy as an investment, the big picture is about believing in the company’s ability to translate cyclical tailwinds and operational improvements into sustained profitability. The sharply improved third quarter results, with year-over-year revenue climbing from US$105.16 million to US$146.85 million and earnings swinging to a net income of US$23.88 million, could mark a shift in Hallador’s earnings trajectory. Previously, the main catalysts hinged on restructuring impacts, operational efficiency gains from the Sunrise Coal Division, and ongoing index inclusion, while key risks included volatile coal markets and limited growth prospects relative to broader energy peers. Now, with this stronger-than-expected report and a surge in share price, the risk narrative may shift toward questions of whether these earnings improvements are sustainable or a one-off, and if recent outperformance has already been priced in. This latest news adds meaningful weight to the short-term outlook by demonstrating real progress, but it also raises the bar for future performance expectations and highlights the risk of any setbacks. On the flip side, a resurgence in energy price swings remains a risk investors should watch closely.

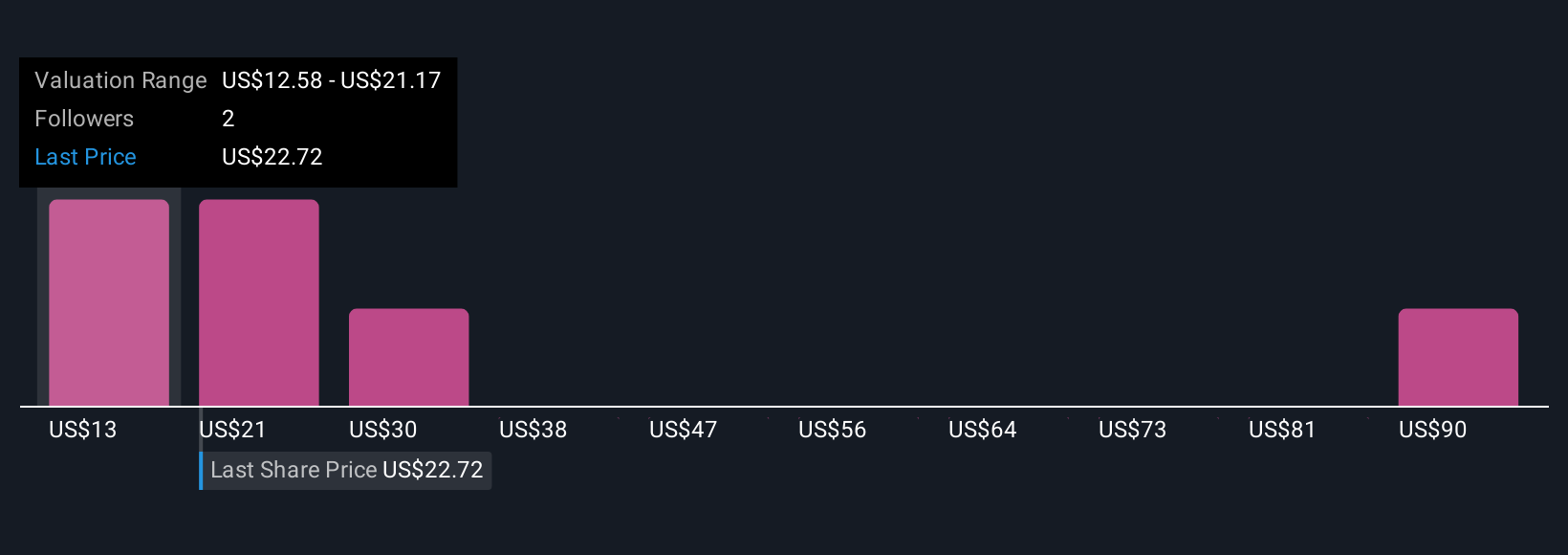

Hallador Energy's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on Hallador Energy - why the stock might be worth 12% less than the current price!

Build Your Own Hallador Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hallador Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Hallador Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hallador Energy's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hallador Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:HNRG

Hallador Energy

Through its subsidiaries, engages in the production of steam coal for the electric power generation industry in Indiana.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives