- United States

- /

- Electric Utilities

- /

- NasdaqGS:EVRG

Evergy (EVRG) Valuation Focus: Third Quarter Earnings Growth and Dividend Boost Draw Fresh Investor Interest

Reviewed by Simply Wall St

Evergy (EVRG) just announced its third quarter earnings, showing a modest uptick in net income over the same period last year. Alongside this, management declared a higher dividend, which has sparked fresh discussion among investors.

See our latest analysis for Evergy.

Momentum has picked up for Evergy as the stock has notched a 25.1% share price return so far this year, fueled in part by the recent dividend increase and steady earnings growth. When looking further back, the company’s total shareholder return of nearly 49% over three years shows it has rewarded longer-term investors while maintaining a stable trajectory.

If Evergy’s rising dividend and solid performance make you curious about what else is out there, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock already climbing and outperforming over multiple years, the key question now is whether Evergy remains undervalued or if the current price already reflects all expected growth and positive momentum.

Most Popular Narrative: 6% Undervalued

Evergy's most widely followed narrative suggests the stock is trading below its fair value estimate of $82.05, with a last close at $77.12. This price gap sets a clear stage for what analysts are projecting as upside still to be captured.

Accelerated investment in grid modernization, new natural gas, and solar generation, backed by supportive state regulatory approvals and legislative mechanisms (such as PISA and CWIP), positions Evergy to efficiently deploy and recover capital. This could benefit future net margins and regulated earnings. Increasing state and federal incentives for clean energy infrastructure, combined with Evergy's ongoing transition to renewables and emissions reduction targets, are expected to unlock multi-year capital deployment opportunities and provide stable, predictable returns, supporting EPS and rate base growth.

Want to know the key levers behind this bullish price target? Bold revenue growth, rising margins, and ambitious energy investments are just part of the puzzle. Curious which projections are driving analyst enthusiasm? Click through to see what is powering this fair value estimate and what makes Evergy’s valuation narrative unique.

Result: Fair Value of $82.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher interest rates or delays with key new customers could put pressure on Evergy’s growth plans and challenge the current optimism regarding its valuation.

Find out about the key risks to this Evergy narrative.

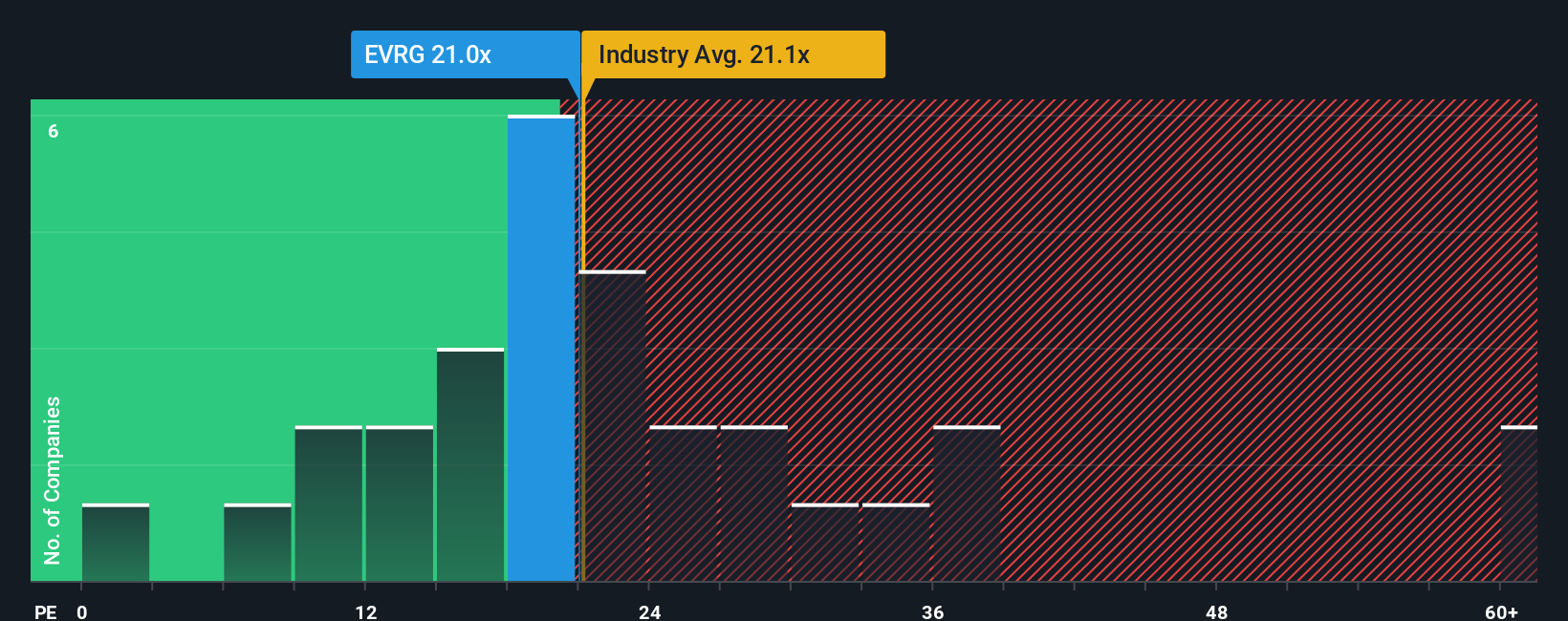

Another View: Signals from Earnings Ratios

While the fair value estimate paints Evergy as undervalued, a look at its price-to-earnings ratio tells a more cautious story. The company's P/E stands at 20.9x, noticeably above its industry peers at 18.6x and slightly higher than its own fair ratio of 20.8x. This suggests the market is already pricing in some optimism, which raises the stakes for any bump in expectations. Could this premium signal future risk, or does it simply acknowledge Evergy's recent progress?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Evergy Narrative

If you have a different take or want to dig into the numbers yourself, you can craft your own narrative for Evergy in just minutes. So why not Do it your way?

A great starting point for your Evergy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take control of your investing journey, and don’t miss your chance to tap into powerful trends and unique stock opportunities identified by our expert screeners below.

- Turbocharge your returns with these 894 undervalued stocks based on cash flows, which are showing strong cash flow potential and may be flying under the radar of most investors.

- Uncover tomorrow’s medical breakthroughs and steady performers among these 31 healthcare AI stocks, combining healthcare innovation with artificial intelligence momentum.

- Boost your income streams by targeting these 18 dividend stocks with yields > 3%, offering attractive yields above 3% for smarter portfolio growth and stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVRG

Evergy

Engages in the generation, transmission, distribution, and sale of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives